Firms Not Offering Tax, Retirement Planning Are Getting it Wrong

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

OCTOBER 4, 2023

Advisors are overdelivering services such as health care, estate and business planning, while falling short in the areas their clients most desire.

Wealth Management

JUNE 26, 2024

Notice 2024-55 clarifies two exceptions to the 10% additional tax.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Abnormal Returns

FEBRUARY 24, 2025

citywire.com) How Jacob Turner turned a professional baseball career into a wealth management business. thinkadvisor.com) Cutting IRS workers is going to make life more difficult for tax preparers (and payers). advisorperspectives.com) Retirement planning models are just uncertainty piled on uncertainty.

Abnormal Returns

JANUARY 15, 2024

Podcasts Michael Kitces talks about starting over with Kimberly Enders who is the Lead Financial Planner and Managing Partner of Enders Wealth Management. citywire.com) Taxes There simply aren't enough tax preparers to go around. thinkadvisor.com) Retirement Baby Boomers were supposed to retire in penury.

Abnormal Returns

NOVEMBER 6, 2023

(riabiz.com) The biz Goldman Sach's ($GS) future is in wealth management. ft.com) Creative Planning has closed on its purchase of Goldman Sachs' ($GS) PFM unit. citywire.com) Creative Planning is expanding its reach in the retirement plan space. papers.ssrn.com) Taxes A 2023 year-end tax planning guide.

Abnormal Returns

APRIL 1, 2024

Podcasts Kevin Thompson, CEO of 9i Capital Group LLC, discusses the RIA industry's impact on advisors' autonomy with Josh Brown, CEO of Ritholtz Wealth Management. youtube.com) Christine Benz and Amy Arnott talk with Peter Mallouk, President and CEO of Creative Planning, about the 'messy' business of financial advice.

Wealth Management

FEBRUARY 21, 2024

The intellectual case for getting rid of tax-advantaged retirement plans is strong, and the political case is catching up.

Darrow Wealth Management

SEPTEMBER 19, 2024

Unlike most types of retirement plans, the SEP IRA is funded by the employer. Here’s more on what a SEP IRA is, tax benefits, contribution limits, and important deadlines. The SEP IRA is a straightforward and cost-effective way for small business owners to save for retirement. What is a SEP IRA?

Talon Wealth

OCTOBER 26, 2023

Retirement planning is a critical part of financial security that many women still overlook. However, remember that as a woman, you have a longer life expectancy than a man, which means retirement planning is even more important. Consider early retirement tax planning.

Darrow Wealth Management

APRIL 21, 2025

While a Roth conversion may never make sense for some individuals, for others, early retirement years may be the best time to convert pre-tax accounts to tax-free Roth. Your current and projected future tax rate is often a main component of the decision, but there are other considerations and benefits as well.

Harness Wealth

MARCH 7, 2025

This weeks Tax Advisor news roundup covers key updates for financial professionals. Senate committee during the pandemic and set new standards for remote team management and firm culture. Last but not least, we have a rundown of the IRSs ‘Dirty Dozen’ tax scams for 2025.

Abnormal Returns

JULY 18, 2022

(standarddeviationspod.com) A talk with Tony and Dina Isola about the awful situation facing teachers saving for retirement. ngpf.org) Christine Benz and Jeff Ptak talk with Justin Fitzpatrick who is the co-founder and chief innovation officer at Income Lab, which provides retirement planning software.

Darrow Wealth Management

NOVEMBER 17, 2022

In November 2022, proponents of the Massachusetts ‘millionaires’ tax (question 1) won their bid to nearly double the income tax rate on individuals with taxable income over $1M a year. As proposed, the new legislation would increase these tax rates to 9% and perhaps even 16% , respectively, starting in 2023.

Darrow Wealth Management

OCTOBER 21, 2022

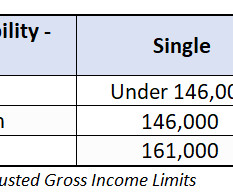

The IRS has released the 2023 contribution limits for retirement plans and other cost-of-living adjustments. The agency also released tax brackets for ordinary income and long-term capital gains. Income Limits for Tax-Deductible IRA Contributions & Roth IRA Contribution Eligibility. Income Tax Rates in 2023.

Darrow Wealth Management

NOVEMBER 2, 2023

The IRS has released the 2024 contribution limits for retirement plans and other cost-of-living adjustments.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Carson Wealth

AUGUST 25, 2022

often fail to consider sequence of return, housing, longevity, health or family risks faced in retirement. Focus on Your Retirement Plan Rather Than a Magic Number. would be “How do I plan for retirement?“ Social Security is a federal retirement plan originally created under the Social Security Act of 1935.

Abnormal Returns

AUGUST 5, 2024

kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal. investmentnews.com) On the importance of tax planning in the first few years of retirement. papers.ssrn.com) Four steps to create a digital estate plan. morningstar.com) Wealth matters when we activate it. forbes.com)

Abnormal Returns

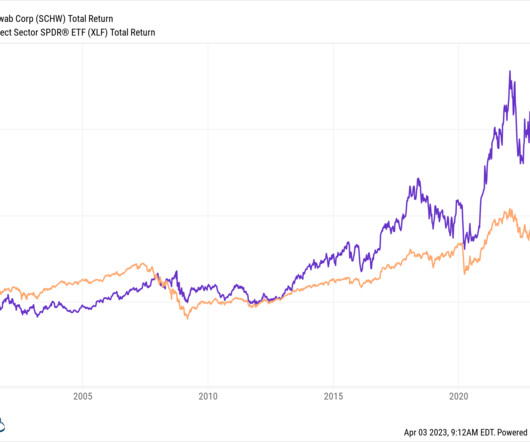

APRIL 3, 2023

riabiz.com) First Citizens is acquiring SVB's wealth management unit. investmentnews.com) Practice management The SEC has been tightening up on the grace period it allows new RIAs before examining them. advisorperspectives.com) Retirement How longevity risk makes decumulation decisions more difficult.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

Dear Mr. Market

DECEMBER 31, 2024

Prioritize high-interest debt first (were looking at you, credit cards) while maintaining manageable payments on lower-interest loans like mortgages. Optimize Tax Strategies Its not what you makeits what you keep. Consolidation might be a smart move too.

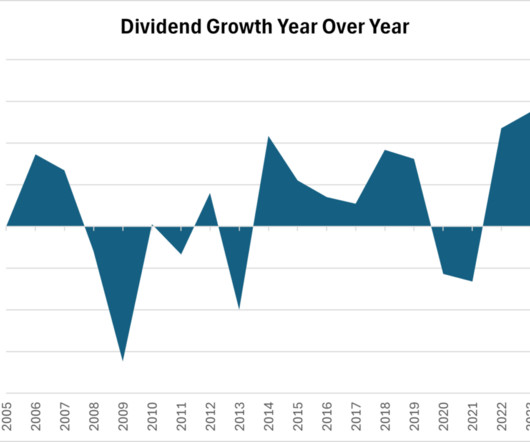

Darrow Wealth Management

FEBRUARY 9, 2025

So historically, every $1 million invested would yield annual dividend income of $19,800 on average… before tax. If you own 10,000 shares, you receive $40,000 in dividend income (before taxes) and have a portfolio currently worth $2M. If qualified, the IRS uses more favorable long-term capital gains tax rates.

Fortune Financial

SEPTEMBER 25, 2023

How to Choose the Right Wealth Management Firm in Kansas City Managing your wealth is a crucial aspect of financial success and security. Let’s look at key factors to consider when selecting the ideal wealth management firm in the Kansas City metro area.

International College of Financial Planning

MARCH 31, 2023

Wealth management is an important aspect of the financial world that focuses on managing wealth to help individuals and families achieve their financial goals. Wealth management involves a range of financial services as an investment, finance, real estate, tax, and risk management.

Darrow Wealth Management

DECEMBER 23, 2022

Congress is once again poised to make sweeping changes to the retirement and tax rules in the last two weeks of the year. retirement changes. In the new bill, the age when retirees must begin drawing from non-Roth tax-deferred retirement accounts would increase to 73 in 2023 and 75 in 2033. The Secure Act 2.0

International College of Financial Planning

JUNE 30, 2022

Hiring a wealth manager is one of the biggest financial decisions you’ll make. Hiring a wealth manager is a long-term investment, so it’s important to find someone who will take the time to get to know your goals, values, and long-term goals. Factors to be considered before hiring a wealth manager. .

Darrow Wealth Management

NOVEMBER 20, 2023

If you think retirement planning moves stop at retirement, think again. Although it won’t make sense in every situation, retirement can be a unique opportunity for Roth conversions for some investors. For high earners, converting an IRA to a Roth IRA while you’re still working could be the worst time of all.

Darrow Wealth Management

MARCH 3, 2025

Taxes, fees, expenses, trading costs, etc. Retirement planning, like any type of robust financial planning, should include stress testing your investment strategy and financial plan. But returns on a 100% fixed income portfolio aren’t going to meet the needs of most retirees. can all weigh on performance.

Talon Wealth

AUGUST 26, 2023

Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement. As such, you must be aware of any tax implications arising from your investments during your working years.

Talon Wealth

OCTOBER 26, 2023

Of course, one of the most important aspects of retirement planning is managing retirement taxes. Taxes can significantly impact the amount of money you’ll have for retirement. As such, you must be aware of any tax implications arising from your investments during your working years.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. A financial advisor provides personalized guidance to help manage and grow your wealth.

Harness Wealth

JUNE 1, 2023

When it comes to managing wealth and planning for a secure financial future, the services of financial professionals, such as financial advisors or wealth managers, are invaluable. This plan may cover estate and retirement planning, college savings, debt management, and more.

Darrow Wealth Management

APRIL 15, 2024

It goes by many different names: semi-retirement, partial or phased retirement, second career, and so on. But typically, it means the same thing: working in some capacity after retiring early. A partial retirement helps with the emotional transition There are two phases of retirement planning: time and money.

Darrow Wealth Management

OCTOBER 28, 2024

A strategy for managing your investments is also key: understanding your risk capacity vs appetite, balancing a need for a current income stream and future growth, and ways to be more tax efficient in taxable accounts. Put the plan into action. This is the best way to stress-test a retirement plan.

Darrow Wealth Management

SEPTEMBER 26, 2024

If you have time to dig into the details, here’s a primer on what you can do after maxing out a 401(k) including the tax advantages of each account type. If you have time to dig into the details, here’s a primer on what you can do after maxing out a 401(k) including the tax advantages of each account type.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. Life happens.

Yardley Wealth Management

MARCH 1, 2022

The post Part 3: Tax-Wise Financial Planning appeared first on Yardley Wealth Management, LLC. Part 3: Tax-Wise Financial Planning. In our last two pieces, we covered some tools of the tax-planning trade, as well as how to deploy them for tax-efficient investing. . Life happens.

Carson Wealth

JULY 12, 2022

In financial services, you might encounter an LLM in tax or estate planning. . Broad Based Financial Planning Designations. Broad financial planning designations are different than degrees. CPA professionals often focus on auditing, tax or accounting functions. . Specialized Financial Planning Designations.

Darrow Wealth Management

MARCH 31, 2023

But that doesn’t mean the actual assets are just split down the middle, and some assets are much more favorable from a tax perspective than others. Here are some key considerations when financial planning for a divorce. You’ll also want to consider engaging a financial advisor, tax advisor, and estate planning attorney too.

Yardley Wealth Management

SEPTEMBER 14, 2020

Understanding the benefits and details of a SEP IRA before committing to this retirement savings vehicle. appeared first on Yardley Wealth Management, LLC. Understanding the benefits and details of a SEP IRA before committing to this retirement savings vehicle. Retirement Planning, Income Taxes.

Darrow Wealth Management

JULY 1, 2024

The 2017 Tax Cuts and Jobs Act (TCJA) brought sweeping changes to the tax code, impacting every taxpayer and business owner. Here’s a summary of the major tax law changes coming in 2026 and some steps individuals and business owners can take to prepare. For some, this may lead to more taxes paid on capital gains.

Park Place Financial

JANUARY 9, 2023

FINANCIAL PLANNING Tax and Financial Planning Ideas For 2023 Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Additionally, the government has made changes to tax rules, further prompting Americans to reevaluate their tax and financial strategies. Retirement Savings Accounts .

Indigo Marketing Agency

MARCH 19, 2025

Example: Instead of writing something like: With our advanced wealth management strategies, we help high-net-worth individuals maximize tax-efficient investments while securing generational wealth. Try using shorter, more common words like: We help you save money on taxes and grow your investments.

Yardley Wealth Management

MAY 30, 2023

appeared first on Yardley Wealth Management, LLC. A Guide for Financial Planning When it comes to managing your finances, it’s crucial to work with a professional who puts your interests first. Tax Planning: A fiduciary, fee-only advisor can advise on tax planning , reducing liability and maximizing returns.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content