Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Abnormal Returns

NOVEMBER 11, 2024

(riabiz.com) What is the target market for MAGA-centric Strive Wealth Management? riabiz.com) A round-up of recent financial advisortech news including Holistiplan's estate planning module. kitces.com) Practice management Should you outsource your marketing to an outside firm? advisorperspectives.com)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

MARCH 7, 2025

Carson, Mesirow and Sequoia are recent RIA dealmakers in the growing push to add tax planning and services.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Wealth Management

MARCH 23, 2023

Make the most of available charitable tax deductions.

Wealth Management

OCTOBER 15, 2024

Thursday, November 14, 2024 | 2:00 PM ET

Abnormal Returns

NOVEMBER 18, 2024

justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand. downtownjoshbrown.com) How tax deferment can backfire. (podcasts.apple.com) Bogumil Baranowski talks with Justin Castelli about living an authentic life.

Abnormal Returns

JULY 8, 2024

wiredplanning.com) Daniel Crosby talks with Andy Baxley, Senior Financial Planner at The Planning Center. investmentnews.com) Advisers It takes a village to run a successful wealth management firm. citywire.com) How turning wealth into annuitized income in retirement boosts spending.

Wealth Management

AUGUST 15, 2022

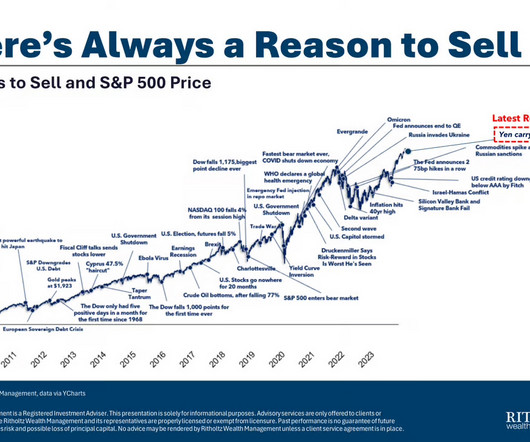

Some advisors who have built their practices on ETFs and mutual funds have never experienced a market correction like the one we are in now.

Abnormal Returns

NOVEMBER 6, 2023

(riabiz.com) The biz Goldman Sach's ($GS) future is in wealth management. ft.com) Creative Planning has closed on its purchase of Goldman Sachs' ($GS) PFM unit. citywire.com) Creative Planning is expanding its reach in the retirement plan space. papers.ssrn.com) Taxes A 2023 year-end tax planning guide.

Wealth Management

JULY 24, 2023

Charles Lubar, retired senior counsel from McDermott Will & Emery, details the complexities in dealing with tax implications of projects involving the Muppets and Michael Jackson.

Wealth Management

APRIL 3, 2025

Steven Jarvis, the founder and CEO of Retirement Tax Services, offers advice on how a CPA can help increase the growth and enterprise value of an advisors business.

Wealth Management

JANUARY 6, 2025

Tim Tallach has joined as director of advanced tax planning and family office services, as the RIA continues to expand its family office division.

Wealth Management

NOVEMBER 14, 2024

Kevin Knull, President of TaxStatus, reveals how a direct integration with the IRS is revolutionizing tax planning at Nitrogen's 2024 Fearless Investing Summit.

Wealth Management

MARCH 12, 2025

The changes, which take effect September 2025, expand the CPWAs curriculum related to human dynamics, tax planning and specialty client strategies.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Wealth Management

FEBRUARY 3, 2023

This week, Orion announced they were making it easier for those in need of free financial planning to find help, TIFIN and Morningstar partnered to enhance their AI-powered distribution platform and eMoney responded to recently-passed legislation with tax planning upgrades.

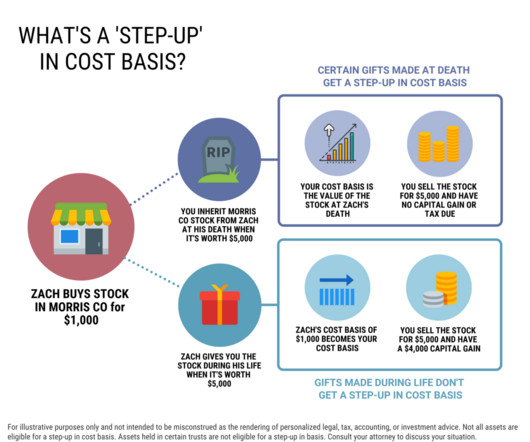

Darrow Wealth Management

JANUARY 16, 2025

This can get very tricky so it’s important to work with the estate planning attorney settling the estate. These rules can be very complex and nuanced so its essential to consult with a tax professional and trust and estates attorney to understand the specific rules and current law in your state. Can stocks get stepped up twice?

Abnormal Returns

AUGUST 28, 2023

riabiz.com) Charles Schwab ($SCHW) is planning more job cuts due to the TDA integration. investmentnews.com) Pro bono planning Does financial planning have a pro bono problem? mywealthplanners.com) The CFP Board wants to encourage pro bono planning. kitces.com) The SEC is focusing on RIA marketing.

Wealth Management

JANUARY 29, 2025

The deal with Carlson Capital Management is Sequoias largest by number of employees and wealth advisors. It also allows the firm to offer internal tax planning and preparation services.

Abnormal Returns

APRIL 10, 2023

blog.xyplanningnetwork.com) Technology Highlights from the 2023 T3 Advisor Conference including the growing importance of tax planning software. (etftrends.com) How to create a better onboarding process for new employees. kitces.com) The latest in adviser technology happenings including Altruists move to self-clearing.

Darrow Wealth Management

NOVEMBER 2, 2024

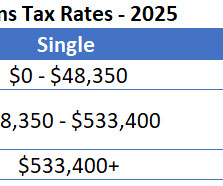

Contribution Limits for 401(k)s, IRAs and More in 2025 Income Limits for Tax-Deductible IRA Contributions Roth IRA Contribution Eligibility 2025 Income Tax Brackets Long-Term Capital Gains Tax Rates Standard Exemptions Married filing jointly: $30,000 ($33,200 if age 65+ or blind) Single: $15,000 ($17,000 if age 65+ or blind) AMT Exemptions Married (..)

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. forbes.com)

Nerd's Eye View

FEBRUARY 19, 2024

Finally, the annual T3/Inside Information Software Survey, which assesses the software programs used by financial advisors, found that tax planning tools are on the rise – with adoption rates jumping from 30% to 43%.

Talon Wealth

OCTOBER 26, 2023

Retirement planning is a critical part of financial security that many women still overlook. However, remember that as a woman, you have a longer life expectancy than a man, which means retirement planning is even more important. That means you should plan for your retirement savings to last at least 18 years, if not more.

Darrow Wealth Management

NOVEMBER 11, 2024

There are income limits for contributions to a traditional IRA that qualify for a tax deduction. The deductibility phase-out is based on filing status, income (MAGI), and whether or not the individual(s) are eligible to participate in a retirement plan at work. To calculate the tax-free percentage: Your Total Basis (e.g.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Darrow Wealth Management

NOVEMBER 17, 2022

Article is a general communication only and should not be used as the basis for making any type of tax, financial, legal, or investment decision. Darrow Wealth Management doesn’t provide tax advice; consult your tax advisor to discuss your personal situation. . that could increase the tax due from the surtax.

Abnormal Returns

DECEMBER 12, 2022

(investmentnews.com) Tax planning Why financial advisers need to be careful when offering tax advice. kitces.com) Tax planning is an ongoing process. riaintel.com) Older Americans are planning to stay in the homes. kitces.com) When is 'superfunding' a 529 plan the right move? thinkadvisor.com).

Zoe Financial

DECEMBER 5, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA December 5, 2023 Watch Time: 3 minutes Transcript: Welcome to this week’s Wealth Management Digest. Financial planning, estate planning, tax planning, etc, rather than just picking stocks like in the old days.

International College of Financial Planning

JUNE 30, 2022

Hiring a wealth manager is one of the biggest financial decisions you’ll make. Hiring a wealth manager is a long-term investment, so it’s important to find someone who will take the time to get to know your goals, values, and long-term goals. Factors to be considered before hiring a wealth manager. .

Fortune Financial

JULY 28, 2022

You cannot sell the securities within the retirement plan, then move cash to a brokerage account and purchase the same shares at that point. But, they are nonetheless taxed when received, which can reduce overall returns due to the taxes owed on these. . This would negate the NUA benefit. Cost Tradeoff.

Zoe Financial

JANUARY 17, 2024

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA January 17, 2023 Watch Time: 3 minutes Transcript : Welcome to this week’s Wealth Management Digest. But they did close tax prep. We have three headlines this week.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Darrow Wealth Management

JANUARY 30, 2023

just upended retirement planning…again. Raising the age when withdrawals must begin is great as it gives investors more planning opportunities. Here are some tax planning strategies to consider when you should start drawing from your IRA. The Secure Act 2.0 But just because you can doesn’t mean you should.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. It can also preclude some tax planning strategies down the road.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade Whether you’re saving, investing, spending, bequeathing, or receiving wealth, there’s scarcely a move you can make without considering how taxes might influence the outcome.

Yardley Wealth Management

FEBRUARY 1, 2022

The post Part 1: The Tools of the Tax-Planning Trade appeared first on Yardley Wealth Management, LLC. Part 1: The Tools of the Tax-Planning Trade. No wonder people get nervous when there’s lots of talk about higher taxes, but little certainty on what may come of it, and who it might affect. .

eMoney Advisor

DECEMBER 27, 2022

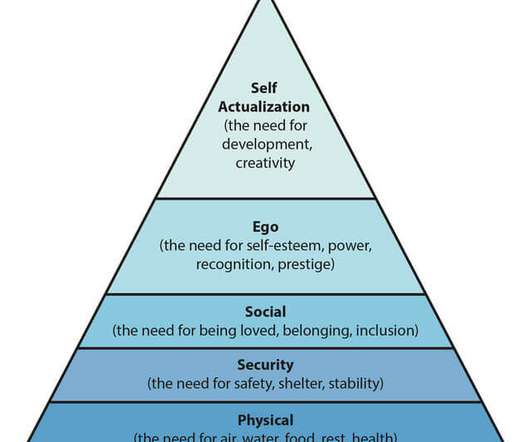

As client expectations continue to evolve, there is an opportunity for financial planners to broaden and deepen their service offerings by providing holistic financial planning. Legacy covers estate and tax planning, and business succession planning if applicable, connecting with self-actualization in Maslow’s pyramid.

Abnormal Returns

SEPTEMBER 26, 2022

Podcasts Christine Benz and Jeff Ptak talk with Tim Steffen, director of tax planning for Baird. ft.com) Advisers Why checklist-style financial planning isn't all bad. kitces.com) How one firm plans to use client testimonials. kitces.com) Daniel Crosby talks with Tom Morgan about personal myth making.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content