*New* White Paper – All Duration Investing

Pragmatic Capitalism

AUGUST 16, 2022

I’m excited to share a new research paper with you all. It’s the first one I’ve published in 6 years and it’s one of the few things I’ve written that [ … ].

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Pragmatic Capitalism

AUGUST 16, 2022

I’m excited to share a new research paper with you all. It’s the first one I’ve published in 6 years and it’s one of the few things I’ve written that [ … ].

Pragmatic Capitalism

SEPTEMBER 19, 2022

I’m excited to share a new research paper with you all. It’s the first one I’ve published in 6 years and it’s one of the few things I’ve written that [ … ]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

MARCH 4, 2025

Skew Why investors avoid positive-skew investment strategies. mailchi.mp) Round-ups A round-up of recent white papers including 'A New Paradigm in Active Equity.' noahpinion.blog) Asset growth High investment has historically led to disappointing future returns. ubs.com) What factors drive the stock-bond correlation?

Abnormal Returns

JULY 2, 2024

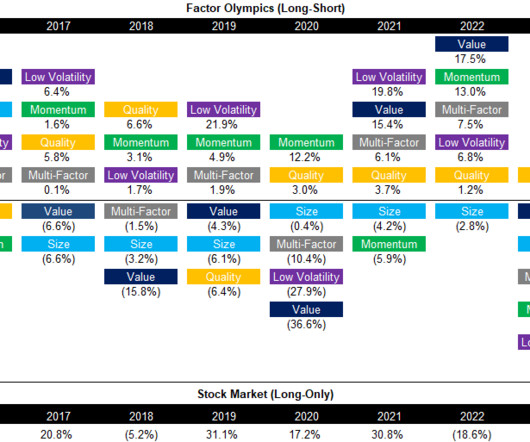

retirementresearcher.com) A round-up of recent white papers including 'Embracing Down Rounds: A Potential Path to Long-Term Equity Value.' paulkedrosky.com) The case against a diversified approach to hedge fund investing. Quant stuff Beware small sample sizes. blogs.cfainstitute.org) What happened to the size premium?

Nerd's Eye View

APRIL 15, 2025

So, whether you're interested in learning about engaging on a new growth path after already achieving significant growth as a firm, investing in internal data management capabilities, or the process of evaluating acquisition offers, then we hope you enjoy this episode of the Financial Advisor Success podcast, with Cameron Passmore.

Nerd's Eye View

MARCH 14, 2025

Which, if implemented under the new administration, could provide relief for investment advisers, particularly smaller firms that already have to balance compliance with client service, marketing, and the other duties that go into running a firm.

Abnormal Returns

NOVEMBER 7, 2023

mrzepczynski.blogspot.com) A round-up of recent white papers including 'Japan: The Land of the Rising Profits.' papers.ssrn.com) How equity market neutral investing works. (alphaarchitect.com) Poor ESG scores don't prevent new share issuance. papers.ssrn.com) Quant stuff Research shouldn't happen in a vacuum.

Abnormal Returns

FEBRUARY 6, 2024

mathinvestor.org) A round-up of recent research white papers including 'Long-Term Private Equity Performance: 2000 to 2023.' alphaarchitect.com) Why do active managers invest in anything other than their best ideas? (morningstar.com) There are more problems in academic finance than just p-hacking.

Abnormal Returns

APRIL 2, 2024

Lists Cullen Roche's top ten pet peeves including 'Passive investing will destroy the world.' aqr.com) Active management If passive investing is bad for market efficiency, why aren't active managers cleaning up? rogersplanning.blogspot.com) What happens when traders manage credit-focused bond funds?

Abnormal Returns

FEBRUARY 7, 2023

Quant stuff The problem with most factor investing research. priceactionlab.com) A review of January's best white papers including 'Should quantitative investors embrace machine learning techniques?' papers.ssrn.com) Research Institutional investors confuse investment policy and investment strategy.

Midstream Marketing

OCTOBER 30, 2024

Introduction In today’s changing finance world, registered investment advisors (RIAs) must comply with the provisions of the marketing rule, including entering into a written agreement, and must not include any untrue statement of a material fact to stand out from others. Clients looking for investment advice have many options.

Investment Writing

OCTOBER 4, 2022

Have you ever struggled to generate topics for your blog posts, white papers, and other publications? Have you ever gone off on a tangent in a white paper or blog post, only to realize that you need to cut that idea to keep your publication focused? You are not alone. I have some solutions to help you brainstorm.

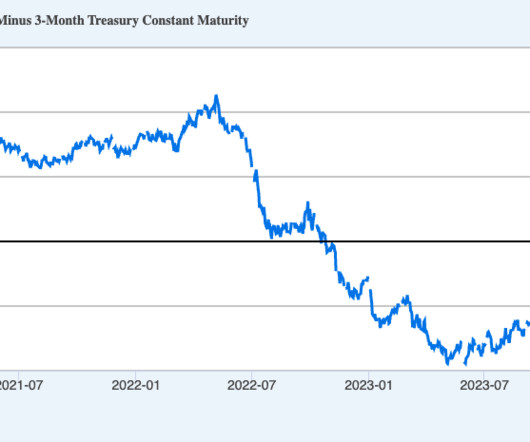

Discipline Funds

SEPTEMBER 19, 2023

We’ve been implementing the Defined Duration strategy in real-time for over a year now and the feedback has been tremendously positive (updated white paper is here ). We hope you enjoy the paper and as always, feel free to reach out with any questions or comments.

Nationwide Financial

OCTOBER 25, 2022

Guidance for clients should emphasize tuning out the noise and turning to the fundamentals of economic and business performance, which have a more significant impact on the return opportunity from their investments. That may be easier said than done. Nowadays, we all have more information at our fingertips.

Advisor Perspectives

DECEMBER 1, 2023

Freedom, control, and economic advantages are the key reasons for the impressive growth of the independent Registered Investment Advisor (RIA) channel over the years. If that’s what you’re looking for, this white paper explains it all from a top-down view.

Random Roger's Retirement Planning

JUNE 17, 2023

Meb Faber posted a short white paper titled What Is The Safest Investment Asset ? The white paper plays with the following mixes of GAA and T-bills. This will be fun. The table assumes 2.94% annualized inflation to yield the following real returns.

Midstream Marketing

NOVEMBER 26, 2024

Introduction In the busy world of financial services, asset managers and Registered Investment Advisors (RIAs) require solid marketing strategies to succeed. They need to recognize the special needs and challenges investment advisors face. With targeted marketing efforts, investment advisors can stand out.

Discipline Funds

FEBRUARY 21, 2023

The problem with investing is that these time horizons involve uncertainty because we do not know the time horizons over which certain instruments exist and protect us. The All Duration Investing approach adds the element of time by quantifying a portfolio for returns per unit of risk across time.

Nationwide Financial

OCTOBER 20, 2022

From a financial planning standpoint, investors need to maintain an objective view of the news during this time and avoid emotional investment decisions influenced by politics. The potential impact on the markets and economy. Congressional activity for the end-of-year “lame duck” session. •

Advisor Perspectives

JANUARY 1, 2023

This white paper will teach you how to successfully evaluate potential B-D/RIA partners and find the perfect fit for your financial practice by sharing valuable insights and advice from advisors who’ve been through the process of switching firms. Evaluating a B-D/RIA’s investment products and financial planning support.

Advisor Perspectives

NOVEMBER 29, 2022

This white paper will teach you how to successfully evaluate potential B-D/RIA partners and find the perfect fit for your financial practice by sharing valuable insights and advice from advisors who’ve been through the process of switching firms. Evaluating a B-D/RIA’s investment products and financial planning support.

Discipline Funds

DECEMBER 28, 2022

Understanding Money If you start with the following book, white paper and videos you’ll have a very solid starting point for understanding money: Pragmatic Capitalism – What Every Investor Needs to Know About Money and Finance (the only item on this page that is not free. Where Does Money Come From?

Midstream Marketing

NOVEMBER 8, 2024

Introduction In today’s tough market, financial advisors and investment advisors need to find effective lead generation strategies to get their own leads and new clients, often turning to lead generation companies for assistance. Articles: Discuss topics such as investing, retirement planning, and related subjects.

Nationwide Financial

JANUARY 27, 2023

This refers to the client’s intentions to continue working with you, invest additional assets with you, and refer you to friends and family. You can also visit nationwidefinancial.com/legacy-essentials for white papers, client-facing materials, and other valuable insights. The post Why is Estate and Legacy Planning Important?

Nationwide Financial

FEBRUARY 14, 2023

According to a Nationwide Retirement Institute® Diverse Markets White Paper, decades of research show that Black consumers tend to express higher levels of generalized distrust than whites.

ClearMoney

DECEMBER 14, 2021

Systematic, or factor-based, investing has become quite common in equities. The many parallels between Dimensional’s equity and fixed income approaches provide an opportunity to demystify systematic bond investing through the familiar lens of our approach in equities. The following is provided by Dimensional Fund Advisors.

Nationwide Financial

APRIL 6, 2023

Heightened geopolitical tensions, deglobalization, steep inflation, and a course-reset in the Fed’s monetary policy have created uncertainty in the markets and caused many of us to question long-held investment beliefs. The era of easy money might very well be gone. But fixed income isn’t.

Advisor Perspectives

DECEMBER 12, 2022

When I heard that the investment management firm GMO had created a retirement planning tool to mitigate “sequence of returns” risk I looked forward to learning about it. After setting aside a stumbling block or two in its white papers, I found it to be the best platform for financial advisors I have ever seen.

The Big Picture

MARCH 6, 2025

Or business investment are the thing that drives the recession. How do we, and I know the Fed has looked at this, there’ve been a number of white papers that have come out of the Fed. Industries that are not normally cyclical. Normally cyclicals like consumer durables.

Brown Advisory

JUNE 21, 2017

Investment Perspectives - The Great Debate achen Wed, 06/21/2017 - 12:35 Aside from some current political and economic topics that dominate the financial media, the most widely debated investment issue today involves the merits of passive investing, or indexing. equity funds in 2016 alone.

Brown Advisory

JUNE 21, 2017

Investment Perspectives - The Great Debate. Aside from some current political and economic topics that dominate the financial media, the most widely debated investment issue today involves the merits of passive investing, or indexing. Wed, 06/21/2017 - 12:35. Assuring "Average". Manager Characteristics.

Steve Sanduski

JANUARY 16, 2024

In a Nutshell: Back in 1999, Mark Hurley dropped a bombshell white paper that predicted the wealth management industry would be consolidated into less than 100 firms, there would be a huge amount of M&A, and the small RIAs would fall by the wayside. Should all advisors be rain makers?

eMoney Advisor

JANUARY 31, 2023

The subject matter at the time was focused on investment and economic updates. We now have a marketing director who is responsible for creating new content that will deepen the webinar experience by offering additional assets like blog articles and white papers to supplement our presentations.

The Big Picture

SEPTEMBER 3, 2024

They are a publicly traded investment manager, stocks symbol DHIL, that have been public since day one since 2016. They do a number of things at Diamond Hill that many other investment shops don’t. And so I felt like all of those experiences just really led me to love investing. Brilliant is CEO of Diamond Hill.

Midstream Marketing

NOVEMBER 6, 2024

When you share useful things, like white papers, blog posts, articles, and updates on social media, you can show that you are a thought leader in the financial industry. Are you aiming at young workers who need help with investing? This can show your skills in sustainable investing or share good feedback from happy clients.

Inside Information

DECEMBER 26, 2023

He published a number of white papers around the turn of the century that predicted a dystopian professional landscape composed of a small handful of giant RIAs and a few smaller firms scurrying under their feet, looking for table scraps. Think: they invest back in the firm.) Which means?

Walkner Condon Financial Advisors

AUGUST 13, 2022

It allows employees to deduct a portion of their salary and put it into an account that is invested for their retirement. Investment Option Differences Between 401(k)s and IRAs. A couple of other differences between a 401(k) and an IRA are the investment options and the ability to take a loan from the account.

Indigo Marketing Agency

JULY 1, 2024

The agency’s expertise in using these tools ensures you get the best return on your investment. You need blog posts, white papers, and social media updates that are written to keep your audience engaged and informed. Good content not only brings people to your site, it also helps you keep clients for the long haul.

The Big Picture

SEPTEMBER 19, 2023

Elizabeth Burton is Goldman Sachs asset management’s client investment strategist. Previously she was Chief Investment Officer at various state pension funds, including Maryland and Hawaii. I, I found this to be really an intriguing conversation with somebody who, whose investment charge is unconstrained.

Random Roger's Retirement Planning

JUNE 27, 2022

Another example of this from my past, working at Fisher Investments 20 years ago, a couple of my smarter co-workers were intrigued by the fact that allocating 2% to a position shorting Nikkei futures, putting the rest in cash provided a return that was inline with the S&P 500. of our investment capital in cash. The remaining 57.5%

Steve Sanduski

OCTOBER 1, 2024

But to get that flywheel spinning, RIA CEOs need to make careful investments in both tech and team building so that your best people are able to spend their time doing what they do best. We have an instructor, she goes out, she teaches the class, and at the end of the day they raise their hand if they want to come sit with us.

Discipline Funds

FEBRUARY 17, 2023

This is extremely important as the main factor in investment performance is not stocking picking or generating market alpha, but YOUR BEHAVIOR. Read our white paper on Countercyclical Indexing here. * It can be low fee, tax efficient and just as passive as other traditional indexing strategies.

Midstream Marketing

NOVEMBER 26, 2024

Introduction In the fast-changing world of financial services, marketing to RIAs plays a significant role in helping Registered Investment Advisors (RIAs) succeed. Why SEO Strategies Matter in Marketing to RIAs In the busy financial services world, investment advisors and asset managers must attract and keep clients.

BlueMind

APRIL 25, 2022

Therefore, when it comes to investing, women tend to be more “smart and cautious” investors. They tend to ask more questions in hopes of better understanding the short and long-term impact of their investments. She says, “Women base their investment decisions on facts, not on instinct.”.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content