Will my Social Security be Taxed?

The Chicago Financial Planner

FEBRUARY 8, 2023

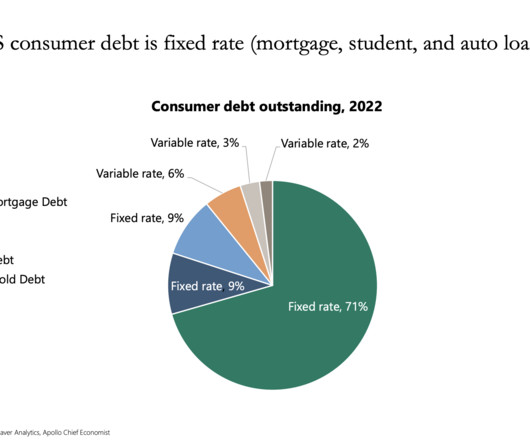

You’ve paid Social Security taxes over the course of your working life and you’ve earned these benefits. Many retirees and others collecting Social Security wonder about the tax treatment of their benefit. The answer to the question in the title is that your Social Security benefits may be subject to taxes.

Let's personalize your content