Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

The Chicago Financial Planner

NOVEMBER 27, 2022

One of the best tax deductions for a small business owner is funding a retirement plan. Beyond any tax deduction you are saving for your own retirement. You deserve a comfortable retirement. If you don’t plan for your own retirement who will? You need to start a retirement plan today.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The Chicago Financial Planner

OCTOBER 21, 2021

Health savings accounts (HSA) provide another vehicle to save for retirement. Many of you have the option to enroll in high-deductible insurance plans that allow the use of a health savings account via your employer. High deductible health insurance plans . A portion of the premiums for a tax-qualified long-term care policy.

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

Nerd's Eye View

JANUARY 31, 2025

Also in industry news this week: While RIA M&A deal flow hit record levels in 2024 (both in terms of volume and the speed of completing them), firm valuations saw relatively modest gains In its latest annual regulatory oversight report, FINRA joined the SEC in flagging the potential risks to firm and client data from the use of third-party vendors (..)

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households. Welcome everyone! Welcome to the 432nd episode of the Financial Advisor Success Podcast!

Nerd's Eye View

NOVEMBER 29, 2024

Also in industry news this week: While many financial advisors are paying close attention to the potential extension of sunsetting measures within the Tax Cuts and Jobs Act (TCJA) in the coming year, legislation related to retirement savings could be on Congress' agenda as well Fidelity is planning to change the default for its existing RIA non-retirement (..)

Nerd's Eye View

MARCH 28, 2025

Also in industry news this week: A recent survey indicates that younger "DIY" investors are more likely to be interested in working with a human advisor than their older counterparts, suggesting an opportunity for advisors to tap into this demographic (perhaps by setting minimum planning fees that ensure these clients can be served profitably today (..)

Nerd's Eye View

SEPTEMBER 29, 2022

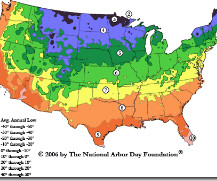

As an individual begins planning for retirement, one of the factors often considered is whether (and where) they might relocate to enjoy their retirement. a state’s income tax rules can have a significant impact on where they might choose to live. When evaluating their potential options across the U.S.,

Carson Wealth

DECEMBER 20, 2024

Strategic charitable giving not only benefits the recipient but can also create significant tax advantages for the giver. While many people approach their financial planning with careful strategy, its easy to overlook the same level of intention when it comes to charitable giving. It just needs to be given to a qualified 501(c)(3).

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses.

Nerd's Eye View

FEBRUARY 8, 2023

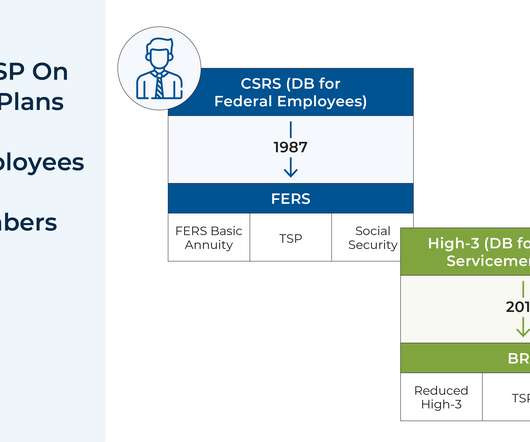

government is the largest employer in the country, it can be especially helpful for advisors to be familiar with the ins and outs of (and recent changes to) the Federal government’s own defined contribution plan: the Thrift Savings Plan (TSP). But given that the U.S. While many features of the TSP (e.g.,

The Chicago Financial Planner

FEBRUARY 8, 2023

You’ve paid Social Security taxes over the course of your working life and you’ve earned these benefits. Many retirees and others collecting Social Security wonder about the tax treatment of their benefit. The answer to the question in the title is that your Social Security benefits may be subject to taxes.

Getting Your Financial Ducks In A Row

APRIL 3, 2023

We’ve covered a lot of ground with regard to how various tax laws impact your retirement plans: pensions, IRAs, 403(b) and 401(k) plans. But we’ve primarily focused on the US income tax laws (the IRS) affect your plans – and there are many nuances that you need to take into account with regard to state tax laws.

Nerd's Eye View

MAY 17, 2023

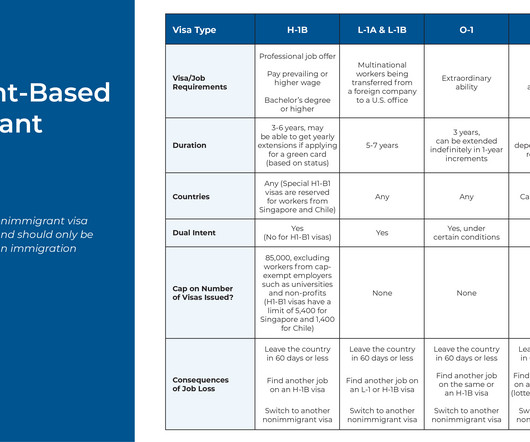

Like native-born workers, foreign workers need to think about saving for retirement, planning for their children’s college, managing healthcare costs, and all manner of other financial goals. For example, the tax benefits of certain accounts can sometimes work in the other direction if a non-U.S.-born

Carson Wealth

MARCH 28, 2024

Retirement planning is a journey that generally takes decades to complete and most of us start out along the do-it-yourself path. More than likely, your first step was to enroll in an employer-provided plan such as a 401(k) or setting up an individual retirement account, also known as an IRA.

Wealth Management

FEBRUARY 21, 2024

The intellectual case for getting rid of tax-advantaged retirement plans is strong, and the political case is catching up.

Nerd's Eye View

MARCH 13, 2024

Most of the time, people are subject to state taxes in the states where they live and/or earn their income. So when moving to a lower-tax state or another, their income tax burden likewise shifts to the new state along with them.

Nerd's Eye View

NOVEMBER 23, 2022

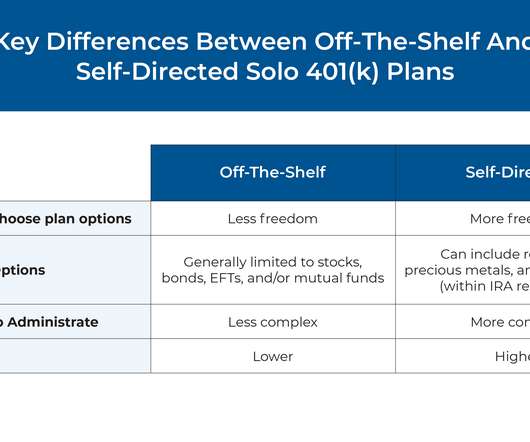

Among the several different types of retirement plans that are available to self-employed workers, solo 401(k) plans can offer the most flexibility and the ability to contribute the highest amount of tax-advantaged savings.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. Here’s more on what a SEP IRA is, tax benefits, contribution limits, and important deadlines. The SEP IRA is a straightforward and cost-effective way for small business owners to save for retirement. What is a SEP IRA?

A Wealth of Common Sense

FEBRUARY 6, 2025

Bill Sweet joined me on the show this week to discuss questions about the tax benefits of owning rental properties, the tax implications of an inheritance, retirement planning for military service members and how tariffs work. Further Reading: The U.S. Housing Market vs. The Canadian Housing Market The post The U.S.

Abnormal Returns

FEBRUARY 24, 2025

thinkadvisor.com) Cutting IRS workers is going to make life more difficult for tax preparers (and payers). advisorperspectives.com) Retirement planning models are just uncertainty piled on uncertainty. (citywire.com) How Jacob Turner turned a professional baseball career into a wealth management business. crr.bc.edu)

Abnormal Returns

JANUARY 15, 2024

citywire.com) Taxes There simply aren't enough tax preparers to go around. obliviousinvestor.com) It's hard to say you are a holistic financial adviser without tax management. thinkadvisor.com) Retirement Baby Boomers were supposed to retire in penury. (riabiz.com) Avise is a cooperative platform for advisers.

Abnormal Returns

APRIL 10, 2024

(morningstar.com) Dan Haylett talks with Eric Brotman, who is the founder and CEO of BFG Financial Advisors, about retirement as 'graduation.' humansvsretirement.com) Estate planning Why you should update your estate plans periodically. obliviousinvestor.com) Estate planning should most importantly include talking about it.

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Abnormal Returns

FEBRUARY 28, 2024

Podcasts Peter Lazaroff with five reasons you need a financial plan that have nothing to do with money. morningstar.com) Rick Ferri talks all things taxes with Kaye Thoma of Fairmark.com (bogleheads.podbean.com) Housing What's the bear case for housing prices? wsj.com) Retirement How rising interest rates affect retirement planning.

Harness Wealth

APRIL 16, 2025

Let us face ittech startups encounter a unique set of tax challenges that can make or break their financial future. The complex interplay between traditional tax regulations and the innovative nature of tech businesses demands smart planning from day one.

Abnormal Returns

NOVEMBER 6, 2023

ft.com) Creative Planning has closed on its purchase of Goldman Sachs' ($GS) PFM unit. citywire.com) Creative Planning is expanding its reach in the retirement plan space. papers.ssrn.com) Taxes A 2023 year-end tax planning guide. investmentnews.com) M&A The RIA model continues to take share.

Carson Wealth

JULY 3, 2024

Set up separate plans and goals for your business and your personal finances. It helps you plan for future expenses, allocate resources efficiently and stay on track with your financial goals. Identifying these risks early and having a plan to mitigate them can save your business from significant setbacks.

Abnormal Returns

FEBRUARY 21, 2024

(youtube.com) Retirement Why planning in retirement is so challenging. Rowe Price about non-financial considerations in retirement. morningstar.com) People work in retirement for any number of reasons. awealthofcommonsense.com) Taxes Do you know how to pay taxes on your Series I savings bonds?

Nerd's Eye View

JANUARY 26, 2024

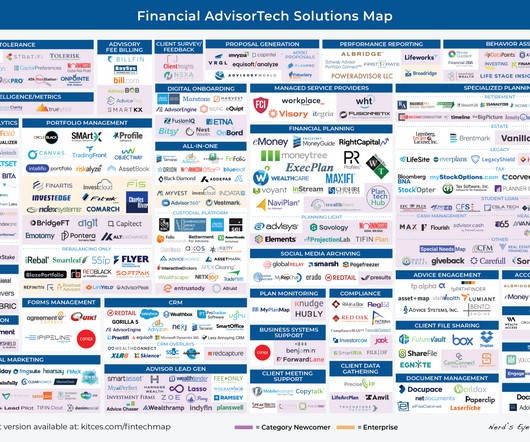

The survey also suggests that a firm's tech stack can affect its ability to attract and retain clients, with 93% of advisors who said they work with state-of-the-art technology reporting that they have added new clients as a result of another firm's bad technology, and 58% of all advisors surveyed reporting they had lost new business due to bad technology. (..)

Talon Wealth

NOVEMBER 12, 2024

Even though retirees have contributed throughout their careers, a portion of those benefits could still be taxed, depending on your total income. Here’s how it breaks down for 2023-2024: If a couple’s total retirement income is between $32,000 and $44,000, up to 50% of Social Security benefits could be taxable.

Carson Wealth

DECEMBER 8, 2023

Petersen, CPA, CFP ® , CP, Affluent Wealth Planning The holidays are upon us! That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA).

Abnormal Returns

APRIL 1, 2024

(youtube.com) Christine Benz and Amy Arnott talk with Peter Mallouk, President and CEO of Creative Planning, about the 'messy' business of financial advice. morningstar.com) Thomas Kopelman and Jacob Turner talk with Ankur Nagpal about tax considerations when selling a business. thinkadvisor.com) Not everyone is happier in retirement.

Nerd's Eye View

NOVEMBER 1, 2023

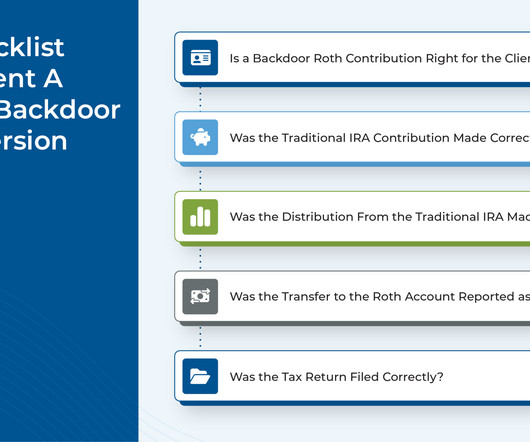

There are many tax planning strategies that allow financial advisors to demonstrate the ongoing value they provide to clients in exchange for the fees they charge. Advisors also can support the backdoor Roth process by communicating with clients' tax preparers about the strategy and why they are recommending it for their mutual client.

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. In this episode, we talk about five strategies you can use during tax season to create opportunities to help you reach your financial goals.

Abnormal Returns

MARCH 15, 2023

wsj.com) Retirement Retirement planning is a moving target. humbledollar.com) Retirement is, in part, about declaring career victory. kindnessfp.com) When does it make sense to get help with your taxes? (thisisthetop.substack.com) Consumers are piling into CDs.

Abnormal Returns

DECEMBER 14, 2022

Podcasts Christine Benz and Jeff Ptak talks with Jamie Hopkins of Carson Wealth about some common retirement planning questions. ft.com) Who really benefits from 529 plans? nytimes.com) Planning Doug Boneparth, "Cash flow lives at the heart of financial organization." morningstar.com) 20 thing to do before year-end.

Nerd's Eye View

MAY 1, 2023

This month's edition kicks off with the news that robo-advisor Betterment entered into a $9M settlement with the SEC for misrepresenting its tax-loss harvesting practices in its client agreements and marketing materials compared with its actual practices (e.g.,

Nerd's Eye View

OCTOBER 1, 2022

A new bill would make many parts of the Tax Cuts and Jobs Act of 2017 permanent, including its changes to tax brackets, the higher standard deduction, and the cap on state and local tax deductions. What advisory firms can do to make the most out of client testimonials and avoid negative reviews on third-party websites.

Abnormal Returns

JULY 18, 2022

(standarddeviationspod.com) A talk with Tony and Dina Isola about the awful situation facing teachers saving for retirement. ngpf.org) Christine Benz and Jeff Ptak talk with Justin Fitzpatrick who is the co-founder and chief innovation officer at Income Lab, which provides retirement planning software. barrons.com).

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Your current and projected future tax rate is often a main component of the decision, but there are other considerations and benefits as well.

Nerd's Eye View

NOVEMBER 4, 2022

From there, we have several articles on investment planning: While I Bonds have received significant attention during the past year, TIPS could be an attractive alternative for many client situations. ” to pass by the end of the year, while passage of other proposed tax measures appears to be less likely.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content