Retirement Tech Startup Notches $1.33B Valuation

Wealth Management

JULY 17, 2024

Human Interest helps small businesses set up 401(k) services.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JULY 17, 2024

Human Interest helps small businesses set up 401(k) services.

Nerd's Eye View

DECEMBER 27, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners" - this week's edition kicks off with the news that according to a recent study by DeVoe & Company, only 42% of RIAs surveyed have written succession plans and either have begun to implement them or have already done so.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

MARCH 6, 2024

An assumed rate of return is needed, for example, to illustrate how much a client might need to save for retirement, how much savings they'll have when they do retire, and how long their savings will last after they stop working. The good news, however, is that there are ways for advisors to address the current issue of high U.S.

Nerd's Eye View

JANUARY 31, 2025

Also in industry news this week: While RIA M&A deal flow hit record levels in 2024 (both in terms of volume and the speed of completing them), firm valuations saw relatively modest gains In its latest annual regulatory oversight report, FINRA joined the SEC in flagging the potential risks to firm and client data from the use of third-party vendors (..)

Nerd's Eye View

FEBRUARY 11, 2025

David is the President of Succession Resource Group, an advisory consulting and valuation business based in Portland, Oregon that serves independent financial advisors with RIAs and broker-dealers. Welcome to the 424th episode of the Financial Advisor Success Podcast ! My guest on today's podcast is David Grau, Jr.

Abnormal Returns

DECEMBER 18, 2024

(awealthofcommonsense.com) Market valuations aren't going to help you time the stock market. tonyisola.com) Aging 10 steps to prepare financially for retirement, including 'Design a retirement paycheck.' theretirementmanifesto.com) How to think about retirement planning even though it may be decades off.

Abnormal Returns

SEPTEMBER 8, 2024

awealthofcommonsense.com) Early in retirement is the time to do some tax planning. worksinprogress.co) Good luck trying to time the stock market using valuation metrics. (wsj.com) Three reasons why the stock market declines. whitecoatinvestor.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That."

Nerd's Eye View

MARCH 14, 2025

Also in industry news this week: A recent survey finds that while advisors are increasingly using passive investment vehicles, many are taking the time to look beneath the hood to examine the makeup of different indexes in order to choose the best option for their clients A survey of advisors working at enterprise firms shows a significant increase (..)

Nerd's Eye View

MAY 10, 2024

Enjoy the current installment of "Weekend Reading For Financial Planners"– this week's edition kicks off with the news that a recent analysis from Morningstar suggests that the Department of Labor's (DoL's) new Retirement Security Rule (aka Fiduciary Rule 2.0)

Abnormal Returns

DECEMBER 26, 2022

kitces.com) Christine Benz and Jeff Ptak discuss the recent "The State of Retirement Income" report. rationalreminder.libsyn.com) The biz The DeVoe 2023 M&A report shows expectations for lower RIA valuations. nytimes.com) Retirement How to optimize Social Security benefits as a widow. morningstar.com) SECURE Act 2.0

Nerd's Eye View

JULY 5, 2024

Supreme Court decision shifting authority to interpret laws passed by Congress from Federal agencies to the judicial system could have significant impacts on regulation of the financial advice industry, including the potential for additional legal challenges to regulations from the Securities and Exchange Commission (SEC), the Department of Labor (DoL), (..)

The Big Picture

APRIL 17, 2025

My buddy could pay off his mortgage and car loans, pre-pay the kids colleges, fully fund retirement accounts, and still have cash left over. My advice was not based on fear of a bubble or the (over)valuation of Yahoo; rather, I suggested employing a regret minimization framework.2 Torn about what to do, he asked my opinion.

The Big Picture

FEBRUARY 27, 2023

Recall last week , we were discussing thinking about the impact of retiring Baby Boomers on the equity markets and of rising rates on housing. The demographic question touches on a big issue: $6 trillion dollars in 650,000 (401k) retirement plans held by 10s of millions of Americans.

Nerd's Eye View

OCTOBER 4, 2024

Also in industry news this week: A recent survey found that while 1/3 of advisory firms are currently using AI tools, another 1/3 are fearful of doing so, indicating that while some firms are eager to be early adopters of this technology, others are taking a wait-and-see approach, perhaps as regulation surrounding this technology evolves over time (..)

Nerd's Eye View

DECEMBER 23, 2022

”, a series of measures that will have significant impacts on the world of retirement planning. While RIA M&A activity has been red hot during the past couple of years, a survey suggests that advisors are expecting lower valuations in 2023.

A Wealth of Common Sense

SEPTEMBER 19, 2023

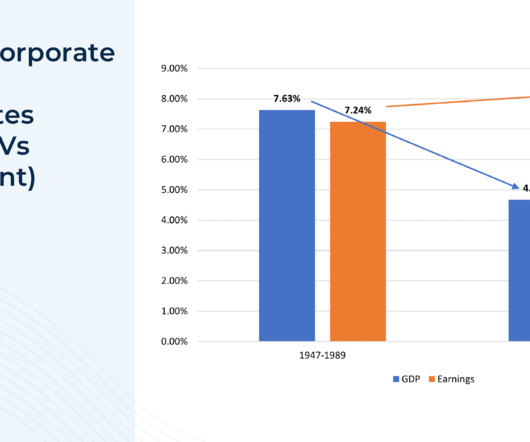

Fundamentals like valuations, economic growth, earnings and dividends are the main drivers of returns over the long run. There are a lot of factors that drive the performance of financial markets over time. Plus you have to consider demographics, productivity and innovation. And the hardest variable to quantify will always be psychology.

Nerd's Eye View

NOVEMBER 4, 2022

A recent study shows that while many consumers have expressed an interest in ESG investing, such funds within retirement plans have received limited allocations from investors. While private valuations have soared in recent years, public markets continue to be less kind to RIAs. Enjoy the ‘light’ reading! Read More.

The Big Picture

JANUARY 4, 2023

Folks of retirement age had a pet boom in the wake of the Great Recession, but pet ownership among people at peak earning age (think 40s and early 50s) hasn’t changed much. Venture capital’s reckoning looms closer : Valuations on holdings will have to converge sooner rather than later with listed tech sector. Bloomberg ).

The Big Picture

MARCH 6, 2023

Venture-capital investments are plunging, along with valuations of prepublic companies. Lawmakers are trying to restrict these investment choices in workplace retirement plans, but big fund managers are trying to give shareholders a voice. ( The Justice Department just can’t stop filing antitrust suits against Google.

Random Roger's Retirement Planning

DECEMBER 16, 2022

A few things from the last couple of days all with the theme of retirement planning mistakes to avoid. The 4% rule of course refers to the percentage that can be safely withdrawn from portfolio assets for a sustainable retirement (not running out of money). The increase in bond yields is also a valuation call.

The Big Picture

APRIL 24, 2023

Nobody should be swinging around billions of dollars based on gut instinct, and certainly not retirement accounts or other very important capital. Note we have not even referencing the valuation debate. Real in terms of both importance to investors and size. The post When, Where, and for How Long appeared first on The Big Picture.

Diamond Consultants

DECEMBER 16, 2024

As a result, its often incumbent upon the retiring advisor to either accept a discounted valuation for the book and/or show a great deal of flexibility in how their next gen ultimately takes the reigns of the business. After all, shouldnt the retiring advisors be compensated fairly for their lifes work? But is that fair?

The Big Picture

MARCH 18, 2023

Be sure to check out our Masters in Business next week with Dominique Mielle, (retired) partner at Canyon Capital, a $25 billion hedge fund where she worked there for 20+ years. You can stream and download our full conversation, including any podcast extras, on iTunes , Spotify , Stitcher , Google , YouTube , and Bloomberg.

Diamond Consultants

JUNE 1, 2023

Here are 3 valuation scenarios to address that curiosity. Focus Financial Partners, the largest investor in the independent space, is being taken private at a $7B valuation. Prolific RIA acquirer CI Financial recently monetized a stake in their business at a $5B valuation. Those are some eye-popping numbers.

Abnormal Returns

AUGUST 15, 2022

investmentnews.com) Advisers What is happening with RIA valuations? kitces.com) It's hard to talk about retirement without Social Security which turned 87 years old. (riabiz.com) Niches Niche advisers tend to earn more revenue. thinkadvisor.com) Young lawyers have their own unique financial planning needs.

Nerd's Eye View

APRIL 18, 2024

For over a decade, the financial advice industry has been bracing for an "any-minute-now" tsunami of advisor retirements and concomitant sales of financial planning practices. The primary risks when selling an advisory firm are that the deal may fall through, and existing clients may choose to leave the firm.

Abnormal Returns

AUGUST 22, 2022

investmentnews.com) What's the story behind the valuation behind startup Farther? advisorperspectives.com) Divorce becomes even more complex nearing retirement. (investmentnews.com) How Creative Planning came to be comfortable doing acquisitions. riabiz.com) How M&A transactions are getting structured in light of a bear market.

Park Place Financial

JULY 6, 2022

RETIREMENT PLANNING The Impact of Public Retirement in Texas Schedule a Complimentary Financial Review CLICK HERE TO SCHEDULE. Current and upcoming rulings are changing public retirement for Texans. Learn more about this retirement legislation to determine whether or not you need to make changes to your retirement planning.

James Hendries

FEBRUARY 23, 2023

If you are getting ready to retire and thinking about selling your financial firm, you have to decide how much your business is worth, and it can be challenging to put a number on something you’ve been building for your whole life. Important Disclosures: LPL Financial does not provide business valuation services.

Nerd's Eye View

AUGUST 19, 2024

Which means that longer-term projects, such as creating a succession plan to have in place for the firm when the owner retires, may tend to get put on the back burner.

Mr. Money Mustache

FEBRUARY 25, 2025

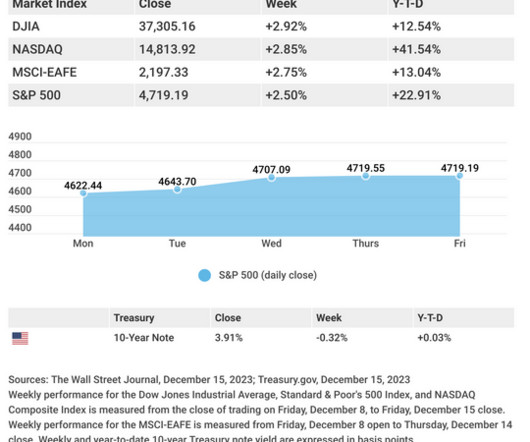

The value of the S&P 500 index of stocks, where most of us hopefully have a good chunk of our retirement savings stashed into index funds, is up about fifty seven percent in just the past two years. Does this make it more vulnerable to a huge crash in the future, and will it affect my retirement?

Darrow Wealth Management

AUGUST 28, 2023

With many sellers relying on the sale to fund their retirement and lifelong financial goals, getting it right from the start is critical. It’s not uncommon for business owners to assume they’ll never retire at some point during their life. On the bright side, you only need to get through it once.

Steve Sanduski

AUGUST 29, 2023

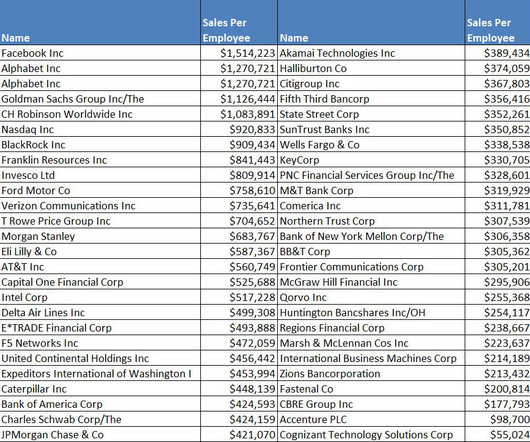

But that span coincided with an unprecedented combination of low interest rates, a roaring market, the first wave of retiring baby boomer CEOs, and the AUM model boosting profits and valuations. Private versus public valuations of RIA firms. Matt Crow and I discuss: The main drivers of the recent RIA M&A environment.

Darrow Wealth Management

MARCH 31, 2023

How different assets are taxed matters a lot during asset division Money in retirement accounts will be fully taxable as regular income (unless in a Roth account when funds can be tax-free when holding periods are met). Retirement accounts: IRAs vs 401(k)s. Update retirement plan beneficiary designations.

Advisor Perspectives

MARCH 15, 2023

They recognize that it is a client’s income – not their wealth – that matters in retirement, and annuities are the only way to provide a longevity-protected income solution.

The Irrelevant Investor

NOVEMBER 12, 2015

In it, he discusses the efficacy of using valuations, specifically the CAPE ratio, to help time the market. One thing Asness addresses is the valuation drift upward which U.S. He then addresses the oft-heard argument that this valuation drift is a secular change. stocks have experienced over the last century. In 1902, U.S.

Discipline Funds

SEPTEMBER 7, 2023

02:32 – Cullen’s goals with his personal portfolio 04:50 – Matching the duration of assets with liabilities 09:38 – How Cullen views retirement 14:28 – Do Cullen’s macro views influence his portfolio? I hope you learn something new from this interview.

Cornerstone Financial Advisory

DECEMBER 18, 2023

.” – Charles Schulz Tax Benefit And Credits: FAQs For Retirees Lots of questions can come up about income taxes after one has retired. However, if you sell a Treasury Note prior to maturity, it may be worth more or less than the original price paid.

Fortune Financial

OCTOBER 1, 2022

In fact, railroads have retired a number approaching one-third of shares outstanding over the last decade, and, as a result, free cash flow per share has grown enormously: Not surprisingly, returns on invested capital have improved as well: Of course, this is not to suggest that railroad performance will always be so stellar.

Validea

JANUARY 13, 2023

Valuations have come way down, and many companies are still reporting earnings higher than the market average, with roughly 8% expected for 2023 in the S&P 500. Healthcare company Humana was another company that passed the Barron’s test, as more retirement-age Americans purchase their Medicare Advantage plans.

Nationwide Financial

FEBRUARY 1, 2023

These recurring shifts in the composition of the benchmark stock Index can offer insight into how different factors, such as cyclicality, long-term growth potential, and valuation, may impact stock performance in the future. The outsized influence of tech company earnings on the S&P 500 is important to understand.

Dear Mr. Market

AUGUST 5, 2022

We’re currently seeing one of the largest disparities in valuations between growth and value stocks which in our opinion presents a very appealing opportunity for dividend seeking investors. Inflation is currently at 40 year highs with increasing signs of slowing economic growth.

The Irrelevant Investor

MARCH 23, 2021

See important Disclaimer here On today’s show we discuss : There's a housing affordability crisis But what if houses aren't as expensive as we think There are more realtors than houses It's hard work being a junior investment banker Retiring early might not be all it's cracked up to be The child tax credit is a big deal Ray Dalio on what happens when (..)

The Irrelevant Investor

FEBRUARY 13, 2017

Whether you choose the CAPE ratio or a different valuation metric, they all say the same thing; Expensive markets leave investors with a smaller margin for error. Jumping in or out of stocks based on valuation can be extremely difficult, if not completely impossible. Retirement didn't exist. The more you pay, the less you get.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content