Tax Planning in a Down Market with SMAs

Wealth Management

AUGUST 15, 2022

Some advisors who have built their practices on ETFs and mutual funds have never experienced a market correction like the one we are in now.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

AUGUST 15, 2022

Some advisors who have built their practices on ETFs and mutual funds have never experienced a market correction like the one we are in now.

Nerd's Eye View

NOVEMBER 28, 2024

A firm's pricing strategy often reflects both the local market (or niche-related) norms – such as the nearly-ubiquitous 1%. Others may align with broader industry trends, like transitioning to fee-only structures to buffer against market volatility.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) What is the target market for MAGA-centric Strive Wealth Management? riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) Practice management Should you outsource your marketing to an outside firm? thinkadvisor.com) A year-end tax planning checklist.

Abnormal Returns

SEPTEMBER 8, 2024

(wsj.com) Three reasons why the stock market declines. awealthofcommonsense.com) Early in retirement is the time to do some tax planning. worksinprogress.co) Good luck trying to time the stock market using valuation metrics. ritholtz.com) How pour-over coffee got so good.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. What is the Lifetime Gift Tax Exemption? million ($27.22

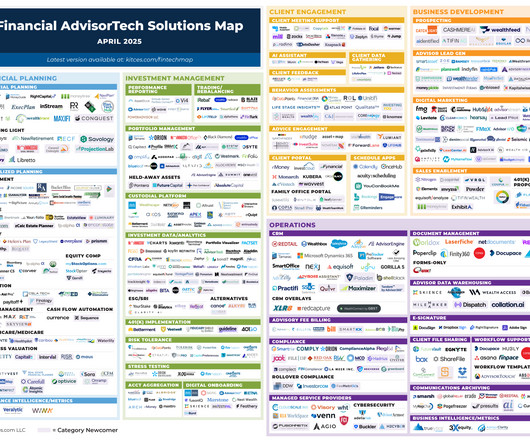

Nerd's Eye View

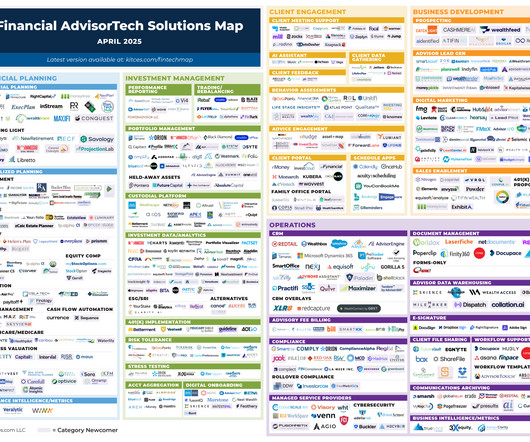

APRIL 7, 2025

Advisor workflow support solution Hubly has been acquired by Docupace, which suggests that Hubly might have struggled to gain a critical mass of users as a solution to help solve the shortcomings of advisor CRM systems' workflow capabilities – especially given that the price of Hubly was often as much or more expensive than the CRM platforms (..)

Nerd's Eye View

AUGUST 21, 2023

But typically, the opportunity to create and implement a marketing strategy is not one of these reasons. In fact, data from the latest Kitces Research study, How Financial Planners Actually Market Their Services, shows that many advisors find marketing to be difficult and not very effective. frequent travelers) niches.

Abnormal Returns

JANUARY 15, 2025

podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning. readthejointaccount.com) Taxes What you need to know about paying taxes on your crypto trading. cnbc.com) Personal finance Why focusing on short term market returns is so dangerous. sherwood.news) Direct File is expanding.

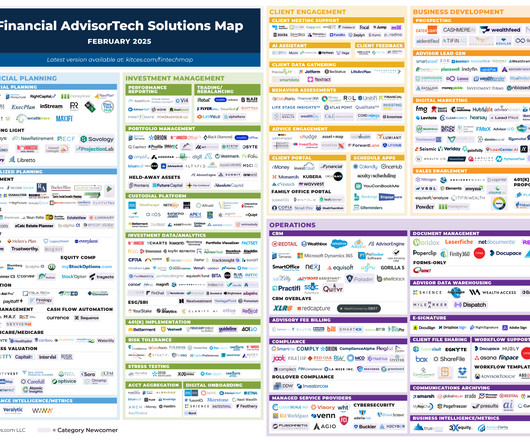

Nerd's Eye View

FEBRUARY 3, 2025

This month's edition kicks off with the news that FP Alpha has released its tax return extraction and analysis module as a standalone product, while RightCapital has separately launched its own tax return extraction tool bundled within its platform – with both announcements coming on the heels of Holistiplan implementing a significant price increase, (..)

Abnormal Returns

AUGUST 28, 2023

(investmentnews.com) Practice management How choosing an advisory niche makes for better marketing efforts. kitces.com) The SEC is focusing on RIA marketing. taps.substack.com) Advisers Wade Pfau on why tax planning in retirement is so challenging. citywire.com) Motivational interviewing is in large part about listening.

Indigo Marketing Agency

DECEMBER 17, 2024

3 Small Ways to See Big Marketing Results Financial advisors often feel overwhelmed by the idea of tackling marketing. Lets explore three small yet impactful strategies to elevate your marketing and grow your practice. Example topics: 5 Tips for Navigating Market Volatility or How Elections Impact Investment Strategies.

Nerd's Eye View

FEBRUARY 24, 2023

Also in industry news this week: Why the behavior of some TAMPs and investment advisers might have led the SEC to propose its new (and potentially burdensome) ‘outsourcing rule’ Why independent broker-dealers could become major players in RIA M&A in the coming year From there, we have several articles on advisor marketing: How to craft (..)

Nerd's Eye View

SEPTEMBER 20, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" – this week's edition kicks off with the news that the North American Securities Administrators Association (NASAA) released the latest edition its annual survey outlining the state of state-registered RIAs, showing that the number of state-registered firms and their assets (..)

Nerd's Eye View

SEPTEMBER 6, 2022

Read More.

Nerd's Eye View

JULY 7, 2023

Also in industry news this week: A recent survey indicates that a strong majority of financial advisory clients have maintained their trust in their advisors despite the investment market setbacks experienced last year A report from the SEC shows that a majority RIAs have mandatory arbitration clauses in their client agreements, a practice that has (..)

Midstream Marketing

DECEMBER 6, 2024

Key Highlights Learn why having a clear marketing strategy is important for RIAs, especially in hard markets. Understand the key rules and best practices to keep your marketing activities aligned with industry standards. Find answers to common questions about RIA marketing to help you succeed.

Advisor Perspectives

APRIL 16, 2025

Navigating market volatility can be challenging for investors. Our Bill Cass shares several tax planning strategies to consider.

Nerd's Eye View

SEPTEMBER 6, 2024

Also in industry news this week: A probe by the Government Accountability Office found that the conflict-of-interest disclosures offered by many firms offering financial advice are often inadequate or confusing, making it hard for consumers to understand whether and when a financial professional is operating in their best interest A recent study has (..)

Nerd's Eye View

JUNE 21, 2024

Also in industry news this week: A recent survey indicates that financial advisors continue to move towards ETFs and away from mutual funds when it comes to client portfolio recommendations, though a majority of advisors continue to see a role for active management in the investment management process A former employee has filed a lawsuit alleging (..)

Nerd's Eye View

MAY 12, 2023

The study also highlighted the importance of advisors taking the time to build trust with clients and to understand a client’s goals and needs, as this can not only differentiate an advisor from those providing purely transactional investment advice, but also could promote client retention, even in years of poor market performance.

Harness Wealth

MARCH 29, 2023

Avoid panic-selling When markets plummet, as they did by more 30% in March 2020, it can be easy to scramble for the exit and sell, sell, sell to avoid potential future losses. And depending on your specific tax situation, you may be paying between 15% and 20% or even more in capital gain taxes.

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. Get it right, and you will have set yourself up for a smooth transition and maximized returns.

Nerd's Eye View

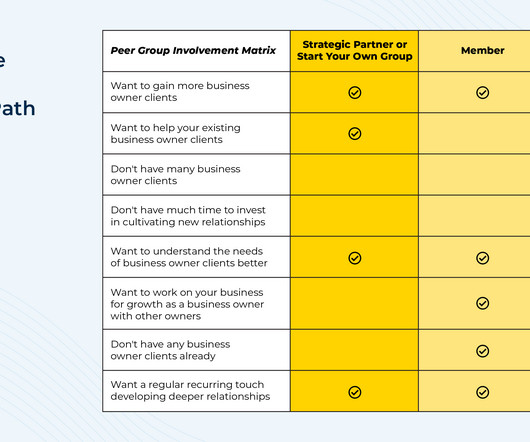

SEPTEMBER 30, 2024

When it comes to focusing on a niche for financial advisors, business owner clients can be an appealing target as they can have complex financial planning problems ranging from cash flow management to tax planning to acquisition strategies. Ultimately, the key point is that for advisors who work with (or would like to work with!)

Nerd's Eye View

SEPTEMBER 7, 2022

Tax-loss harvesting – i.e., selling investments at a loss to capture a tax deduction while re-investing the proceeds to maintain market exposure – is a popular strategy for financial advisors to increase their clients’ after-tax investment returns. With these three tools (i.e.,

Nerd's Eye View

OCTOBER 2, 2023

Read the analysis about these announcements in this month's column, and a discussion of more trends in advisor technology, including: Brand design consultancy firm Intention.ly

Nerd's Eye View

DECEMBER 25, 2023

Each week in Weekend Reading For Financial Planners, we seek to bring you synopses and commentaries on 12 articles covering news for financial advisors including topics covering technical planning, practice management, advisor marketing, career development, and more.

Nerd's Eye View

APRIL 7, 2025

Advisor workflow support solution Hubly has been acquired by Docupace, which suggests that Hubly might have struggled to gain a critical mass of users as a solution to help solve the shortcomings of advisor CRM systems' workflow capabilities – especially given that the price of Hubly was often as much or more expensive than the CRM platforms (..)

Midstream Marketing

NOVEMBER 6, 2024

Key Highlights Content marketing helps financial advisors stand out and earn trust from potential clients. A strong content marketing strategy involves setting clear goals, knowing your target audience, creating various types of content, and using social media and SEO effectively. This group will appreciate your knowledge and skills.

Nerd's Eye View

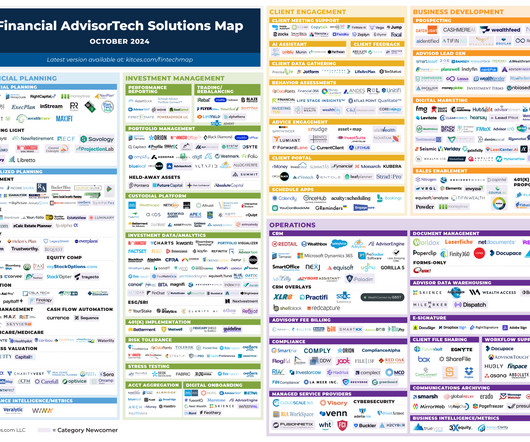

OCTOBER 7, 2024

This month's edition kicks off with the news that digital estate planning platform Wealth.com has raised a whopping $30 million in Series A funding, following on the heels of Vanilla's follow-on $20M capital round just a few months ago – which on the one hand reflects the anticipated enthusiasm for solutions that can help advisors efficiently (..)

Nerd's Eye View

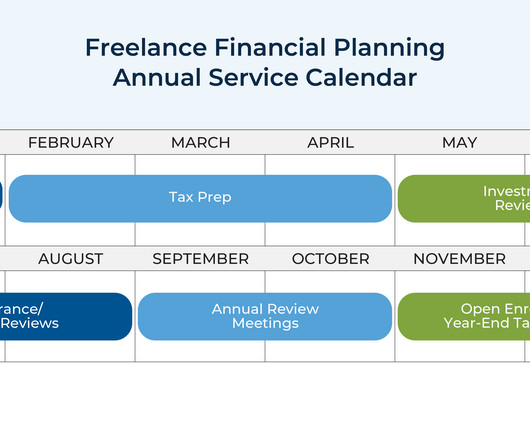

MAY 8, 2023

In this post, Kitces.com Senior Financial Planning Nerd Ben Henry-Moreland writes about how he went from being hesitant to offer tax preparation at his solo RIA (given how common it is for tax preparers to work long hours throughout tax season) to embracing it as a core part of the business’ service offering.

Harness Wealth

FEBRUARY 26, 2023

Cost-saving tax planning can be much more difficult to implement after your company is well-established and has reached the stage where an IPO, merger, or acquisition becomes a likely event. This type of stock option is only taxed upon the sale of the stock, and the valuation requirements are less stringent.

Nerd's Eye View

JUNE 7, 2024

Also in industry news this week: Backers announced the new Texas Stock Exchange, which seeks to provide companies with a lower-cost alternative to the NYSE and Nasdaq, which, if successful, could create a more competitive landscape and potentially better execution and reduced trading costs for financial advisors and their clients The American College (..)

Harness Wealth

APRIL 16, 2025

Let us face ittech startups encounter a unique set of tax challenges that can make or break their financial future. The complex interplay between traditional tax regulations and the innovative nature of tech businesses demands smart planning from day one.

Carson Wealth

JANUARY 8, 2025

Behavioral Guidance and Emotional Support Investing often involves emotional decision-making, which can lead to impulsive actions during market volatility. This support can be important in maintaining discipline and making rational decisions amidst market fluctuations.

Nerd's Eye View

JULY 12, 2024

Also in industry news this week: 2 House committees this week advanced legislation that would halt implementation of the Department of Labor's new Retirement Security Rule, which, combined with ongoing lawsuits, threaten to derail the regulation either before or soon after it becomes effective in late September A Federal judge has put the future of (..)

Nerd's Eye View

SEPTEMBER 6, 2023

Beyond insurance, advisors and their clients can also consider options such as the use of corporate entities such as Limited Liability Companies (LLCs) for business interests, and estate tax planning tools such as Spousal Lifetime Access Trusts (SLATs) that can offer both estate planning and asset protection benefits for married couples.

Carson Wealth

MAY 30, 2023

By Mike Valenti, CPA, CFP ® , Director, Tax Planning Corporate executives often receive the brunt of the U.S. tax system. Typically, most or all of their income is W-2 income and subject to the higher ordinary tax rates as well as FICA taxes. Tax Impact: The same as restricted stock awards.

Carson Wealth

JULY 3, 2024

Identify and Mitigate Risk Every business face risks, whether financial, operational or market-related. Identifying these risks early and having a plan to mitigate them can save your business from significant setbacks. Get Help with Tax Planning Tax planning is a critical component of financial management.

Harness Wealth

MARCH 27, 2025

Secondaries are typically traded before the fund or business is sold in a traditional wayessentially, being the resale market for private investments. As dynamic as the secondary market may be, secondaries come with complex tax implications that can significantly impact returns if not properly managed.

Harness Wealth

FEBRUARY 27, 2023

Traditional IPO: Valuation, Lockup Period, and Employee Equity Founders have more options for reducing the tax consequences of an acquisition Founders are generally in the best position to engage in tax planning and limit the taxable consequences associated with an acquisition.

Ballast Advisors

NOVEMBER 21, 2022

What are appropriate checklists for year-end tax planning? Tax planners often develop checklists to guide taxpayers toward year-end strategies that might help reduce taxes. Certain tax benefits may be available if you can claim an individual as a dependent. Family tax planning.

Sara Grillo

NOVEMBER 11, 2024

In this first episode of “Does my Marketing STINK?”, ”, we’ll interview Chase Dapello of Westlake Private Wealth Management and answer the question of whether or not his marketing stinks. FIND OUT IF YOUR MARKETING STINKS For those of you who are new to my blog, my name is Sara.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content