Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

JANUARY 31, 2025

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that following the change of administration (and a new incoming chair of the SEC), the Investment Adviser Association is seeking to find ways to help RIAs (particularly smaller firms) manage the compliance responsibilities they (..)

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

The Chicago Financial Planner

OCTOBER 21, 2021

The money goes into the account on a pre-tax basis much like a traditional 401(k) or IRA. This is a great opportunity for those who earn too much to make pre-tax contributions to a traditional IRA. Those who have made the maximum contributions to their 401(k) have another pre-tax savings option available to them as well.

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

The Chicago Financial Planner

FEBRUARY 8, 2023

You’ve paid Social Security taxes over the course of your working life and you’ve earned these benefits. Many retirees and others collecting Social Security wonder about the tax treatment of their benefit. The answer to the question in the title is that your Social Security benefits may be subject to taxes.

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households.

Nerd's Eye View

MAY 17, 2023

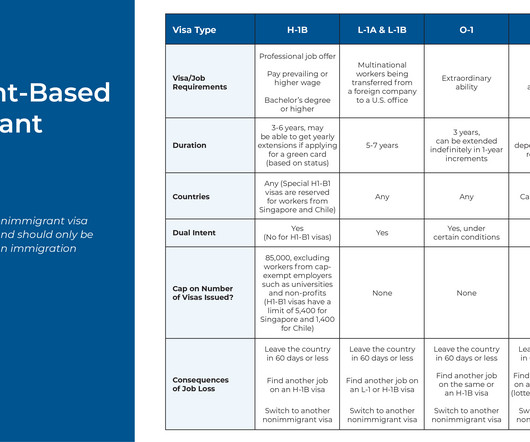

Like native-born workers, foreign workers need to think about saving for retirement, planning for their children’s college, managing healthcare costs, and all manner of other financial goals. For example, the tax benefits of certain accounts can sometimes work in the other direction if a non-U.S.-born

Abnormal Returns

FEBRUARY 24, 2025

citywire.com) How Jacob Turner turned a professional baseball career into a wealth management business. thinkadvisor.com) Cutting IRS workers is going to make life more difficult for tax preparers (and payers). advisorperspectives.com) Retirement planning models are just uncertainty piled on uncertainty. crr.bc.edu)

Abnormal Returns

JANUARY 15, 2024

Podcasts Michael Kitces talks about starting over with Kimberly Enders who is the Lead Financial Planner and Managing Partner of Enders Wealth Management. thinkadvisor.com) Vanguard is entering the cash management space with the Cash Plus Account. citywire.com) Taxes There simply aren't enough tax preparers to go around.

Wealth Management

FEBRUARY 21, 2024

The intellectual case for getting rid of tax-advantaged retirement plans is strong, and the political case is catching up.

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Abnormal Returns

NOVEMBER 6, 2023

(riabiz.com) The biz Goldman Sach's ($GS) future is in wealth management. ft.com) Creative Planning has closed on its purchase of Goldman Sachs' ($GS) PFM unit. citywire.com) Creative Planning is expanding its reach in the retirement plan space. papers.ssrn.com) Taxes A 2023 year-end tax planning guide.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. Here’s more on what a SEP IRA is, tax benefits, contribution limits, and important deadlines. The SEP IRA is a straightforward and cost-effective way for small business owners to save for retirement. What is a SEP IRA?

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Harness Wealth

APRIL 16, 2025

Let us face ittech startups encounter a unique set of tax challenges that can make or break their financial future. The complex interplay between traditional tax regulations and the innovative nature of tech businesses demands smart planning from day one.

Abnormal Returns

APRIL 1, 2024

Podcasts Kevin Thompson, CEO of 9i Capital Group LLC, discusses the RIA industry's impact on advisors' autonomy with Josh Brown, CEO of Ritholtz Wealth Management. youtube.com) Christine Benz and Amy Arnott talk with Peter Mallouk, President and CEO of Creative Planning, about the 'messy' business of financial advice.

Abnormal Returns

FEBRUARY 21, 2024

Rowe Price about non-financial considerations in retirement. morningstar.com) People work in retirement for any number of reasons. wsj.com) Dan Haylett talks retirement planning with Bec Wilson, author of "How to Have an Epic Retirement." (humbledollar.com) Christine Benz and Amy Arnott talk with Roger Young of T.

Talon Wealth

OCTOBER 26, 2023

Retirement planning is a critical part of financial security that many women still overlook. However, remember that as a woman, you have a longer life expectancy than a man, which means retirement planning is even more important. Consider early retirement tax planning.

Harness Wealth

MARCH 7, 2025

This weeks Tax Advisor news roundup covers key updates for financial professionals. Senate committee during the pandemic and set new standards for remote team management and firm culture. Last but not least, we have a rundown of the IRSs ‘Dirty Dozen’ tax scams for 2025.

Nerd's Eye View

FEBRUARY 8, 2023

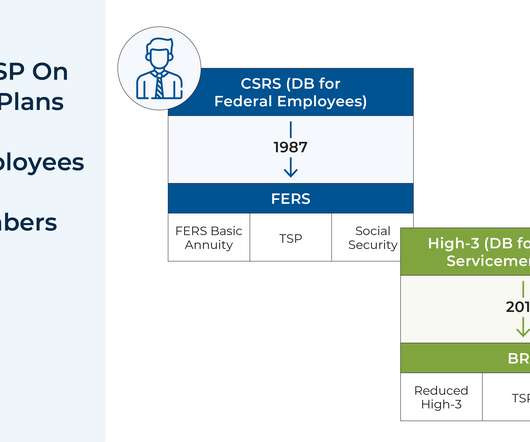

Advisors can also add value for clients who are TSP participants by understanding how the TSP fits within the Federal employee and military retirement systems, which combine the defined contribution TSP feature with a defined benefit pension (though because the value of this pension has been reduced, TSP management has increased in importance).

Nerd's Eye View

MAY 1, 2023

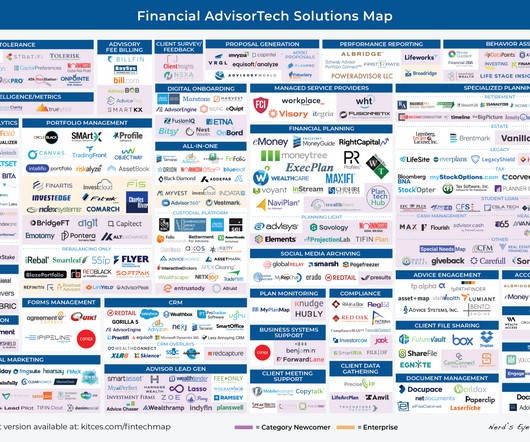

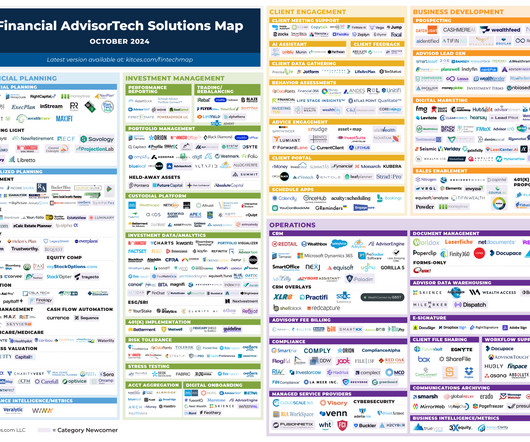

This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g.,

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Your current and projected future tax rate is often a main component of the decision, but there are other considerations and benefits as well.

Nerd's Eye View

NOVEMBER 23, 2022

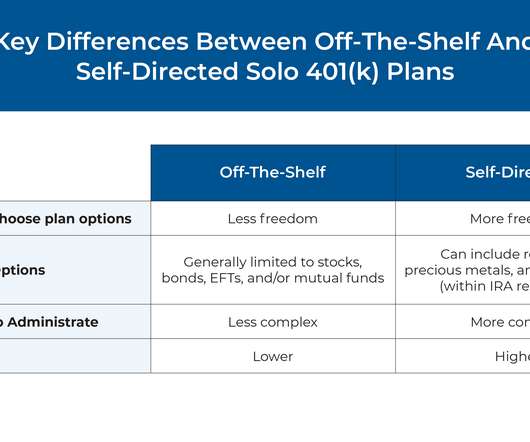

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings. Read More.

Abnormal Returns

JULY 18, 2022

(standarddeviationspod.com) A talk with Tony and Dina Isola about the awful situation facing teachers saving for retirement. ngpf.org) Christine Benz and Jeff Ptak talk with Justin Fitzpatrick who is the co-founder and chief innovation officer at Income Lab, which provides retirement planning software.

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. In this episode, we talk about five strategies you can use during tax season to create opportunities to help you reach your financial goals.

Harness Wealth

MARCH 6, 2025

Freelancers and contractors may enjoy greater flexibility and independence than full-time employees, however, this autonomy brings increased tax responsibility. Unlike W-2 employees, freelancers and independent contractors are responsible for managing their own tax obligations, which can be a complex process.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. forbes.com)

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Harness Wealth

JANUARY 29, 2025

April 15 marks the IRS tax return filing deadline for 2025. Although this is the traditional tax filing deadline, given the spate of recent natural disasters (such as the California wildfires and Hurricane Milton), the IRS is granting certain filing and payment extensions beyond this date.

Carson Wealth

JULY 3, 2024

Managing the business’s finances is one of the most crucial aspects. Proper financial management can be the difference between a thriving business and one that struggles to stay afloat. Get Help with Tax Planning Tax planning is a critical component of financial management.

The Big Picture

FEBRUARY 27, 2023

equity valuations: “Baby-boomers’ huge flow of 401K plan contributions helped to drive equities higher; now that ~70 million Boomers are retiring, when do demographics flip this from a huge positive to a net drag?” This demographic cohort is simply not a seller due to retirement – the tax expenses would be too great.

MainStreet Financial Planning

MARCH 14, 2024

As April 15th approaches, taxpayers across the country are gearing up to fulfill their annual obligation – filing taxes. Whether you’ve already submitted your returns or are yet to tackle the paperwork, now is the perfect time for a tax check-up. Other Resources Should I do my own taxes?

A Wealth of Common Sense

FEBRUARY 16, 2024

Early on in my savings journey I prioritized tax-deferred retirement accounts over all else. The set-it-and-forget-it nature of a workplace retirement plan is one of my favorite features. I like the ease and simplicity of 401k contributions coming out of my paycheck before it ever even touches my checking account.

Nerd's Eye View

OCTOBER 7, 2024

This month's edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla's follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently (..)

Nerd's Eye View

OCTOBER 20, 2023

Notably, this decision has provided both qualitative and quantitative benefits for these advisors, as 85% said they now have more control over their future and 80% saw their assets under management subsequently grow, with a median increase of 42%.

Nerd's Eye View

SEPTEMBER 6, 2022

Andy is the owner of Tenon Financial, a virtual independent RIA that oversees $70 million in assets under management for 43 retired client households. Welcome back to the 297th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Andy Panko. Read More.

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. As proposed, the new legislation would increase these tax rates to 9% and perhaps even 16% , respectively, starting in 2023.

Million Dollar Round Table (MDRT)

APRIL 1, 2025

Would you rather give that amount directly to the organization or withdraw $100,000, pay $40,000 in taxes and have only $60,000 of your contribution left to donate? Obviously, youd choose to avoid taxes and give the full amount, especially if that approach brought additional tax benefits with it. Note: This only applies to U.S.-based

Dear Mr. Market

DECEMBER 31, 2024

Prioritize high-interest debt first (were looking at you, credit cards) while maintaining manageable payments on lower-interest loans like mortgages. Optimize Tax Strategies Its not what you makeits what you keep. Consolidation might be a smart move too.

Harness Wealth

APRIL 16, 2025

Roth IRA conversions present a significant challenge for retirement planners: pay taxes now or later? Moving funds from traditional IRAs to Roth accounts triggers immediate taxation but promises tax-free withdrawals in retirement. One of the Roth IRA’s most compelling features?

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Integrity Financial Planning

JUNE 12, 2023

As you plan for retirement, it’s important to consider tax optimization strategies to minimize your tax liabilities. Here are three key ways to optimize taxes in retirement, based on information from sources published between 2022 and 2023.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content