Your Clients Are Clueless About Their Risk Tolerance

Advisor Perspectives

OCTOBER 23, 2024

Determining your client’s risk tolerance is a critical first step in constructing a tailored investment portfolio.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Advisor Perspectives

OCTOBER 23, 2024

Determining your client’s risk tolerance is a critical first step in constructing a tailored investment portfolio.

Advisor Perspectives

SEPTEMBER 18, 2024

A client recently refused to complete my risk tolerance questionnaire. After looking through our instrument, with its fairly standard hypotheticals about market movements and portfolio returns, they said, “That’s not how I think about risk.”

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Back to Basics with Reconciliations

Less Stress, More Success: Accounting Best Practices & Processes for 2025

Avoiding Lease Accounting Pitfalls in 2025: Lessons Learned from Spreadsheet Errors

BlueMind

SEPTEMBER 3, 2022

Category: Clients Risk. Determining the client’s risk tolerance is not an exact science and requires you to communicate with your client. What Does The Word “Risk” Mean For Your Clients? For some clients, “risk” maybe something exciting or daring that they enjoy and not something they generally avert from.

The Big Picture

APRIL 19, 2023

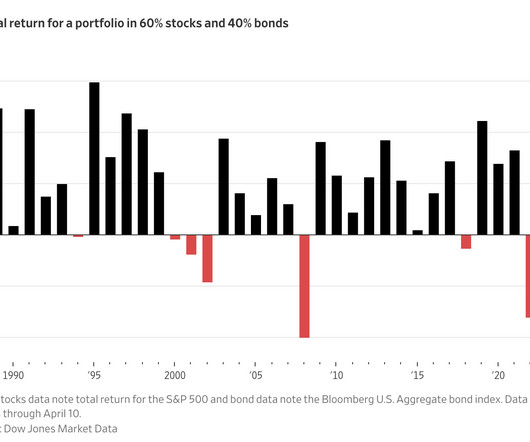

Check out these recent headlines about the classic 60/40 investment strategy 1 : The 60-40 Investment Strategy Is Back After Tanking Last Year BlackRock Ditches 60/40 Portfolio in New Regime of High Inflation Why a 60/40 Portfolio Is No Longer Good Enough The 60-40 portfolio is back Sorry, but all of these headlines utterly miss the point.

Inside Information

JUNE 25, 2024

For more years than I’d care to name, I’ve been trying to put my finger on exactly why I have a such a huge problem with the traditional (Think: Riskalyze, now Nitrogen) risk tolerance assessments in the financial planning profession. You can actually test various bear markets and adjust accordingly.)

WiserAdvisor

MAY 26, 2023

It is essential to choose investments that match your risk appetite to avoid unnecessary stress and surprises later. A financial advisor can help you understand your investment risk tolerance. This article will focus on the risks of investing, how they impact you, and what you can do to determine your risk appetite.

Nerd's Eye View

OCTOBER 18, 2024

Also in industry news this week: 43% of wealth management firms are frustrated with the effectiveness of their CRM software, spurred on by challenges with integrations and workflows, according to a recent survey The Social Security Administration this week announced a 2.5%

Nerd's Eye View

JULY 3, 2024

As a result, advicers have more options than ever to add value for their clients by tailoring investment portfolios that are specific to their unique needs, goals, and risk tolerance. in mind, there are 3 primary ways that advicers can use Quality ETFs in portfolios. size, industry, location) of early mutual funds.

The Irrelevant Investor

AUGUST 25, 2019

If the drop on Friday made you nervous about your portfolio to the point where you felt like pushing a button, you're probably taking too much risk. There are two ways that risk can ruin you: by taking way too much of it or taking way too little. For many, Friday was one of those days. That's not what I'm saying.

Advisor Perspectives

JANUARY 27, 2024

Registered investment advisors have long leaned on the 60% equities/40% fixed income portfolio structure. While it’s not perfect, it has served clients well, broadly speaking.

Clever Girl Finance

MARCH 14, 2023

Portfolio income is the money you make from an investment account, and there are several ways to earn it. We’ll also go over the benefits of growing the income for your portfolio and how to deal with taxes from investments! What is portfolio income? Portfolio income is income earned from investment accounts.

The Irrelevant Investor

FEBRUARY 6, 2018

After nine consecutive years of positive returns, it's likely that a lot of people's asset allocation was out of whack with their true risk tolerance. If investing was just about maximizing returns, we'd all be invested in a 100% stock portfolio. The post Your True Risk Tolerance appeared first on The Irrelevant Investor.

Nerd's Eye View

MAY 8, 2024

step when onboarding a new client, as making any sort of recommendation is impossible without first understanding how comfortable clients may be when their portfolios inevitably experience volatility.

Abnormal Returns

DECEMBER 21, 2022

peterlazaroff.com) Risk tolerance Five behavioral tricks for long-term investors including 'Have a small side account.' bestinterest.blog) On the difference between risk tolerance and risk perception. morningstar.com) Can you tweak your risk tolerance?

Advisor Perspectives

OCTOBER 28, 2023

The ideal rebalancing range varies by investor and depends on an investor’s risk tolerance and market views, among other factors. In a prolonged equity bull market, wider rebalancing ranges will result in higher returns, but also increase a portfolio’s risk.

Integrity Financial Planning

OCTOBER 9, 2023

But no matter if you’re considering wealth growth or income generation, your investment decisions will involve calculations around your risk tolerance and unique goals as well. An investment portfolio focused on income generation has unique qualities, goals, and risks. [1] What is an Income-Generation Investment Strategy?

WiserAdvisor

DECEMBER 3, 2023

Creating a well-diversified portfolio is a pivotal task in investing. However, your work is far from complete, even after drafting a diversified portfolio. Rebalancing is a critical step that can help you optimize your portfolio’s performance. This helps you maintain a risk profile that resonates with your financial goals.

Nerd's Eye View

JUNE 12, 2024

Which means that when an advisor recommends a certain investment strategy for a client, their standards of care should dictate that they first make sure that the strategy is within the client's tolerance for risk.

A Wealth of Common Sense

JULY 13, 2023

A reader asks: I am a 34-year-old with a high risk tolerance. All of my investment accounts are 100% invested in stocks. The one thing I have a hard time finding a tried and true answer on when I do research is how to best allocate my stock investments among large-cap, mid-cap, international, emerging markets, etc.

Abnormal Returns

JULY 12, 2023

stocks are enough for your portfolio. morningstar.com) On average, people overestimate their risk tolerance. James Choi about how economic theory explains consumer behavior. rationalreminder.libsyn.com) Dave Nadig talks ETFs and more with FactSet’s Elisabeth Kashner. etftrends.com) Peter Lazaroff on whether U.S.

Nerd's Eye View

MARCH 20, 2024

By distilling hundreds of pieces of information into a single number that purports to show the percentage chance that a portfolio will not be depleted over the course of a client's life, advisors often place special emphasis on this data point when they present a financial plan.

WiserAdvisor

DECEMBER 2, 2022

When investors create an investment portfolio, they consider several factors, like risk, asset class, inflation, etc., However, what is equally critical when it comes to creating a portfolio is asset allocation and selection. Read more to learn about asset allocation and how it can impact your portfolio.

International College of Financial Planning

AUGUST 31, 2023

This is where diversifying your investment portfolio comes into play. Diversifying your investment portfolio is a vital strategy for managing risk, optimizing returns, and achieving your financial goals. However, diversifying your investment portfolio can help reduce your overall investment risk.

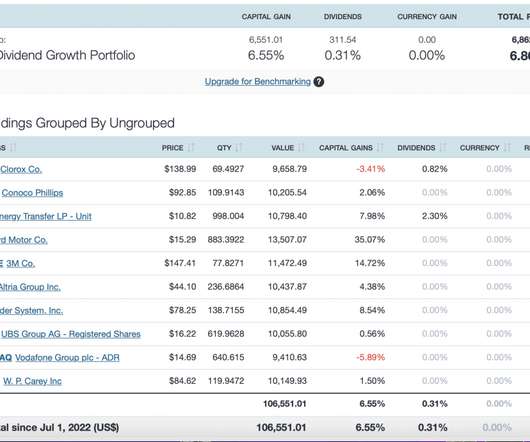

Dear Mr. Market

AUGUST 5, 2022

Not only are we sharing the importance of dividends in this article, but it’s also the official roll-out of the Top 10 Dividend Growth Portfolio strategy managed by My Portfolio Guide, LLC. The Top 10 Dividend Growth Portfolio strategy is a concentrated portfolio.

Nerd's Eye View

SEPTEMBER 20, 2023

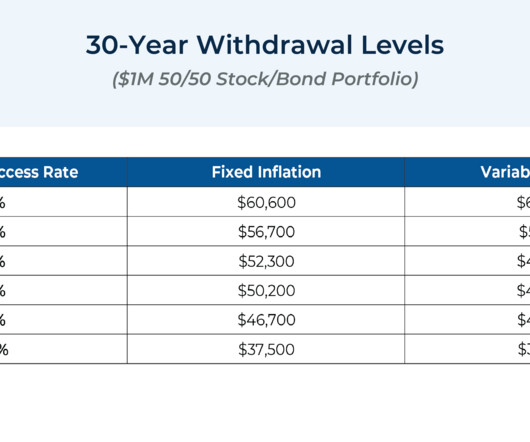

By exploring high-inflation, low-inflation, and mixed-inflation scenarios, advisors have the flexibility of customizing advice that can more holistically balance a client's spending goals with their risk tolerance.

Fortune Financial

AUGUST 7, 2023

Are Alternative Investments the Key to Diversifying Your Portfolio? If you prefer a more indirect approach, Real Estate Investment Trusts (REITs) allow you to invest in a portfolio of properties without the hassle of direct ownership. Each of these alternative investment options offers its own set of risks and rewards.

Fortune Financial

AUGUST 7, 2023

Are Alternative Investments the Key to Diversifying Your Portfolio? If you prefer a more indirect approach, Real Estate Investment Trusts (REITs) allow you to invest in a portfolio of properties without the hassle of direct ownership. Each of these alternative investment options offers its own set of risks and rewards.

Nerd's Eye View

SEPTEMBER 20, 2023

By exploring high-inflation, low-inflation, and mixed-inflation scenarios, advisors have the flexibility of customizing advice that can more holistically balance a client's spending goals with their risk tolerance.

BlueMind

SEPTEMBER 11, 2022

However, it should be well understood that a client’s financial profile includes their risk tolerance and their risk capacity. In this article, although we will be focusing on the latter one and why it is significant to determine your client’s risk capacity let’s first understand the difference between the two.

The Chicago Financial Planner

JUNE 13, 2022

Ideally you’ve been rebalancing your portfolio along the way and your asset allocation is largely in line with your plan and your risk tolerance. You should continue to monitor your portfolio and make these types of adjustments as needed. Focus on risk. If not perhaps you are taking more risk than you had planned.

BlueMind

OCTOBER 25, 2022

Category: Clients Risk. When it comes to their investment portfolios many tend to have a low-risk tolerance and with the unsettling economic situation with the ongoing pandemic, the word “risk” has become even more of a fearsome word for clients. That requires investing.

Nationwide Financial

JANUARY 25, 2023

Review risk tolerance and current asset allocation strategy It’s important to ensure your clients’ portfolios align with their risk tolerance because taking too much risk can negatively impact their ability to navigate market fluctuations.

Park Place Financial

MARCH 14, 2022

FINANCIAL PLANNING What is Portfolio Rebalancing? Investments can be risky since markets constantly fluctuate, but strategies are available to help you maintain a well-balanced portfolio. When people buy and sell sections of their portfolio to maintain a consistent asset allocation, they are rebalancing their investments.

MainStreet Financial Planning

AUGUST 16, 2022

There are many steps in building an investment portfolio, in this article, I’ll discuss how asset allocation and risk tolerance are important considerations when investing. In simple terms, asset allocation is the mix of all the different types of investments you have in your portfolio. Some examples include U.S.

Your Richest Life

SEPTEMBER 10, 2024

Your ideal investing strategy will be unique to you: your life phase, goals and risk tolerance will all play a role in informing your “ideal” methodology. Big, broad dreams and more specific, immediate goals are both instrumental in figuring out the best way forward with your portfolio.

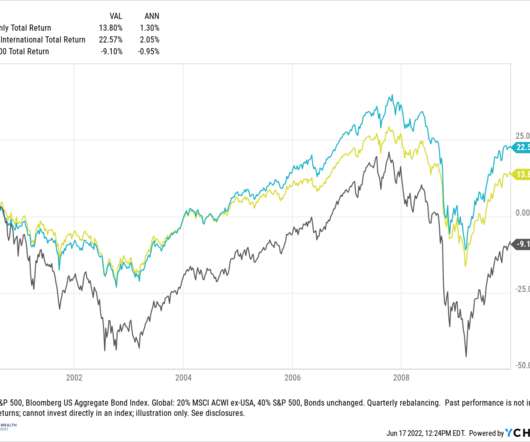

Darrow Wealth Management

JUNE 27, 2022

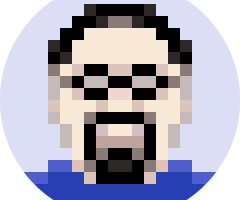

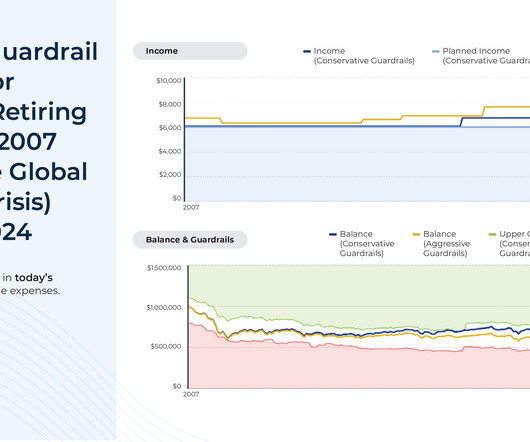

equity may be able to help reduce risk in a portfolio. Having international exposure in your portfolio in the early 2000s and throughout the Global Financial Crisis would have been a key ingredient in reducing overall risk and maintaining some level of investment return. Currency risk and return. in total.².

Carson Wealth

MARCH 7, 2024

Your lifestyle, goals, family situation, and risk tolerance will give a unique signature to your retirement plan. Let’s look at a few of the starting points today for a healthy retirement savings portfolio. Check out the risk tolerance survey to get an idea for your risk profile and help you start your personal finance journey.

Integrity Financial Planning

JUNE 7, 2023

1] What are Your Investment Goals and Risk Tolerance When selecting investments for your IRA, consider your investment goals and risk tolerance. If you are younger, you may be able to take more risks because you have a longer time horizon to earn back potential gains and receive more income in the future.

WiserAdvisor

APRIL 25, 2023

When investing in a 401(k), one of the most important decisions you can make is how often to rebalance your portfolio. Rebalancing involves adjusting the mix of assets in your 401(k) portfolio to maintain a desired level of risk and return. This article will explore how often to rebalance your 401(k). Need a financial advisor?

WiserAdvisor

AUGUST 31, 2023

They can assess your financial situation, long-term goals, risk tolerance, and investment preferences to create personalized strategies. They can also help you optimize your savings and investment plans, ensuring that you maximize your earning potential while minimizing risks.

Darrow Wealth Management

OCTOBER 29, 2024

Rebalancing your 401(k) and investment portfolio is an important part of a successful investment strategy. Your asset allocation is the percentage of your portfolio that you distribute between different asset classes, like stocks and bonds. Why do you need to rebalance your portfolio? Why does this matter?

Truemind Capital

APRIL 5, 2024

One should always be ready for unexpected outcomes and prepare a portfolio that can handle uncertainties. In investments, having too high a return expectation with a lesser ability to take risks can disrupt your game. Having a very low-risk tolerance can compromise achieving decent returns.

Zoe Financial

OCTOBER 12, 2023

Investing in the Future: CAPTRUST’s AI Stock Portfolio Updated October 12th, 2023 Reading Time: 6 minutes Written by: Lauren C. Lambert, CFA CAPTRUST Zoe Network Advisor Investing in the Future: CAPTRUST’s AI Stock Portfolio Updated October 12th, 2023 Reading Time: 6 minutes Written by: Lauren C.

Advisor Perspectives

APRIL 10, 2023

Model portfolios have become an essential component of virtually every advisor’s investment processes. Models can be constructed to meet investor profiles, including their level of risk tolerance, need for income, or tax considerations. Countless third parties, including many asset managers, offer models.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content