Strategic Planning for 2023: Think ‘What’ Not ‘Why’

Wealth Management

OCTOBER 11, 2022

The conversation shouldn’t be about “How are we going to get more?” it needs to be, “What do we want more of?”

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 11, 2022

The conversation shouldn’t be about “How are we going to get more?” it needs to be, “What do we want more of?”

Wealth Management

FEBRUARY 6, 2025

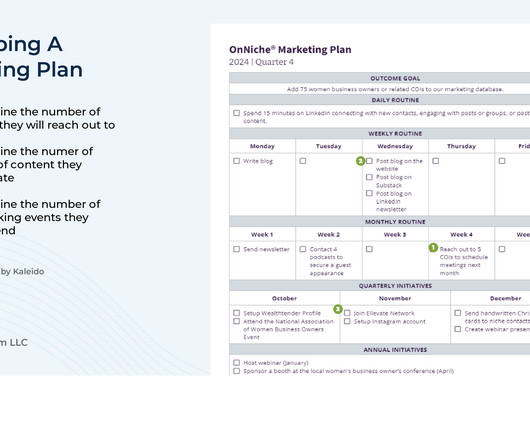

A well-defined plan can expose gaps and reveal the best path toward addressing a RIA's unique goals.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

FEBRUARY 6, 2025

A well-defined strategic plan can expose gaps and reveal the best path toward addressing an RIA's unique goals.

Wealth Management

MARCH 10, 2025

Strategic planning and preparation can equip anyone to ensure philanthropy remains a cornerstone of Americans financial stewardship.

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

Wealth Management

APRIL 22, 2024

Berkshire Hathaway's succession plan is an invaluable case study for businesses of all sizes, exemplifying the importance of forward-thinking leadership and strategic planning.

The Big Picture

AUGUST 26, 2023

He is responsible for the oversight of approximately $7 trillion managed by Vanguard fixed income, equity index, and quantitative equity groups. He has more than 25 years of investment management experience. Miller Samuel’s research and data analytics drive much of the national real estate brokerage publications and strategic plans.

Nerd's Eye View

SEPTEMBER 1, 2023

Also in industry news this week: A legal challenge to FINRA's operations as a self-regulatory organization has the potential to upend the current regulatory system for broker-dealers and their registered representatives A recent study indicates that while many consumers appear confident handling their finances on a 'DIY' basis during their careers, (..)

Nerd's Eye View

OCTOBER 14, 2024

Regardless of the reason, the responsibility of acquiring new clients frequently falls on firm owners, limiting scalability and complicating succession planning. For RIAs aiming for internal succession, the challenge intensifies, as the next generation often lacks the deep, trust-based relationships that founding advisors have cultivated.

Nerd's Eye View

NOVEMBER 17, 2022

As while it is easy to get caught up in the (sometimes unfounded) fears that even just one misstep can have catastrophic consequences, keeping a realistic perspective on the impact of failed attempts also becomes more manageable when aiming for smaller subgoals that are part of a larger process.

The Big Picture

AUGUST 31, 2023

Institutional Investor ) • What to Do With a 45-Story Skyscraper and No Tenants : HSBC’s plan to leave its Canary Wharf tower for a smaller site shows the global challenges ahead in repurposing unwanted office space for a post-pandemic world. The post 10 Thursday AM Reads appeared first on The Big Picture.

Validea

JANUARY 9, 2025

Insider ownership, particularly among executives and directors, is a crucial indicator for investors as it creates a direct alignment between management and shareholder interests. Additionally, high insider ownership can signal management’s confidence in the company’s future prospects.

Brown Advisory

APRIL 19, 2022

The Family Mission Statement and Strategic Plan jharrison Tue, 04/19/2022 - 16:38 Download the Report We believe a family mission statement – and a strategic plan to implement that mission – allows a family to filter out the “background noise” of day-to-day challenges and focus on long-term goals and objectives.

NAIFA Advisor Today

JULY 28, 2022

NAIFA CEO Kevin Mayeux, CAE , who has overseen the rebirth and transformation of NAIFA under the NAIFA 20/20 and now the NAIFA 2025 Strategic Plans knows his stuff when it comes to association management.

Million Dollar Round Table (MDRT)

AUGUST 30, 2022

By Matt Pais, MDRT Content Specialist With seven advisors and six support staff in the office, Carrie Rae Mullins recognizes how essential it is to get some space – away from client meetings, operations questions and more – for strategic planning. Read more about MDRT members who leave the office to do their strategic planning.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. A financial advisor provides personalized guidance to help manage and grow your wealth.

Harness Wealth

APRIL 17, 2025

These sponsors manage the complex mechanics that make DAFs work seamlessly for you. DAFs can serve as sophisticated tax management tools. When managed strategically, investments within your donor-advised fund can potentially multiply your charitable impact by two or three times.

Financial Symmetry

APRIL 9, 2025

Business ventures or new income sources without tax withholding also necessitate proactive planning to avoid year-end surprises. Crafting a Smart Donation Strategy The decision to itemize or claim the standard deduction involves strategic planning, especially given the elevated standard deduction under current laws.

The Big Picture

SEPTEMBER 1, 2023

FT Alphaville ) see also Allan Roth: Lessons From 2 Jim Cramer ETFs : Did Tuttle Capital Management close the wrong fund? ETF.com ) • The Harrowing Story of a Top Manager’s Biggest Investing Mistake : Oakmark’s David Herro waited years for Credit Suisse to deliver. It never did.

Advisor Perspectives

JANUARY 16, 2025

Outsourced trading is a growing trend among asset managers, with recent headlines illustrating how firms are reassessing their approach to how trading fits in their broader strategic plans.

Carson Wealth

APRIL 19, 2024

This is an exciting time – one filled with lots of changes, like starting a new career and learning how to manage living on your own. As you transition into the “real” world, one of the most crucial skills you can develop is managing your finances effectively. Having a budget will help you stay within your means.

Integrity Financial Planning

SEPTEMBER 8, 2023

1] Game #3 – Monopoly Monopoly, a classic board game, encourages strategic planning, negotiation, and financial management. It tests players’ decision-making skills, as they must manage resources, plan ahead, and negotiate with their opponents.

oXYGen Financial

MARCH 1, 2024

These platforms offer tailored advice, comprehensive case management, and strategic planning tools that have revolutionized how individuals and businesses manage their legal and financial affairs. This article illuminates how legal. ]]

SEI

AUGUST 16, 2022

Marketing Specialist, Strategic Sponsorships. Sponsorship and event management. Strategic planning. Emily Knechel is a Marketing Specialist concentrating on strategic sponsorships for SEI Sphere. Emily Knechel SEI Sphere. IT Professionals (ITS). IT professionals (US). Relationship building. eknechel@seic.com.

SEI

AUGUST 16, 2022

Relationship management. Strategic planning. Kevin is a Financial Services Sales Executive with a proven track record of establishing and cultivating strategic partnerships in the investment, insurance, trust, legal, and accounting communities. Director of Sales. Kevin Kline SEI Sphere. IT Professionals (ITS).

Brown Advisory

NOVEMBER 1, 2023

Of course, the hidden truth in these movies is that the team surrounding Ethan Hunt is just as important as he is, managing all the risk and coordinating all the details, so that the impossible mission becomes…possible. How should ownership and management be handled in the future? How should we fund things like education?

Steve Sanduski

FEBRUARY 6, 2023

But folks with more modest wealth can still benefit from Pam’s expertise in those unexpected moments when life and money intersect, such as managing a significant inheritance. Retirement planning is not really as much of a focus for my clients. There’s more differentiation between top-tier managers and median managers.

Steve Sanduski

AUGUST 27, 2024

Guest: Lisa Salvi , Managing Director, Advisor Services at Charles Schwab. Lisa Salvi and her team have developed just such a blueprint for what the most successful firms at Charles Schwab are doing to manage and grow their businesses. Lisa Salvi and I discuss: Intentionally creating and managing your brand.

Brown Advisory

FEBRUARY 23, 2022

Topics will included: • How to structure the earn out. • Creating a diversification plan from a large single stock position • What are some of the key logistical issues to be aware of and how can you navigate them?

Brown Advisory

FEBRUARY 23, 2022

Speakers: Michael Aldrich, Global Head of Operational Security; Rebecca Sugarman, Chief Human Resources Officer; Craig Standish, Head of Boston Office Moderator: Victor Abiamiri, Portfolio Manager. . Planning for Your Liquidity Event and Beyond. Moderator: Brad Dunn, Portfolio Manager; Meredith Shuey Etherington, Portfolio Manager.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. A financial advisor provides personalized guidance to help manage and grow your wealth.

Harness Wealth

APRIL 16, 2025

million in total purchases, enables strategic planning of major technology investments. Meanwhile, purchased software for business use follows a 3-year depreciation schedule, creating predictable tax benefits that can be planned for in advance. This generous limit, with phase-out beginning at $3.05

Harness Wealth

APRIL 17, 2025

Modern digital receipt-tracking applications have made this process more manageable, enabling busy business owners to maintain compliant records without incurring excessive administrative burdens. These variables can significantly impact the final deduction amount, necessitating strategic planning to optimize this benefit.

The Big Picture

FEBRUARY 21, 2023

And we had prioritized all our strategic plans, we had to figure out how to get them done while people were remote. Like, we were managing money for people for a basis point and a half, and then they’re going ahead and charging 70 basis points. Now, how do we think about active managers? What is their active edge?

Indigo Marketing Agency

AUGUST 13, 2024

There’s also the option of hiring support staff or partnering with virtual assistants to allow you to focus on high-value activities like client relationship management and strategic planning. Benefit: Immediate reduction in administrative tasks, allowing you to focus more on client interactions and strategic planning.

Steve Sanduski

AUGUST 2, 2023

The proactive succession plan that Heritage Founder and Chairman Chuck Bean developed with Sammy and the management team. The differences between wealth management and financial planning. Crafting a strategic plan that balances clear business goals with an inspiring vision of the future.

Brown Advisory

JULY 30, 2015

It takes time to integrate decisions regarding your investments, tax situation, estate matters, business planning and charitable objectives into a thoughtful and coordinated plan. We recommend managing your planning efforts as a year-round process rather than an annual exercise in December.

Harness Wealth

OCTOBER 23, 2023

We’ll also introduce you to Harness Tax’s accounting practice management platform, and how it, too, can be the catalyst for your accounting firm’s growth. Accounting advisory services are a suite of strategic planning offerings that extend beyond the realm of traditional tax return preparation and filing.

Harness Wealth

NOVEMBER 27, 2023

Client Accounting Services are a comprehensive set of offerings provided by accounting firms to assist both individual and business clients in both compliance matters and day-to-day financial management. For example, a startup founder who has recently expanded their business may find it challenging to manage growing payroll needs.

Good Financial Cents

DECEMBER 14, 2022

After all, people will always need financial services, whether investing their money , taking out loans, or managing their taxes. The CFO role is multi-faceted and includes everything from financial planning and analysis to business budgeting, financial decision-making, and risk management. Financial Manager.

Steve Sanduski

AUGUST 22, 2023

Guest: John Furey , Founder and Managing Partner of Advisor Growth Strategies. Carving out a place for your firm is going to require a new level of clarity around both strategic planning and how you communicate what makes you unique to your team, clients, and prospects.

James Hendries

JULY 1, 2023

You will need to take an inventory of your current assets and expenses and develop a strategic plan to optimize these factors and help your company reach its potential. Assistance from a financial professional can assist you in your wealth management efforts and overall financial goals.

Brown Advisory

APRIL 20, 2022

1 For NFPs of all kinds, collaborating effectively with your investment advisor is a critical component to managing this complexity when preparing for your annual audit. Clear, proactive communication among your professional staff, auditor and advisor will go a long way to help make the process manageable, efficient and effective.

International College of Financial Planning

MARCH 9, 2024

Who is a Certified Financial Planner® Professional A Certified Financial Planner® (CFP®) professional is a beacon in the financial advisory landscape, offering unmatched expertise in financial management and strategic planning.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content