Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

JANUARY 21, 2025

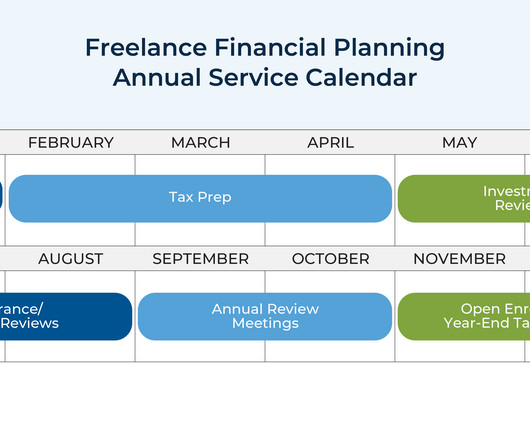

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Wealth Management

MARCH 7, 2025

Carson, Mesirow and Sequoia are recent RIA dealmakers in the growing push to add tax planning and services.

Nerd's Eye View

NOVEMBER 30, 2022

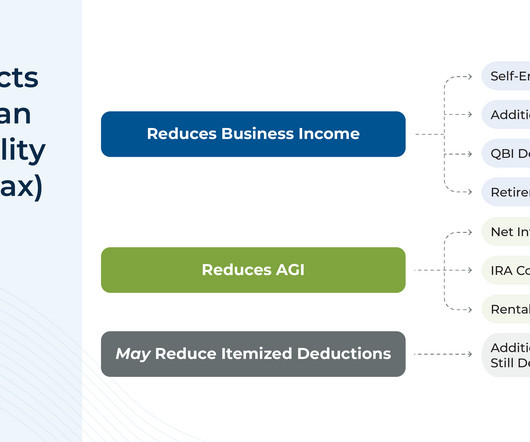

Taxes are a central component of financial planning. Almost every financial planning issue – whether it is retirement, investments, cash flow, insurance, or estate planning – has tax considerations, and advisors provide a great deal of value in helping clients minimize their overall tax burden.

Wealth Management

MARCH 23, 2023

Make the most of available charitable tax deductions.

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Wealth Management

OCTOBER 15, 2024

Thursday, November 14, 2024 | 2:00 PM ET

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. marknewfield.substack.com) How to look for holes in your financial plan. contessacapitaladvisors.com) Four steps to an estate plan. whitecoatinvestor.com) Spend your travel rewards.

Carson Wealth

FEBRUARY 13, 2025

Each year it is important to review your plan to ensure you are taking advantage of all the tax breaks and incentives available to you. Annual inflation adjustments and new laws create opportunities to save for retirement or reduce your tax bill. The post Tax Planning Checklist appeared first on Carson Wealth.

Nerd's Eye View

APRIL 8, 2025

Seth is the founder of Heartwood Financial Planning, an advisory firm affiliated with PlanMember Securities Corporation that is based in Fresno, California, and oversees approximately $100 million in assets under management for 850 client households. Welcome everyone! Welcome to the 432nd episode of the Financial Advisor Success Podcast!

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Pricing the impact of financial planning can be challenging, because many of its benefits – like peace of mind – are intangible, compelling in value but difficult to match with an exact price.

Wealth Management

JULY 24, 2023

Charles Lubar, retired senior counsel from McDermott Will & Emery, details the complexities in dealing with tax implications of projects involving the Muppets and Michael Jackson.

Wealth Management

AUGUST 15, 2022

Some advisors who have built their practices on ETFs and mutual funds have never experienced a market correction like the one we are in now.

Nerd's Eye View

SEPTEMBER 25, 2024

Over the last 60 years, the top Federal marginal tax bracket has steadily decreased from over 90% in the 1950s and 60s to 'just' 37% today. While it's true that the top marginal tax rate has decreased dramatically since the mid-20th century, the difference in the actual tax paid by most Americans has been far more modest.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Wealth Management

NOVEMBER 14, 2024

Kevin Knull, President of TaxStatus, reveals how a direct integration with the IRS is revolutionizing tax planning at Nitrogen's 2024 Fearless Investing Summit.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. Find your next tax advisor at Harness today. Starting at $2,500.

Wealth Management

APRIL 3, 2025

Steven Jarvis, the founder and CEO of Retirement Tax Services, offers advice on how a CPA can help increase the growth and enterprise value of an advisors business.

MainStreet Financial Planning

NOVEMBER 8, 2024

As December unfolds, it’s easy to overlook year-end tax planning amid the holiday hustle. However, dedicating a few moments now can lead to significant savings come tax season. To help you retain more of your hard-earned money and reduce your tax liability, consider these five strategic moves before the year concludes.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

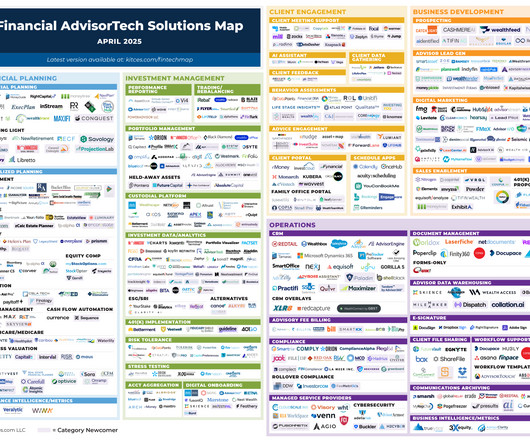

Nerd's Eye View

APRIL 7, 2025

Welcome to the April 2025 issue of the Latest News in Financial #AdvisorTech – where we look at the big news, announcements, and underlying trends and developments that are emerging in the world of technology solutions for financial advisors!

Nerd's Eye View

MAY 31, 2023

The 2017 Tax Cuts & Jobs Act introduced a $10,000 limit on the State And Local Tax (SALT) deduction that was previously available for taxpayers who itemized their deductions. Another set of considerations involves owners of businesses that operate in multiple states, which can compound the complexity of electing a PTET.

Nerd's Eye View

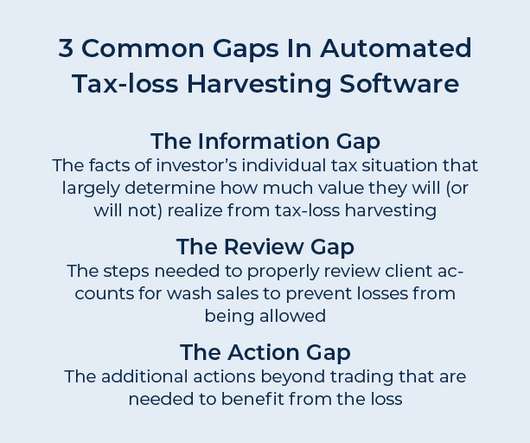

OCTOBER 5, 2022

In recent years, numerous software solutions have sprung up that aim to automate the process of tax-loss harvesting. But what the providers of automated tax-loss harvesting often don’t mention is that the actual value of tax-loss harvesting depends highly on an individual’s own tax circumstances.

Abnormal Returns

NOVEMBER 11, 2024

riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. thinkadvisor.com) A year-end tax planning checklist. (riabiz.com) What is the target market for MAGA-centric Strive Wealth Management? kitces.com) Practice management Should you outsource your marketing to an outside firm?

Nerd's Eye View

SEPTEMBER 29, 2022

As an individual begins planning for retirement, one of the factors often considered is whether (and where) they might relocate to enjoy their retirement. a state’s income tax rules can have a significant impact on where they might choose to live. When evaluating their potential options across the U.S., Every state in the U.S.,

Nerd's Eye View

MAY 8, 2023

Traditionally, financial advice and tax preparation have existed as 2 related, but separate, services. CPA, EA, or JD) to prepare tax returns and represent clients before the IRS, there has also been the impression that there is simply not enough time for one person to do both.

Wealth Management

FEBRUARY 3, 2023

This week, Orion announced they were making it easier for those in need of free financial planning to find help, TIFIN and Morningstar partnered to enhance their AI-powered distribution platform and eMoney responded to recently-passed legislation with tax planning upgrades.

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Abnormal Returns

JANUARY 15, 2025

podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning. readthejointaccount.com) Taxes What you need to know about paying taxes on your crypto trading. awealthofcommonsense.com) The best retirement withdrawal strategy is one you can live with. sherwood.news) Direct File is expanding.

Nerd's Eye View

SEPTEMBER 7, 2022

Tax-loss harvesting – i.e., selling investments at a loss to capture a tax deduction while re-investing the proceeds to maintain market exposure – is a popular strategy for financial advisors to increase their clients’ after-tax investment returns. With these three tools (i.e.,

Wealth Management

JANUARY 6, 2025

Tim Tallach has joined as director of advanced tax planning and family office services, as the RIA continues to expand its family office division.

Integrity Financial Planning

SEPTEMBER 19, 2022

Taxes are among the most common concern for people in retirement. You might be wondering how to start thinking about your tax strategy so you aren’t taxed more than you need to be. These three mistakes can help start the conversation about what a comprehensive tax strategy might look like for you. Taking Too Much Income.

Nerd's Eye View

APRIL 5, 2023

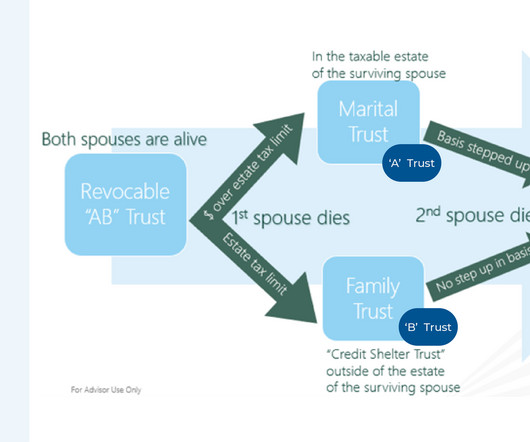

In recent years, the Internal Revenue Code (IRC) has endured some drastic changes resulting from legislative action that have altered the strategies estate planning professionals have recommended to clients. For instance, prior to the 2017 Tax Cuts and Jobs Act (TCJA), "A/B trusts" had become ubiquitous for spousal estate tax planning.

Abnormal Returns

NOVEMBER 18, 2024

justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand. downtownjoshbrown.com) How tax deferment can backfire. (podcasts.apple.com) Bogumil Baranowski talks with Justin Castelli about living an authentic life.

Abnormal Returns

SEPTEMBER 8, 2024

awealthofcommonsense.com) Early in retirement is the time to do some tax planning. Top clicks this week High yields come with risk. Don't let anyone tell you otherwise. wsj.com) Three reasons why the stock market declines. whitecoatinvestor.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That."

Darrow Wealth Management

NOVEMBER 2, 2024

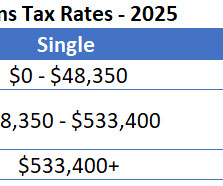

The IRA and Roth IRA contribution limits are unchanged but income eligibility for tax-deductible IRA contributions and Roth IRA contributions have changed. The 2025 income tax brackets and long-term capital gains tax rates are also updated. The 2025 income tax brackets and long-term capital gains tax rates are also updated.

Wealth Management

MARCH 12, 2025

The changes, which take effect September 2025, expand the CPWAs curriculum related to human dynamics, tax planning and specialty client strategies.

Covisum

AUGUST 5, 2022

In the absence of Congressional action, multiple provisions of the Tax Cut and Jobs Act (TCJA) will expire at the end of 2025, and tax rules will revert to what they were before the legislation. The TCJA reduced specific tax brackets and increased the standard deduction. Certain charitable gift deductions moved from 50% to 60%.

Harness Wealth

APRIL 16, 2025

Tax planning serves as the cornerstone of the entire acquisition deal, extending far beyond a simple checkbox. Every element, from structure to price negotiations, hinges on understanding tax implications for all parties involved. Get it right, and you will have set yourself up for a smooth transition and maximized returns.

Financial Symmetry

APRIL 9, 2025

Tax planning might not top everyone’s list of leisure activities, but in the middle of tax season, theres a hidden opportunity. In this episode, we talk about five strategies you can use during tax season to create opportunities to help you reach your financial goals.

Harness Wealth

APRIL 17, 2025

Tax deductions can save you thousands annually by reducing your taxable income through legitimate business expenses. Understanding these deductions is more critical than ever as tax laws evolve, presenting new opportunities for savings. Understanding this distinction is crucial for maximizing your tax benefits effectively.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content