Expanding Horizons: Driving Convergence of Wealth Management and Retirement Planning

Wealth Management

OCTOBER 4, 2023

Advisors look toward holistic client-focused strategies with converging retirement planning and wealth management.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Wealth Management

OCTOBER 4, 2023

Advisors look toward holistic client-focused strategies with converging retirement planning and wealth management.

Wealth Management

OCTOBER 12, 2022

Chicago-based and women-led, the former LPL affiliate will join SageView as it continues to build out its wealth management capabilities alongside retirement plans.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Back to Basics with Reconciliations

Less Stress, More Success: Accounting Best Practices & Processes for 2025

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

Wealth Management

NOVEMBER 20, 2023

While wealth management advisors need to serve smaller/start-up retirement plans.

Carson Wealth

MARCH 7, 2024

By Jake Anderson, CFP ® , Wealth Planner When helping clients begin retirement planning, the same questions often arise: What should my retirement plan look like? Your lifestyle, goals, family situation, and risk tolerance will give a unique signature to your retirement plan. Talk to us today.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Wealth Management

SEPTEMBER 11, 2024

For an upfront purchase price of $50 million, the deal brings $47 billion of assets in the emerging and mid-market retirement plan segments and competitive ESOP administration.

Wealth Management

APRIL 9, 2024

Adopting an adaptive approach to retirement planning acknowledges the dynamic nature of spending patterns and emphasizes flexibility in financial strategies.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Abnormal Returns

OCTOBER 30, 2023

kitces.com) AI How recommendation engines could work in wealth management. nextavenue.org) Advisers Comprehensive financial planning takes more time and effort. kitces.com) Why formal retirement plans provide clients with additional confidence. morningstar.com) How working with UNHW clients is different.

Abnormal Returns

JANUARY 15, 2024

Podcasts Michael Kitces talks about starting over with Kimberly Enders who is the Lead Financial Planner and Managing Partner of Enders Wealth Management. thinkadvisor.com) Vanguard is entering the cash management space with the Cash Plus Account. riabiz.com) Avise is a cooperative platform for advisers.

Abnormal Returns

NOVEMBER 6, 2023

(riabiz.com) The biz Goldman Sach's ($GS) future is in wealth management. ft.com) Creative Planning has closed on its purchase of Goldman Sachs' ($GS) PFM unit. citywire.com) Creative Planning is expanding its reach in the retirement plan space.

Talon Wealth

SEPTEMBER 14, 2023

Retirement planning can be a difficult and confusing process for couples. By focusing on a few key areas, setting financial goals, and doing your research, you can find ways to enjoy retirement together. Set Financial Goals In retirement, educate yourself on your financial situation and investment strategy.

Talon Wealth

OCTOBER 26, 2023

Retirement planning is a critical part of financial security that many women still overlook. However, remember that as a woman, you have a longer life expectancy than a man, which means retirement planning is even more important. Retirement planning is an important part of financial security for women.

Wealth Management

APRIL 30, 2024

The program builds on the expertise of Caliber Wealth Management, which merged with Diversify earlier this year.

Wealth Management

SEPTEMBER 23, 2024

The bar is only getting higher for retirement plan advisors.

Abnormal Returns

APRIL 1, 2024

Podcasts Kevin Thompson, CEO of 9i Capital Group LLC, discusses the RIA industry's impact on advisors' autonomy with Josh Brown, CEO of Ritholtz Wealth Management. youtube.com) Christine Benz and Amy Arnott talk with Peter Mallouk, President and CEO of Creative Planning, about the 'messy' business of financial advice.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. A SEP IRA (Simplified Employee Pension Individual Retirement Account) is a type of retirement plan specifically designed for self-employed individuals and small business owners. What is a SEP IRA?

International College of Financial Planning

JUNE 30, 2022

Hiring a wealth manager is one of the biggest financial decisions you’ll make. Hiring a wealth manager is a long-term investment, so it’s important to find someone who will take the time to get to know your goals, values, and long-term goals. Factors to be considered before hiring a wealth manager. .

Wealth Management

MARCH 19, 2024

The key is finding the right firm that will enhance an advisor’s ability to work with retirement plans in an efficient and scalable manner.

Nerd's Eye View

OCTOBER 17, 2023

Brad is the Co-Founder & CEO of Intellicents, an independent RIA with 12 offices across the country and headquartered in Albert Lea, Minnesota, that oversees $6 billion in assets under management for more than 3,000 client households. Read More.

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. Financial Planning: This involves creating a comprehensive financial plan, considering all aspects of your financial situation.

Talon Wealth

OCTOBER 26, 2023

Retirement planning can be a difficult and confusing process for couples. By focusing on a few key areas, setting financial goals, and doing your research, you can find ways to enjoy retirement together. Set Financial Goals In retirement, educate yourself on your financial situation and investment strategy.

Nerd's Eye View

NOVEMBER 22, 2024

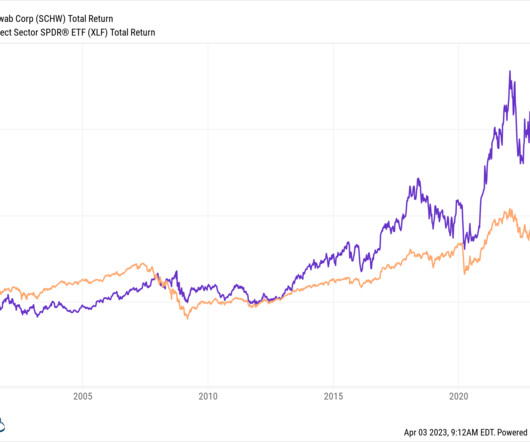

Further, amidst grumbling from some firms, incoming CEO Rick Wurster reiterated a pledge that Schwab (which offers its own direct wealth management services) will not seek to compete for clients with RIAs on its platform, seeing opportunities to pursue prospective clients currently unserved by either group.

Wealth Management

APRIL 22, 2024

Internal professionals at employers are poorly trained or ill-equipped to properly handle plans.

Wealth Management

DECEMBER 4, 2023

AFS 401(k) Retirement Services and AFS Financial Group is a retirement plan and wealth management consulting firm with $2.3 billion in assets under advisement.

Wealth Management

FEBRUARY 16, 2023

The author of the recently published book, Retirement Reboot: Commonsense Financial Strategies for Getting Back on Track, discusses the challenges of retirement planning from both an advisor’s and client’s perspective.

Nerd's Eye View

MAY 17, 2024

Altogether, the study suggests that social media engagement is driven more by the quality (and originality) of the advisor's content, rather than the quantity of posts. Read More.

Abnormal Returns

JUNE 28, 2023

Podcasts Christine Benz and Jeff Ptak talk with Fritz Gilbert and Eric Weigel about retirement planning mistakes. Mack talks with Goldstone — a manager of investment research at Condor Capital Wealth Management and co-author of Condor's "Robo Report." Meir Statman. cnbc.com) Robo-advisors Robo-advisors, ranked.

Wealth Management

JUNE 12, 2023

But most wealth, retirement plan and benefits advisors are still stuck in silos and old business models.

Carson Wealth

AUGUST 25, 2022

often fail to consider sequence of return, housing, longevity, health or family risks faced in retirement. Focus on Your Retirement Plan Rather Than a Magic Number. would be “How do I plan for retirement?“ Social Security is a federal retirement plan originally created under the Social Security Act of 1935.

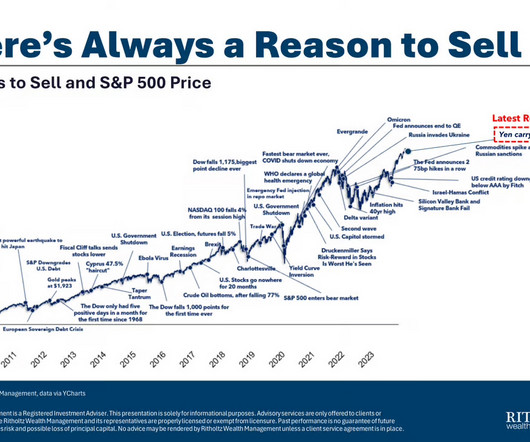

Abnormal Returns

APRIL 3, 2023

riabiz.com) First Citizens is acquiring SVB's wealth management unit. investmentnews.com) Practice management The SEC has been tightening up on the grace period it allows new RIAs before examining them. advisorperspectives.com) Retirement How longevity risk makes decumulation decisions more difficult.

Nerd's Eye View

JULY 10, 2023

Gary Siperstein, Jason's father, had built a successful investment management firm exclusively focused on managing portfolios of small-cap value stocks. Jason's next move was to shift the firm away from pure investment management by incorporating comprehensive financial planning for his clients.

Darrow Wealth Management

NOVEMBER 2, 2023

The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments.

Yardley Wealth Management

OCTOBER 7, 2020

The post Is COVID-19 affecting your Retirement Planning? appeared first on Yardley Wealth Management, LLC. Is COVID-19 affecting your Retirement Planning? Retirement Planning Financial Planning Risk. Don’t be passive in your retirement planning, take charge of it.

Wealth Management

NOVEMBER 1, 2024

Jania Stout, who sold her firm to OneDigital in 2021, will lead Prime Capital Retirement and Prime Capital Wellness.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. papers.ssrn.com) Four steps to create a digital estate plan. forbes.com)

Wealth Management

APRIL 14, 2023

OneDigital acquired Huntington National Bank’s 401(k) and retirement plan business this week, while Clearstead Advisors picked up local firm CLS Consulting. The Mather Group and NewEdge Wealth both announced key hires.

Nerd's Eye View

FEBRUARY 17, 2023

Further, an investment adviser who can make trades on behalf of a client would be deemed to have custody of the client’s assets, which could substantively shift a very sizable portion of the wealth management RIA community under the custody rule, though it remains to be seen whether or what exact custody rule compliance requirements would be (..)

Abnormal Returns

SEPTEMBER 2, 2024

(citywire.com) M&A For better or worse, advisers are putting off retirement. investmentnews.com) Retirement Retirement planning is challenging because we simply don't know how long someone will live. kitces.com) Retirement spending is by its nature dynamic.

Abnormal Returns

MAY 13, 2024

investmentnews.com) Research The problematic math of passing down generational wealth. blogs.cfainstitute.org) How life events affect retirement planning. investmentecosystem.com) Reflections on eight years of running a financial planning practice.

Good Financial Cents

JUNE 11, 2023

You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees. Personal Capital to the rescue.

Yardley Wealth Management

JUNE 6, 2023

The post Secure Your Financial Legacy appeared first on Yardley Wealth Management, LLC. Secure Your Financial Legacy When planning for your legacy, it’s important to consider various financial aspects. Assets under management (AUM) refers to the total value of assets managed by a financial advisor or firm.

Abnormal Returns

JULY 1, 2024

Podcasts Amy Arnott and Christine Benz talk with Don Graves and Wade Pfau about the role of home equity in retirement planning. blog.altruist.com) After splitting with Sanctuary Wealth, Jim Dickson has co-founded Elevation Point, an RIA platform services business and investor. frazerrice.com) The biz How Altruist makes money.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content