Former Allianz Exec Launches Advanced Planning Firm

Wealth Management

MARCH 12, 2025

Heather Kellys Mosaic Advanced Planning is a platform to help advisors integrate risk management and insurance into their practices.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MARCH 12, 2025

Heather Kellys Mosaic Advanced Planning is a platform to help advisors integrate risk management and insurance into their practices.

Carson Wealth

FEBRUARY 4, 2025

Understanding Tax Compliance and Risk Management Ultra-high-net-worth individuals face unique tax challenges, including high rates and ever-changing complex tax codes. If managed improperly or inefficiently, tax issues could significantly erode your familys wealth and even lead to legal complications.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

JANUARY 24, 2025

Nonetheless, given the scale and brand awareness of the wirehouses, and as their own use of fee-based models increases (as opposed to primarily relying on commissions from selling products), competition for clients (and advisors) will likely remain stiff going forward, even amidst the favorable trends for RIAs Also in industry news this week: A recent (..)

Wealth Management

APRIL 10, 2024

Estate planners should have a role in the overall risk management aspect of a client’s planning.

Abnormal Returns

JANUARY 29, 2024

(kitces.com) Daniel Crosby talks with Jon Dauphiné of the Foundation for Financial Planning about the value of pro bono planning. riaintel.com) A look at GuardRails a new risk management offering focused on drawdowns. standarddeviationspod.com) Advisortech Advisers just want technology that works.

The Big Picture

MAY 29, 2024

In today’s ATM, we discuss the advantages of having a financial captain in charge of all of your financial affairs Full transcript below. ~~~ About this week’s guest: Peter Mallouk is CEO of Creative Planning, with over $300 billion in client assets. He’s the CEO of Creative Planning.

Carson Wealth

JULY 3, 2024

Set up separate plans and goals for your business and your personal finances. It helps you plan for future expenses, allocate resources efficiently and stay on track with your financial goals. Identify and Mitigate Risk Every business face risks, whether financial, operational or market-related.

Abnormal Returns

OCTOBER 2, 2024

wsj.com) Personal finance Ben Carlson, "Your two best forms of risk management in retirement are diversification and flexibility with your plan." (vox.com) The case against high yield savings accounts. disciplinefunds.com) Your credit card points are going down in value. tonyisola.com) What is money good for?

BlueMind

OCTOBER 25, 2022

However, amid these fears, it has become difficult for financial advisors to explain to clients that taking appropriate risks is deemed necessary in order to ensure your portfolio has the growth potential to reach your financial goals. Would they consider a 5% return worth taking a risk or 20%?

Abnormal Returns

JULY 26, 2024

The biz Spotify ($SPOT) is planning to add an even higher paid tier. epsilontheory.com) Joe Weisenthal and Tracy Alloway talk with Rich Falk-Wallace, founder and CEO of Arcana, about building risk management tools for pod shops. theverge.com) Is the worst over for the podcasting industry? bloomberg.com) What's new in Overcast.

Nerd's Eye View

MARCH 15, 2023

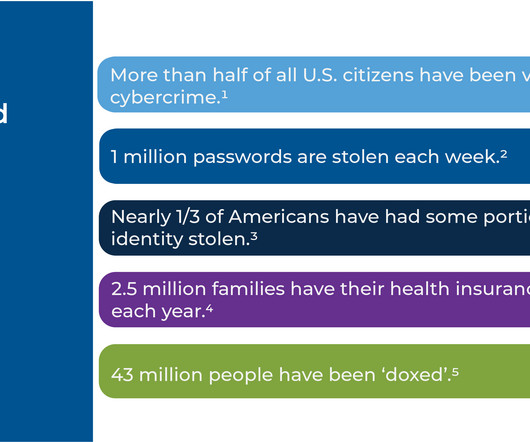

Risk management is a key part of many financial advisors’ value propositions. For instance, ensuring clients maintain the proper insurance coverage based on their needs is an important part of the financial planning process. At the same time, clients face another class of risks that advisors often do not consider: cyber.

Carson Wealth

JANUARY 23, 2025

Enter bucketing, a powerful strategy that helps simplify your financial planning by categorizing your assets into three time-based buckets: today, tomorrow, and the future. By dividing your investments into these three buckets, you help create a clear plan for how and when your money will be used. What Is Bucketing?

International College of Financial Planning

MARCH 12, 2025

Heres how to avoid them (without giving up your weekend plans or your love for good coffee). Why This Is a Problem: Future youwho needs a house, financial security, and maybe even early retirementmight resent past you for not planning ahead. Why This Is a Problem: Many BNPL plans dont feel like debt but they are.

Risk Management Guru

OCTOBER 3, 2022

There are basically five strategies which can help you in allocating your risk management. If you have a firm grasp of these elements and how they influence stock market fluctuations, you will be in a better position to plan your investments. Stock Market Risk Management Strategies. Learn about the company.

Nerd's Eye View

JANUARY 22, 2024

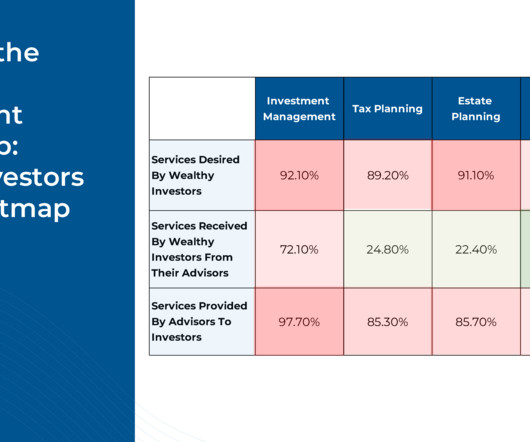

For example, an advisor may think of "risk management" in terms of life and property insurance coverage, whereas HNW clients may instead think of tax and estate-planning strategies as asset protection measures – particularly for the future wealth of their heirs.

Carson Wealth

JANUARY 8, 2025

Knowledge and Personalized Planning Financial advisors can bring a wealth of knowledge from extensive education and experience, helping enable them to craft tailored strategies that align with your unique financial goals. This personalized approach can help you make financial decisions that are well-informed and strategically sound.

Risk Management Guru

SEPTEMBER 29, 2022

In the stock market, risk management is locating, quantifying, and dealing with the various risks that can affect investment. Due to the potential negative effects of various risks on a person’s investment portfolio, effective risk management is crucial. appeared first on Risk Management Guru.

Norman Marks

NOVEMBER 13, 2024

My good friend, Brian Barnier, is a brilliant individual with excellent insights into financial and cyber risk management His personal website has a challenging sidebar. It says: Good risk management is… Building value Always having a Plan B (and C, D and …) The laser eye surgery of business — it sharpens focus.

Trade Brains

MAY 8, 2024

Bearish Harami Candlestick Pattern – Trading Plans Traders must ensure that the prior trend before forming this pattern is an uptrend. However, as with any trading signal, it’s crucial to consider additional factors and employ risk management strategies.

Harness Wealth

APRIL 16, 2025

The stakes became higher after the Tax Cuts and Jobs Act of 2017 eliminated recharacterizationthe ability to reverse conversions that did not work as planned. This flexibility allows for more sophisticated estate planning strategies and continued tax-free growth throughout retirement.

Million Dollar Round Table (MDRT)

MAY 9, 2024

This helps them truly understand and connect with their assets, rather than shopping for the best rate in a fruitless search for yield,” said the 14-year MDRT member from Calgary, Alberta, Canada.

Norman Marks

DECEMBER 13, 2022

This time its about how internal auditors address risk management, including whether and how they audit it; who performs the risk assessment for management and the board; and how the audit plan is built. I would appreciate your help with another short survey. You can find it here. Thanks in advance.

NAIFA Advisor Today

JANUARY 28, 2025

As a Retirement Income Certified Professional and a Life and Annuities Certified Professional, John advises clients on retirement planning, investment planning, and risk management. Zack is also skilled in presenting, emceeing, event planning, program management, and social media.

Nationwide Financial

OCTOBER 1, 2022

Many Hispanic business owners are optimistic about the future of their businesses, but even the savviest owner needs advice from subject matter experts who can help them plan for the unexpected. Small business owners wear many hats, and the topic of risk management presents an opportunity for you to add value. economy each year.

Abnormal Returns

MARCH 13, 2023

Podcasts Mihael Kitces talks the challenges of succession planning with Yonhee Choi Gordon a Principal and the COO of JMG Financial Group. peterlazaroff.com) Daniel Crosby talks with Eben Burr, who is the President of Toews, about risk management. thinkadvisor.com) Practice management What really makes financial advisers happy?

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. Estate Planning : Ensuring your wealth is passed on according to your wishes. Optimizing tax-efficient retirement income.

MainStreet Financial Planning

FEBRUARY 7, 2024

“MainStreet Chalk Talk” The MainStreet Financial Planning Discussion Club When: Tuesday 2-20-24 at 7:30pm Eastern; 4:30pm Pacific ~30-45 minutes Recorded and able to retrieve for one week How : Zoom Meeting Free for current clients, $10 for guests Register Here!

eMoney Advisor

DECEMBER 27, 2022

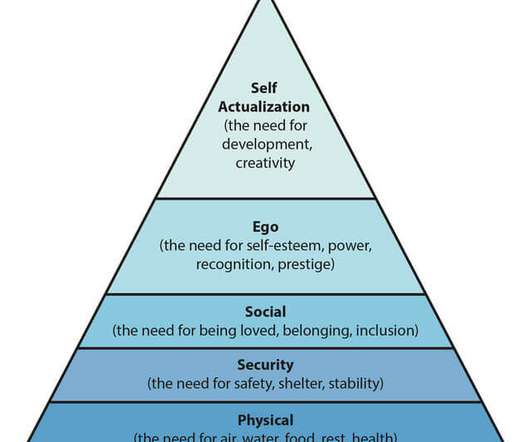

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. Legacy covers estate and tax planning, and business succession planning if applicable, connecting with self-actualization in Maslow’s pyramid.

SEI

OCTOBER 4, 2022

More than 30 years of experience providing employer-defined contribution plans with access to our risk-managed investment portfolios.

NAIFA Advisor Today

MAY 18, 2023

Errors & Omissions (E&O) insurance can be an essential part of every business' risk management plan.

WiserAdvisor

SEPTEMBER 8, 2022

Interest rate risk, inflation risk, recession risk, and others can surface from time to time and affect your investments as well as peace of mind. This is why portfolio risk management can be very critical. However, it is crucial to understand how to manage portfolio risk and what can trigger it.

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Key takeaways Tax planning impacts every facet of an acquisition, from initial valuation to post-closing integration, with early strategic decisions potentially saving millions in future tax liabilities.

Trade Brains

FEBRUARY 3, 2024

Since effective risk management is the key to a profitable journey, new individuals must gain actual knowledge of currency markets. Hence, managing leverage and margin is a crucial task for beginners for risk management in forex trading. Risk management is the key factor for traders to consider in trading.

Advisor Perspectives

JANUARY 9, 2025

Our Cash Indicator methodology acts as a plan in case of an emergency. Investors should expect more equity market volatility ahead.

Midstream Marketing

OCTOBER 31, 2024

They make plans for different products while following the rules. By teaming up with these experts, financial institutions can create a complete marketing plan. It helps them create a strong marketing plan that fits their business goals. They help financial institutions feel secure by focusing on risk management.

International College of Financial Planning

APRIL 25, 2024

This certification is recognized globally and showcases a deep, systematic understanding of personal financial management, including investment planning, risk management, tax planning, and retirement planning. From there, they collaborate with you to develop a tailored financial plan.

Risk Management Guru

SEPTEMBER 20, 2021

Whether you’ve just started in Risk Management or you’re already a professional in this arena, this article will interest you. We are highlighting some of the reference professionals we follow who are seasoned Risk Managers, each in its own area of expertise. Website / Blog. Linked In. Steve Burns. Website / Blog.

Carson Wealth

JULY 12, 2022

We speak a secret language in financial planning. Translating from the secret language of financial planning, the sentence would read “Tammy specializes in insurance. In the financial planning profession, graduate degrees are generally listed behind a name, while undergraduate degrees tend to be omitted. . Conferred Degrees.

Workable Wealth

OCTOBER 14, 2020

Financial planning can take your money game up a notch by bringing clarity, strategy, and intention to your financial life. A healthy financial plan gives you the tools to take control of your finances and start living your life with passion, purpose, and freedom. So what’s the value of a financial plan? Tax Planning.

Risk Management Guru

SEPTEMBER 22, 2021

This event is considered to be the biggest virtual conference about Risk Management topics, delivering more than 50 interactive workshops with more than 30 speakers, including the best Risk Management professionals in the planet. Don’t miss this great opportunity. Click here and secure your place now!

Trade Brains

NOVEMBER 21, 2023

The course topics are an introduction to technical analysis, various candlestick patterns, charting tools & software, trendlines& price patterns, technical indicators & their application, trading strategy and risk management. Also, traders can get certified for the course by clearing the exam conducted by NCFM.

Brown Advisory

NOVEMBER 5, 2021

2021 Year-End Planning Letter. Without downplaying the importance of appropriate action around year-end tax planning, our purpose in this letter is to encourage clients to step back, take a breath and consider using this time to focus on the long term. How does all of this impact your thoughts on longer term planning and even legacy?

Tobias Financial

APRIL 11, 2024

We are thrilled to announce that our Wealth Advisors, Edzai Chimedza, CFP® and Franklin Gay , CFP®, EA will be leading two Financial Planning Seminars at Nova Southeastern University. The post Wealth Advisors Edzai Chimedza and Franklin Gay lead Financial Planning Seminars at Nova Southeastern University – April 12th and May 3rd at 11 a.m.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content