The Inside ETFs Podcast: Nancy Davis on Portfolio Management For 2023

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Portfolio Management Related Topics

Portfolio Management Related Topics

Wealth Management

DECEMBER 14, 2022

The portfolio manager for IVOL and BNDD discusses how those funds fit within modern investing portfolios.

Wealth Management

NOVEMBER 12, 2024

At Nitrogen's 2024 Fearless Investing Summit, experts discuss how new technology is empowering advisors to deliver hyper-personalized portfolios through seamless integration and cost-saving strategies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

The Big Picture

NOVEMBER 15, 2024

He is the portfolio manager of the Return Stacked ETF Suite, manging 800 million in ETF assets. All of our earlier podcasts on your favorite pod hosts can be found here. Be sure to check out our Masters in Business next week with Corey Hoffstein , CEO/CIO Newfound Research.

The Big Picture

FEBRUARY 14, 2025

This week, I speak with Christine Phillpotts , Portfolio Manager for Ariel Investment s emerging markets value strategies. Previously, she spent 10 years at AllianceBernstein as Portfolio Manager and Senior Research analyst in emerging markets. She also covers all sectors in Africa.

Nerd's Eye View

MARCH 3, 2025

This month's edition kicks off with the news that Morningstar Office will be shutting down in early 2026 as a part of Morningstar's ongoing effort to refocus on its core investment data and analytics business – forcing advisors currently using the tool to switch (which might be a net positive for many of those advisors who have long complained (..)

Nerd's Eye View

NOVEMBER 25, 2024

Over the past decade, a growing number of advisors have expanded into offering comprehensive financial planning services, reflecting a shift that not only helps them stand out from (increasingly commoditized) portfolio management offerings but also supports clients' broader financial goals.

Wealth Management

SEPTEMBER 22, 2022

Valian complements the firm's established Pulse portfolio management and reporting platform.

Calculated Risk

APRIL 13, 2025

m/m due to a very large upward revision to portfolio management. This would be a notable deceleration from the first two months of the year. However, February is likely to be revised up significantly to 0.5% As a result, we expect y/y core PCE to fall to 2.6% from an upwardly revised 2.9%.

Wealth Management

SEPTEMBER 5, 2024

Barry Gilbert, portfolio manager with the Carson Group, talks about why the firm is risk-on right now, why it prefers ETFs over mutual funds and what’s different about this market cycle.

Wealth Management

JUNE 4, 2024

The new features include a one-stop client portal, cloud data platform, consolidated APIs and portfolio management suite.

Wealth Management

MAY 15, 2024

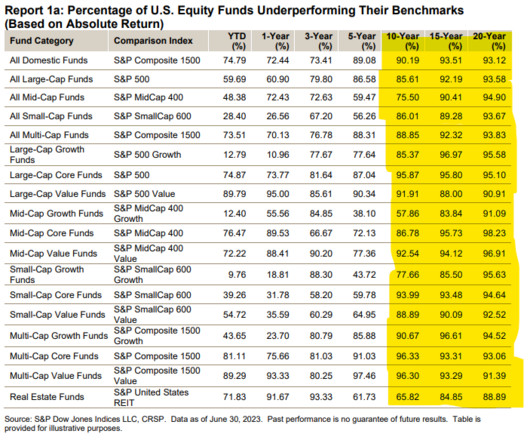

Often the most accessible investment choices deliver the best returns, according to portfolio managers.

The Big Picture

DECEMBER 30, 2024

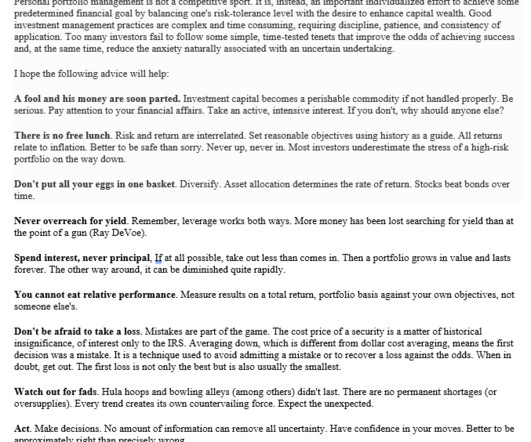

He co-authored Investment Analysis and Portfolio Management , now in its fifth edition. Zeikel famously shared his investing insights in a 1994 letter to his daughter: “Personal portfolio management is not a competitive sport. He was an adjunct professor at NYU STern School of Business.

Wealth Management

AUGUST 15, 2024

The products, which will be managed by a trio of portfolio managers who joined earlier this year from Invesco Ltd., will focus on lower-rated bonds.

Wealth Management

JUNE 6, 2024

Portfolio managers have poured money into the active sector for 50 consecutive months after a $22 billion allocation in May, data compiled by Bloomberg Intelligence show.

Abnormal Returns

MARCH 10, 2025

citywire.com) The latest in advisor fintech news including saturation in the portfolio management tech space. Advisortech The CFP Board has released guidelines for using AI. kitces.com) Estate planning Estate plans are a big lift for everyone, including advisers themselves.

Nerd's Eye View

MARCH 28, 2025

Also in industry news this week: A recent survey indicates that younger "DIY" investors are more likely to be interested in working with a human advisor than their older counterparts, suggesting an opportunity for advisors to tap into this demographic (perhaps by setting minimum planning fees that ensure these clients can be served profitably today (..)

Wealth Management

NOVEMBER 1, 2024

In one case, the firm agreed to pay $45 million to settle charges that it didn’t disclose financial conflicts regarding a portfolio management program to clients.

Abnormal Returns

MARCH 31, 2025

open.spotify.com) Robinhood What to think of Robinhood's ($HOOD) push into portfolio management. thinkadvisor.com) Robinhood ($HOOD) is taking different bites at the wealth management apple. wealthmanagement.com) Custody Dynasty Financial Partners has a custody agreement with Goldman Sachs ($GS).

Wealth Management

MARCH 13, 2024

Apex Fintech Solutions announced it acquired AdvisorArch, a portfolio management company and rebalancer.

Wealth Management

AUGUST 26, 2024

Javier Altimari, a former senior director and portfolio manager at Oppenheimer & Co., will be instrumental in building out Americana Partners International, the RIA’s new division serving international UHNW clients.

Wealth Management

DECEMBER 4, 2023

Harley Lank, portfolio manager at Fidelity, discusses high yield, selective decision-making, and navigating credit market dislocations.

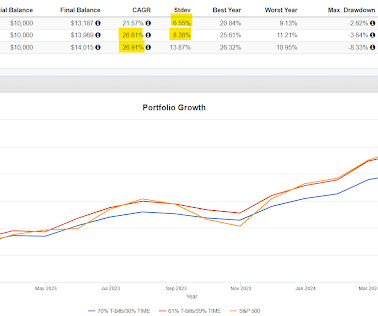

Random Roger's Retirement Planning

JUNE 14, 2024

The better takeaway is more along the lines of how risk is managed, maybe allocating a little to asymmetry to maybe dial down the volatility elsewhere in the portfolio or using alternatives to manage volatility and risk.

Wealth Management

NOVEMBER 19, 2024

Called Auria, Advyzon's new technology will combine portfolio management, performance reporting, CRM and other tools.

Wealth Management

APRIL 21, 2024

Denver-based Alpha Capital Family Offices tapped the veteran asset manager to lead portfolio management as part of a talent-driven growth strategy.

The Big Picture

FEBRUARY 7, 2025

Be sure to check out our Masters in Business next week with Christine Phillpotts , Portfolio Manager at Ariel Investments. She manages Ariels Emerging Markets Value strategies. You can stream and download our full conversation, including any podcast extras, on Apple Podcasts , Spotify , YouTube , and Bloomberg.

Wealth Management

APRIL 8, 2024

Procyon takes a bottom-up approach to portfolio management, but the firm’s real differentiator lies in its own alternative funds, giving clients access to unique opportunities in the private markets.

Wealth Management

DECEMBER 6, 2023

Celso Munoz, portfolio manager at Fidelity Investments, shares a comprehensive approach to enhancing risk-adjusted returns in the dynamic world of fixed income investments.

Abnormal Returns

SEPTEMBER 26, 2023

Portfolio management Fund investors prefer managers who stick to their knitting. papers.ssrn.com) Why portfolio managers invest more research into short positions. papers.ssrn.com) Research The structure of the stock market has changed a lot over time, but the results are still largely the same.

Wealth Management

OCTOBER 13, 2023

“Volatility is off the chart,” said Ben Emons, a senior portfolio manager at NewEdge Wealth. People are trading bonds like stocks.”

Wealth Management

NOVEMBER 10, 2022

Boutique portfolio management firm in OK further expands the insurance giant’s wealth advisory arm.

Wealth Management

DECEMBER 5, 2023

Insights from Nidhi Gupta, portfolio manager at Fidelity Investments, on identifying attractively valued stocks, leveraging global research, and navigating market environments for long-term portfolio growth.

Wealth Management

NOVEMBER 30, 2022

He'll no longer serve as portfolio manager of SARK and more than two dozen other funds. Matthew Tuttle's ETF lineup was acquired by AXS Investments.

Wealth Management

SEPTEMBER 29, 2022

The firm has hired John Morrison, portfolio manager at Dimensional Fund Advisors, to run the RIA, which aims to help startup employees plan around option-rich, but cash-poor, wealth.

Wealth Management

JANUARY 13, 2025

Listen in as Shannon Rosic, Director of WealthStack, Content & Solutions at Informa Connect, sits down with Andrew Choi, Portfolio Manager and Senior Analyst at Parnassus Investments, to explore the transformative role of artificial intelligence in investment strategies.

Wealth Management

MARCH 11, 2025

Mount Lucas Management's COO, Senior Portfolio Manager & Managing Partner, Jerry Prior drops a ton of insight about investing in managed futures. During this very informative and fun conversation.,

Abnormal Returns

OCTOBER 10, 2023

libertystreeteconomics.newyorkfed.org) Portfolio managers Why portfolio managers get fired. alphaarchitect.com) Is there a relationship between manager attractiveness and fund performance? (papers.ssrn.com) Box spreads The pros and cons of using box spreads to generate cash-like returns.

Wealth Management

DECEMBER 5, 2023

Therese Icuss, managing director, portfolio management and underwriting, Fidelity Investments, unlocks the vast potential of the U.S. and China middle market, Fidelity's unique approach to bespoke portfolios, and prioritizing client success in the fidelity private credit fund.

Wealth Management

JANUARY 15, 2024

Listen in as Ian Sexsmith, CFA, Portfolio Manager and Senior Research Analyst, Parnassus Investments, and David Armstrong, Director of Editorial Strategy & Operations, WealthManagement.com, discuss the untapped potential in mid cap tech stocks and the unique opportunities and risks they pose.

A Wealth of Common Sense

FEBRUARY 16, 2024

Early on in my savings journey I prioritized tax-deferred retirement accounts over all else. I like the ease and simplicity of 401k contributions coming out of my paycheck before it ever even touches my checking account. It’s easy to automate. The set-it-and-forget-it nature of a workplace retirement plan is one of my favorite features.

Wealth Management

MARCH 12, 2023

Watch as Shivani Vohra, Portfolio Manager and Senior Research Analyst, Parnassus Investments, discusses the outlook for growth stocks in 2023 and whether now is a good time to buy.

Abnormal Returns

FEBRUARY 4, 2025

ft.com) How people talked about portfolio management in the 19th century. (priceactionlab.com) Public pension funds are undeperforming any reasonable benchmark. blogs.cfainstitute.org) Do floor traders still add value to markets?

Nerd's Eye View

JANUARY 6, 2025

From there, the latest highlights also feature a number of other interesting advisor technology announcements, including: SEI has acquired LifeYield, which is designed to facilitate tax-efficient management of multiple accounts across an entire household, to bundle into its RIA custodial platform and investment management technology – underscoring (..)

Abnormal Returns

NOVEMBER 15, 2024

capitalallocators.com) Shane Parrish talks with Adam Karr, President and Portfolio Manager at Orbis Investments. (advisoranalyst.com) Ted Seides talks with Scott Bessent who is the CEO and CIO of Key Square Group. fs.blog) Dan Lefkovitz and Christine Benz talk muni bonds with Jim Murphy and Charlie Hill of T. Rowe Price.

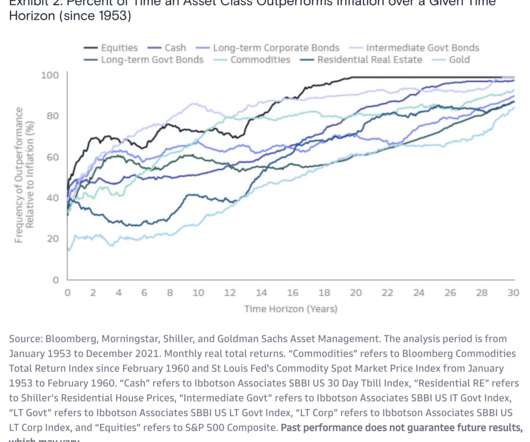

The Reformed Broker

NOVEMBER 25, 2022

Especially if we’re referring to the past performance of a particular investment strategy, portfolio manager, mutual fund or individual stock. Past performance is not a guarantee of future results. Of course it isn’t. Things change. But past performance of asset classes should be well understood.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content