Webinar: The Door Is Open… Wider: ESG Investing for Retirement Plans

Wealth Management

JANUARY 20, 2023

Available On Demand

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JANUARY 20, 2023

Available On Demand

eMoney Advisor

NOVEMBER 7, 2022

Whether they are on the cusp of retirement or living as a retiree, this is an impactful time of transition. Navigating the Retirement Transition with “Switches” Because the transition to retirement is dynamic and requires financial, lifestyle, and social choices, clients need a full understanding of their “switches” or options.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Nerd's Eye View

FEBRUARY 16, 2024

Also in industry news this week: While AUM fees remain ubiquitous among fee-only advisors, recent data show that an increasing number leverage multiple fee models to meet different client needs and preferences While CFP Board has come out firmly in favor of the Department of Labor's proposed Retirement Security Rule, FPA has taken a more cautious approach, (..)

Wealth Management

JANUARY 20, 2023

Thursday, January 26, 2023 | 2:00 PM ET

Wealth Management

JANUARY 20, 2023

Tuesday, January 24, 2023 | 2:00 PM ET

Indigo Marketing Agency

FEBRUARY 8, 2025

For example, your target audience could be young professionals saving for retirement or retirees focused on wealth preservation. For more help with finding your niche and selecting the right audience Watch this free webinar called Your Riches Are in Niches. How can hosting webinars help financial planners attract more clients?

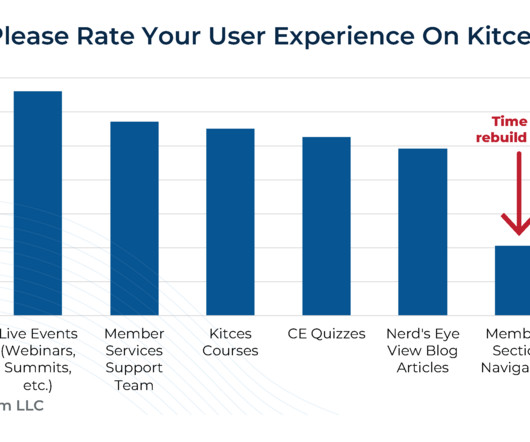

Nerd's Eye View

JANUARY 13, 2025

for all of our Kitces article and webinar content as well; these CE Intensives are simply meant for those who would prefer to 'binge' the content all at once in single-day live experiences! As always, though, we remain committed to providing IAR CE (and all our other types of CE!) In the meantime, our own Team of Nerds continues to expand.

Covisum

MARCH 12, 2024

Beginning March 14th and running monthly through September, Founder and President of Covisum Joe Elsasser, CFP ® will be presenting a 7-part webinar series, Retirement Delivered , showcasing the framework that top advisors are using to deliver dramatic value to clients, grow their practices and feel good about the impact they make in their client’s (..)

FMG

FEBRUARY 13, 2025

Whether youre hosting virtual webinars or in-person gatherings, the right approach can transform your client event into a lead-generating, referral powerhouse. Virtual Webinars: Maximizing Engagement and Lead Generation Virtual webinars remain a top choice for hosting client events in 2025.

FMG

FEBRUARY 13, 2025

Whether youre hosting virtual webinars or in-person gatherings, the right approach can transform your client event into a lead-generating, referral powerhouse. Virtual Webinars: Maximizing Engagement and Lead Generation Virtual webinars remain a top choice for hosting client events in 2025.

Indigo Marketing Agency

MARCH 5, 2025

According to DemandSage : The average webinar conversion rate is approximately 56%. A significant 85% of businesses consider webinars essential to their marketing strategy. More than half (51%) of content marketers say webinars provided the best results. Learn more about our webinar services here.

MainStreet Financial Planning

MAY 4, 2023

Exploring Retirement Housing Decisions Hosted by: Jennifer Bush, CFP® MainStreet Financial Planning As people approach retirement age, one of the most significant decisions they face is where and how they will live during their golden years. Topics Include: What are some considerations when choosing a retirement home?

Nerd's Eye View

OCTOBER 1, 2024

What's unique about Gaetano, though, is how after breaking away from an insurance broker-dealer with barely $5M in assets under management, he has been able to quickly build his practice to $75 million in AUM in just 5 years in part by turning what was originally a liability for him in his 20s – being a 'young' advisor who prospective clients (..)

Investing Caffeine

FEBRUARY 21, 2023

Upcoming Webinar – February 22nd at 12:00pm PST Volatility has spiked due to changing concerns over inflation, interest rates, recession fears, geopolitics, and other fear-provoking issues, but how can you grow and protect your retirement nest egg?

Indigo Marketing Agency

JUNE 16, 2021

Did you know the topic you choose for your webinar is the most important factor determining its success? Do you need webinar topic ideas? You’ve decided that a webinar is just what you need to warm up prospects and convert them into clients. But now the big question is: Which webinar topic do you choose?

Covisum

MAY 19, 2022

You know that taxes are a crucial element of any retirement strategy that can't and shouldn't be ignored. However, taxes are rarely straightforward, especially taxes on retirement income. Help your clients keep more of their hard-earned retirement dollars by identifying tax traps and opportunities. That's where you come in.

Indigo Marketing Agency

MAY 5, 2020

How To Grow Your Retirement Plan Business In The 2020 Economic Crisis. We’ll review: – How has the retirement landscape been affected by COVID-19? – How can advisors grow their retirement business in the current crisis? I’m super excited to welcome the team at Retirement Learning Center.

Covisum

MARCH 20, 2024

Covisum® Founder and President, Joe Elsasser, CFP®, recently launched the first of a 7-part webinar series scheduled monthly through September. The series focuses on highlighting the framework used by top advisors to grow their practices by delivering dramatic value to their clients.

Steve Sanduski

APRIL 8, 2025

In a nutshell: Bill Keen named his book Keen on Retirement: Engineering the Second Half of Your Life. Bill, Matt, and their team have become such experts in these companies’ retirement and benefit programs that even their HR professionals call Keen Wealth with questions. Webinars don’t work.’

NAIFA Advisor Today

APRIL 12, 2024

Join us on Wednesday, May 1, 2024, from 12:00 pm to 1:00 pm Eastern for an in-depth webinar that focuses on aligning your clients' financial assets with their estate planning goals. This webinar, cosponsored by NAEPC, is free for both NAIFA members and non-members and offers CE credits for attendees.

Indigo Marketing Agency

AUGUST 11, 2020

Webinars for financial advisors are a great way to secure high conversion rates. So you’ve decided to create a webinar. After doing dozens of webinars myself and creating countless webinars for financial advisors, I’ve come to realize one thing. Your webinar attendance rate is only as strong as the topic you select.

NAIFA Advisor Today

DECEMBER 2, 2024

Discover how to seamlessly combine charitable giving with retirement income strategies in our upcoming webinar Bridging Charitable Planning with Retirement Income on Tuesday December 10, 2024, from 12:00 to 1:00 pm Eastern.

Indigo Marketing Agency

FEBRUARY 19, 2025

Host Educational Webinars Webinars are a powerful way for financial advisors to connect with potential clients and build trust. Whether through evergreen content or addressing timely issues, webinars remain one of the best strategies for generating leads and showcasing your expertise. Authenticity is key.

Midstream Marketing

NOVEMBER 8, 2024

Articles: Discuss topics such as investing, retirement planning, and related subjects. Hosting Webinars and Online Workshops for Direct Interaction Webinars and online workshops are a great way to connect with potential clients. Advertise your webinars on your website. Webinars are engaging.

Indigo Marketing Agency

AUGUST 11, 2020

Webinar marketing for financial advisors is the key to unlocking high conversion rates. If you’ve spent any time on my website or reading my blogs, you know I really like webinars. It was webinars. The more webinar viewers we could get, the faster the business would grow. Creating those webinars allowed me to: .

NAIFA Advisor Today

APRIL 29, 2024

A NAIFA Advocacy Webinar May 2 | 2 pm eastern The U.S. Department of Labor‘s final fiduciary-only rule will force the vast majority of financial professionals offering retirement planning services and products into a fee-for-service model, unless Congress or the courts intervene.

NAIFA Advisor Today

JANUARY 9, 2024

In this Society of Financial Service Professionals (FSP) webinar, Fairway Reverse Mortgage Specialist, George Bain, will explore the challenges today’s retirees face and how they can benefit from the strategic use of a reverse mortgage.

NAIFA Advisor Today

MAY 31, 2023

If you are concerned about diversifying your clients' income during retirement and are searching for strategies to protect against potential increases in taxes and inflation, then j oin the next Advisor Today webinar on Tuesday, June 13 at 2 pm eastern with Allianz.

NAIFA Advisor Today

APRIL 20, 2023

is here, but what does that mean for your clients' retirement and estate planning? SECURE 2.0 On Tuesday, May 9, from 12 pm to 3 pm eastern, join NAIFA and the Society of Financial Service Professionals for an Advanced Practice Center live virtual event, as three industry experts discuss the impact of SECURE 2.0,

eMoney Advisor

JANUARY 20, 2023

Act, signed into law December 29, 2022, is designed to help strengthen the retirement system and Americans’ preparedness for retirement. The act introduces 92 provisions that will impact your clients and their financial plans, whether they’re in, nearing, or still years away from retirement. The SECURE 2.0

FMG

MARCH 3, 2025

Instead of listing ten tips for retirement planning, share your top three and ask, What would you add to this list? For instance, many people feel overwhelmed by retirement planning. Whats your biggest question about retirement? Whats your biggest challenge when it comes to retirement planning?

Random Roger's Retirement Planning

APRIL 11, 2025

Mid-morning on Thursday I sat in on a webinar for the Alpha Architect Tail Risk ETF (CAOS). As they acknowledged on the webinar, the mutual fund predecessor didn't really help in 2022 because of the path that the VIX took. An idea from me, from a long time ago was if you want to use factor funds, you need to just stick with them.

The Irrelevant Investor

OCTOBER 10, 2023

Today’s Animal Spirits is brought to you by YCharts: See here to register for YCharts webinar discussing this quarter’s top 10 visuals for clients and prospects. On today’s show, we discuss: Are bond yields too high, or too low? The post Animal Spirits: The Worst Bear Market Ever appeared first on The Irrelevant Investor.

Indigo Marketing Agency

APRIL 23, 2020

Marketing In A Crisis For Financial Advisors (Free Webinar). How can you market in a crisis to multiply your best clients, grow your business, and help more people? Join this exclusive webinar to learn: 1. Space is limited for this time-sensitive webinar, so save your seat today! Making it easy to work with you virtually 4.

Midstream Marketing

DECEMBER 6, 2024

Running focused social media campaigns that highlight their services and share their skills in areas like tax planning or retirement planning. Hosting webinars or online workshops that teach potential clients about important financial topics and show that the RIA is a leader in the field. Think about using different kinds of content.

eMoney Advisor

JUNE 6, 2023

In our recent webinar, “Key Insights into Becoming a Trusted Advisor” we discussed how to break down client barriers and expand your value as a financial planner. You can preview a few of the session’s highlights here or access the full webinar. ” Lusardi, 2019. Stress in America.”

Carson Wealth

JUNE 16, 2023

Having a retirement income plan in place can help you approach retirement with confidence. Learn more in our informative webinar, Your Retirement Income Plan , with Carson Group’s Senior Wealth Planner Tom Fridrich and Retirement Plan Advisor Chris Tooker , now available on-demand.

Random Roger's Retirement Planning

FEBRUARY 28, 2025

Meb Faber hosted a webinar to support what his firm, Cambria, is doing with 351 exchanges and the upcoming Cambria Endowment ETF (ENDW). Moving to ENDW, we just mentioned this the other day , really just acknowledged that it is coming soon but the webinar added some color. 351's are kind of like 1031 exchanges in real estate.

Investing Caffeine

MAY 3, 2023

These are all interesting and important questions, but preparation for retirement is much more important than panicking over issues you have no control over. For many investors, however, the more important questions to ask and answer relate to your retirement strategy. Risk Tolerance: What is your asset allocation?

Carson Wealth

AUGUST 16, 2024

Our How to Effectively Manage Your Social Security Retirement Benefits webinar, featuring Carson Group’s Sr. The post How To Effectively Manage Your Social Security Retirement Benefits appeared first on Carson Wealth. We have answers!

Indigo Marketing Agency

MARCH 19, 2025

Instead of a headline like Optimize Your Wealth Portfolio for Maximum Returns, try something easier to comprehend like: Grow Your Retirement Savings Faster. Example: Instead of: We provide expert financial advice to help you plan for retirement. Try this: Book a Free 15-Minute Call to Plan Your Retirement Strategy Today!

MainStreet Financial Planning

JULY 23, 2024

Recently, I got an invitation for a webinar titled “Incorporating Property & Casualty into The Holistic Financial Plan.” The webinar was fantastic! The reality is paying premiums to protect my assets is a smart financial decision equal to saving for retirement, investing, etc.

Zoe Financial

DECEMBER 28, 2024

For instance, I will contribute an additional $10,000 to my retirement fund this year or I will pay off my $15,000 credit card balance by December 2025. Allocate funds for savings, retirement, and an emergency fund while leaving room for meaningful indulgences. Outcome: What Results Will You Achieve?

Nationwide Financial

SEPTEMBER 27, 2022

Hispanic adults who work with financial professionals were less likely to have postponed retirement than those who are not. For example: Looking more closely at decisions about retirement, the differences between Hispanic adults and the overall U.S. Obstacles to retirement planning. For Hispanic Heritage Month (Sept. population.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content