Integrated Recruits $1B Retirement Plan-Focused Firm

Wealth Management

JANUARY 15, 2025

RetirementDNA, a San Diego-headquartered advisory team with over $1 billion in assets under management, has joined Integrated Partners.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 15, 2025

RetirementDNA, a San Diego-headquartered advisory team with over $1 billion in assets under management, has joined Integrated Partners.

Nerd's Eye View

FEBRUARY 18, 2025

Sebastian is the President of Guerra Wealth Advisors, a hybrid advisory firm based in Miami, Florida, with nearly $15M of revenue and almost 60 team members, supporting over 1,700 client households.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

MARCH 7, 2024

Created last year, the self-described digital family office has dramatically overshot recruitment goals with spate of Empower expats.

Wealth Management

OCTOBER 28, 2024

Citigold plans to hire 150 advisors over the next two years to fill out bank branches in six affluent markets.

Advertiser: G-P

Research has shown that when executed correctly, hybrid working models can allow companies to recruit better talent, achieve innovation, and build a flexible, productive future. How Globalization Partners’ technology can enable a hybrid game plan. Download the eBook to learn more about: What the hybrid model of work is.

Nerd's Eye View

SEPTEMBER 11, 2023

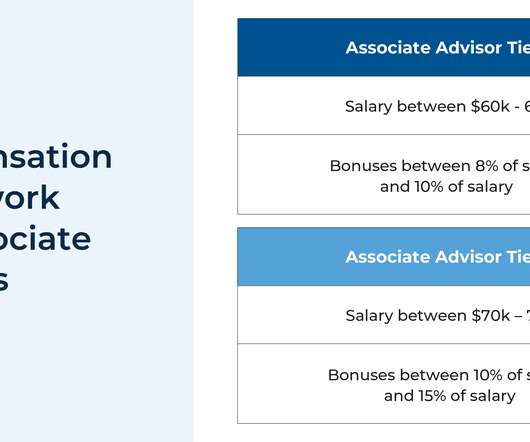

annual plan reviews) to their current clients, they will continue to prospect and onboard new clients as well. a client service associate to handle various administrative and client communication tasks, or a paraplanner or associate advisor to work on more planning-centric issues such as building out drafts of financial plans).

Wealth Management

JANUARY 23, 2025

The self-described digital family office has also beefed up its leadership team with new roles in engineering, trading, product and finance, after recruiting 30 advisors in 2024.

Nerd's Eye View

MARCH 4, 2025

Sten is the owner of Legacy Investment Planning, a hybrid advisory firm based in Franklin, Tennessee, that oversees $220 million in assets under management for 90 client households. Welcome everyone! Welcome to the 427th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is Sten Morgan.

Nerd's Eye View

MARCH 25, 2025

In this episode, we talk in-depth about how AJ and her firm have navigated periods of rapid client headcount growth (with the firm averaging 14 new clients per month in 2021 while having just three planners on staff at the time), how AJ decided to hire rapidly to meet this brisk new client demand (by leveraging LinkedIn's Recruiter platform to actively (..)

Nerd's Eye View

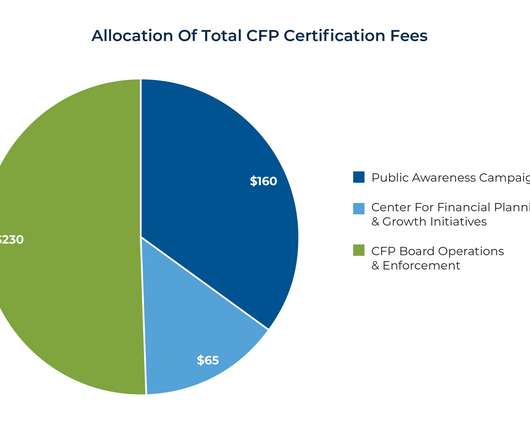

JULY 18, 2022

To meet this challenge, CFP Board’s Center For Financial Planning has engaged in fundraising for several years to fuel campaigns that have focused on building the advisor workforce of the future.

Abnormal Returns

MARCH 4, 2024

fa-mag.com) Headcount RIAs need to do a better job of recruitment AND retention. riabiz.com) Estate planning is growing in importance for advisers. kitces.com) People undergoing divorce need a range of financial planning services. (am.jpmorgan.com) How longevity literacy affect financial wellness in retirement.

Abnormal Returns

JULY 10, 2023

mebfaber.com) Ashby Daniels talks with Hannah Moore about "doing" financial planning. wiredplanning.com) Laurence Kotklikoff talks with David Blanchett about problems with conventional financial planning tools. investmentnews.com) Recruiting Why aren't more women becoming advisers?

Abnormal Returns

JULY 3, 2023

kitces.com) Estate planning Four things to consider in anticipation of 2026. financial-planning.com) Wealth.com's Ester will help you read estate planning documents. riabiz.com) Why advisers need to step up their recruitment game. riaintel.com) Why you should flip your plan presentation meetings on their head.

Nerd's Eye View

NOVEMBER 14, 2022

And as the associate gains experience and trust among existing clients, they can gradually take over some of the lead roles themselves, to be supported by new associate advisors of their own – thus allowing the firm to transition its clients from the founder to the next generation of advisors.

Nerd's Eye View

DECEMBER 9, 2022

Also in industry news this week: A recent survey indicates that retirement plan sponsors currently using financial advisors to support their plan are overwhelmingly satisfied with the service they receive, which also leads to improved retirement savings for their employees.

Nerd's Eye View

SEPTEMBER 13, 2022

Vest and Financial Network to improve upon or outright establish new advisory platforms within their existing brokerage businesses, and how in three short years, Carolyn built a new training and development platform for LPL’s largest advisors – helping them recruit and retain advisors, create better compensation packages, and even build (..)

Nerd's Eye View

MAY 16, 2023

Jim is the Co-Founder and CEO of Dew Wealth Management, an independent RIA based in Scottsdale, AZ, that provides virtual-family-office-style financial planning on a monthly retainer basis for 150 small-business owner entrepreneurs. My guest on today's podcast is Jim Dew.

Nerd's Eye View

JUNE 30, 2023

Also in industry news this week: Concerned about the (insufficient) frequency of its examinations of RIAs, an SEC committee has recommended that the regulator allow third parties to conduct these examinations and to request Congressional authorization to charge investment advisers under its purview a ‘user fee’ that would provide steady (..)

Nerd's Eye View

APRIL 12, 2024

Also in industry news this week: A recent study indicates that advisors charging clients on a monthly subscription basis hiked their fees by an average of 6% in 2023, raising the salience of how advisors can most effectively communicate fee increases to clients A survey suggests that while financial advisors are increasingly aware of Artificial Intelligence (..)

Diamond Consultants

DECEMBER 18, 2024

Whats the reality when it comes to recruiting and transitions? One factor working in favor of higher deals: For the first time in recent memory, all four wirehouses are back in the competitive recruiting battle. Competitive recruiting is coming to an end at the big firms. An annual perspective for advisors. Its simply outdated.

Nerd's Eye View

JANUARY 31, 2023

In this episode, we talk in-depth about how Ali and her firm serve their ultra-high-net-worth families with client relationship teams of wealth planning, investing, and client service, to delve into the full depth of their financial complexities while delivering a ‘white glove’ service, how Waldron instituted an in-depth upfront financial (..)

Abnormal Returns

NOVEMBER 21, 2022

Podcasts Jeff Ptak and Christine Benz talk with Feraud Calixte who is the founder and lead financial planner of Vantage Pointe Planning. riabiz.com) CI Financial ($CIXX) is planning to spin-off its U.S. wsj.com) Advisers How to recruit, train and retain next generation advisers. unit debt-free in 2023.

Diamond Consultants

JANUARY 21, 2025

Advisors regularly get calls from recruiters, consultants, branch managers, complex directors, business development officersthe list goes on and on. Yet there are certain realities that every advisor needs to be aware of (and as a recruiter, I know them very well!): Stay because you have the ability to serve clients without limitation.

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. He is an experienced association professional with a demonstrated history of working in the staffing and recruiting industry.

Nerd's Eye View

SEPTEMBER 17, 2024

We also talk about Eric's own unique career journey, which started in commercial banking with stops along the way that included a variety of roles at Goldman Sachs Asset Management and working as an internal full-time Chief Investment Officer for a large national RIA before starting his current fractional CIO role, how Eric has leveraged recruiters (..)

Leading Advisor

AUGUST 26, 2024

My Role as an FCOO (Fractional Chief Operating Officer) is to listen to my clients, work with them to create a vision and plan, and… The post FCOO – Managing Hiring/Recruiting appeared first on Leading Advisor - Simon Reilly.

Diamond Consultants

DECEMBER 16, 2024

Examples include Creative Planning, Mariner Wealth Advisors, and Beacon Pointe. The Pros: The combination of the recruiting deal (offered as an incentive to change firms) and the new firms retire-in-place deal is highly lucrative.

Nerd's Eye View

AUGUST 6, 2024

What's unique about Jaime, though, is how his firm has grown to more than $1 billion in AUM over the past 20 years in part by making a series of 6 acquisitions, typically buying mixed fee-and-commission practices from retiring advisors in his local area and converting them into ongoing recurring revenue financial planning clientele.

MarketWatch

MARCH 22, 2023

Japan-based Recruit Holdings Inc.’s s JP:6098 Indeed job-search site plans to lay off 15% of its workforce for total of 2,200 positions, according to a company blog post Wednesday. American depositary receipts of Recruit RCRUY were down 0.2% in recent activity. Visit MarketWatch.com for more information on this news.

MarketWatch

MARCH 14, 2023

META plans to lay off 10,000 more employees as it focuses on “efficiency” and cost cutting. With less hiring, I’ve made the difficult decision to further reduce the size of our recruiting team,” Chief Executive Mark Zuckerberg said Tuesday. After restructuring, we plan to lift hiring and transfer freezes in each group,” he noted.

Nerd's Eye View

SEPTEMBER 28, 2022

In this episode, we talk in-depth about how Joe has witnessed firsthand as an advisory firm owner, and now a partner at a leading global investment management firm, how the financial services industry is evolving in real time as more banks and brokerage firms are truly adopting financial planning and implementing advisory services at national scale (..)

Million Dollar Round Table (MDRT)

JANUARY 14, 2024

Each of those salespeople has one-on-one meetings with me to set up their own planning for the year with my observations and maybe some best practices they can focus on. I’m incorporating my trips, my planning and all my continuing education as well as client reviews. I have a team of 15 people, including 10 salespeople.

The Big Picture

JUNE 29, 2023

( Musings on Markets ) • For Trend-Setting Family Offices—and Those Following Their Lead—Timing Is Key : Investors are sensing a regime shift in the market but capturing it will take careful planning. Chief Investment Officer ) • Carry That Weight : There’s a problem with transporting new vehicles across the country: They’re too heavy.

Million Dollar Round Table (MDRT)

OCTOBER 9, 2022

These have helped me gain the trust of new clients and new recruits for my team. My posts here are more related to my financial planning work to gain greater traction. Yet, I’ve made great strides in this area. I don’t produce YouTube videos or TikTok content, but I do a few key things that anyone can do. Authenticity is key.

Nerd's Eye View

APRIL 4, 2023

In this episode, we talk in-depth about how Marc developed and implemented his unique marketing strategy of writing parody commercials that feature a satirical sales-centric advisory firm, Bear Brothers Financial, and how he got mentally comfortable taking such a non-traditional approach to trying to stand out in his marketing, how Marc has sought (..)

XY Planning Network

SEPTEMBER 26, 2022

While there is no bulletproof solution to the new area of recruitment, there are key tips and best practices that can help you make a new hire. New expectations regarding the workplace and its benefits make finding and retaining talent a full-time job in and of itself. Let this blog serve as your guide.

Nerd's Eye View

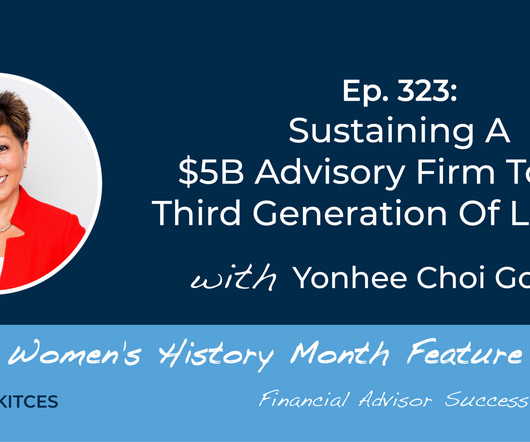

MARCH 7, 2023

What's unique about Yonhee, though, is how, through her nearly 4 decades with JMG Financial Group, Yonhee has been a part of not only the firm’s succession plan to its second generation of owners but now to its third generation of leaders… and along the way, has personally recruited, trained, and retained the majority of the firm’s (..)

Robert B. Ritter Jr.

MARCH 28, 2022

(Click here for Blog Archive)(Click here for Blog Index) (Presentations in this Blog were created using the InsMark Loan-Based Split Dollar System) Editor’s Note: This blog presents a sizzling loan-based split-dollar plan. This executive benefit will be difficult to justify if interest rates increase considerably.

Sara Grillo

OCTOBER 21, 2022

For Jonathan Grannick, his first job as a financial paraplanner he found on the University of Georgia student Financial Planning Association listserv. He cold called over 500 financial planning companies over a year or so to get to a full book of clients. What designations does a paraplanner usually have?

MarketWatch

MARCH 6, 2023

In a blog post, co-founders and co-Chief Executives Mike Cannon-Brookes and Scott Farquhar said that the cuts will be focused on recruiting, program management and research, and that savings will be reinvested in other areas of the company.

James Hendries

JUNE 18, 2023

Richer matching contributions can help employers gain a competitive edge Employer-sponsored retirement plans, such as 401(k) or 403(b) plans, have become an essential part of the benefits package offered by companies to attract and retain employees. Offering a generous employer match for retirement savings plans is one such strategy.

NAIFA Advisor Today

OCTOBER 6, 2023

He has earned several impressive designations, including Chartered Life Underwriter (CLU), Chartered Financial Consultant (ChFC), Chartered Retirement Planning Counselor (CRPC), Life Underwriter Training Council Fellow (LUTCF), LACP, and CLTC.

The Big Picture

MARCH 4, 2025

What was the original plan? Melissa Smith : So I definitely thought that I was gonna work in the public sector when, when I’m recruiting at JP Morgan I always, you know, get the question sort of how did, how did you get into investment banking? And I, and I would love to tell people I had a grand plan.

Clever Girl Finance

JUNE 27, 2023

Online recruiter 16. Digital editors also plan, coordinate, review, and edit content. Travel consultant Do you enjoy planning out great trips? In this role, you’ll be working closely with clients to plan their trips. Online recruiter Are you a matchmaker? Well, then, you could be a superb online recruiter.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content