QSBS Valuation for Enhanced Estate And Tax Benefits

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

MAY 21, 2024

A cornerstone in strategic planning to optimize clients’ financial legacies.

Wealth Management

MARCH 10, 2025

Strategic planning and preparation can equip anyone to ensure philanthropy remains a cornerstone of Americans financial stewardship.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Nerd's Eye View

AUGUST 2, 2023

Which means that financial advisors can play an important role in adoption planning – helping clients strategically plan for the costs involved in the process, including accessing tax credits that can significantly defray these expenses. Read More.

Brown Advisory

APRIL 19, 2022

The Family Mission Statement and Strategic Plan jharrison Tue, 04/19/2022 - 16:38 Download the Report We believe a family mission statement – and a strategic plan to implement that mission – allows a family to filter out the “background noise” of day-to-day challenges and focus on long-term goals and objectives.

Zoe Financial

MARCH 21, 2025

Published: March 21st, 2025 Reading Time: 6 minutes Written by: The Zoe Team Managing wealth involves more than just investingit requires careful planning, strategic decision-making, and a long-term vision. Tax Considerations : Identifying strategies to optimize your tax situation. Ready to Grow Your Wealth?

The Big Picture

SEPTEMBER 6, 2023

You don’t have to think like a tax accountant, actuary and investment adviser to get it right. Miller Samuel’s research and data analytics drive much of the national real estate brokerage publications and strategic plans. Bloomberg ) • Roth vs. Traditional 401(k): Where to Put Your Money for Retirement?

Getting Your Financial Ducks In A Row

APRIL 24, 2023

Photo credit: jb Had an opportunity to read a new book over the tax season (in my spare time!). I found this book, by Jasen Dahm, CFA, CPA, to be a very good review of strategies to maximize your income and avoid taxes where possible, while planning your retirement income stream.

WiserAdvisor

AUGUST 25, 2023

Tax considerations play a crucial role in retirement planning, as they can significantly impact your income and savings. Retirees must carefully strategize to minimize taxes during their non-working years. However, it is important to consider the immediate tax liabilities that come with converting to a Roth account.

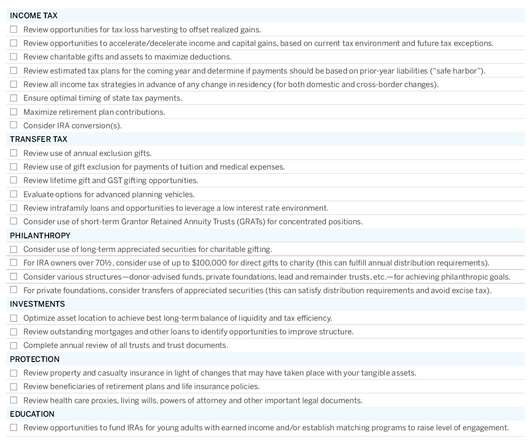

Brown Advisory

JULY 30, 2015

Strategic Advisory Letter | Mid-Year Planning Tools for 2015. It takes time to integrate decisions regarding your investments, tax situation, estate matters, business planning and charitable objectives into a thoughtful and coordinated plan. Thu, 07/30/2015 - 16:44.

Zoe Financial

APRIL 17, 2023

Implementing these strategies can help reduce tax bills, save more, and achieve financial goals sooner. The deadline for tax filing is around the corner. Besides meeting all the requirements for this date, have you considered the impact of implementing long-term tax strategies on your wealth?

Harness Wealth

OCTOBER 23, 2023

Key Takeaways: Accounting advisory services extend beyond traditional tax preparation to offer strategic financial guidance. Specialized areas can include estate planning and tax-efficient investment strategies. Table of Contents What Are Accounting Advisory Services?

Harness Wealth

NOVEMBER 27, 2023

Within the accounting profession, Client Accounting Services (CAS) has emerged as a pivotal offering for entrepreneurial CPAs wishing to help their clients with more than just annual tax filings. Core components of CAS involve bookkeeping, payroll, tax planning & compliance services customized for each client.

Brown Advisory

FEBRUARY 23, 2022

Topics included: - How to set up your company now to prepare for an exit in the future - Understanding whether your planned wealth creation event will support your goals: How much is enough? - Topics will included: • How to structure the earn out. Is it better to take all cash, or cash and stock?

Brown Advisory

FEBRUARY 23, 2022

Planning for Your Liquidity Event and Beyond. On May 6, our panel of experts focused on investment, tax and strategic planning advice to help you prepare for this moment and beyond. MORE ON THIS TOPIC Strategic Planning Roadmap for Entrepreneurs. Thursday, May 6, 2021. Read now >.

Brown Advisory

NOVEMBER 1, 2023

An important complement to a family’s mission statement is the strategic plan put in place to communicate its goals and implementation steps to the family. Such a plan should address: Empowerment : How will family members be empowered to advance the family mission? What should be our financial goal for giving?

Steve Sanduski

FEBRUARY 6, 2023

They’re really focused on transferring wealth to the next generation, charitable gifting, cash flow management, different aspects of planning, and then reporting because of the complexity. We do the strategic planning and advice internally; that’s like the core quarterbacking. ” A game-changer.

Brown Advisory

SEPTEMBER 25, 2023

Click Here to Download the Six Considerations MORE ON THIS TOPIC Good financial planning happens at every stage of life and we believe a family mission statement – and a strategic plan to implement that mission – allows a family to filter out the “background noise” of day-to-day challenges and focus on long-term goals and objectives.

Brown Advisory

JUNE 15, 2022

Good financial planning happens at every stage of life and we believe a family mission statement – and a strategic plan to implement that mission – allows a family to filter out the “background noise” of day-to-day challenges and focus on long-term goals and objectives. Click Here to Download the Six Considerations. .

Brown Advisory

NOVEMBER 28, 2022

Continually assess where you stand today against your current financial and generational plans We have a number of tools we use to help clients think through their initial goal-setting and planning, and to review those goals and plans on an ongoing basis.

Brown Advisory

NOVEMBER 28, 2022

We have a number of tools we use to help clients think through their initial goal-setting and planning, and to review those goals and plans on an ongoing basis. Regularly review and adjust near-term tactical plans to build confidence in the face of current volatility. Tax Loss Harvesting.

Brown Advisory

JULY 28, 2022

In all cases, we believe that thoughtful and careful estate planning in conjunction a prenuptial agreement is best way to safeguard family assets. The Family Mission Statement and Strategic Plan. For a more comprehensive conversation, don’t hesitate to contact us. . MORE ON THIS TOPIC.

MazumaBusinessAccounting

MAY 5, 2020

Nine years ago, we started a small company that helps small businesses with their bookkeeping, taxes, and accounting…a simple but needed service. I have been grateful to see so many businesses be creative, strategically plan, and open their hearts to people around them. May Newsletter.

WiserAdvisor

NOVEMBER 14, 2023

Additionally, a strategic approach ensures the longevity of savings and investments, meaning your resources are structured to last throughout your retirement years, mitigating the risk of outliving your assets. Tax efficiency A savvy retirement strategy also involves optimizing tax implications.

James Hendries

JULY 1, 2023

This could take the form of increasing the profitability of your business by increasing your marketing, reducing your current costs and expenses, finding ways to reduce your tax burden, or continuing your education. 1 Pay Down Debt There are two primary types of debt: productive and reductive.

WiserAdvisor

FEBRUARY 19, 2024

As a couple aged 65 in 2023, you may need approximately $315,000 saved (after tax) to cover your healthcare expenses. This underscores the necessity of integrating healthcare costs into your broader retirement planning strategy. You can also consider using Roth accounts to optimize tax planning in retirement.

The Big Picture

AUGUST 20, 2024

We built a company that was focused on valuation, initially, actually targeting corporate strategic planning departments. And what that will allow me to do is have minimal trading costs, minimal tax costs, and avoid all the behavioral problems that comes with active management. You were subject to the 75% marginal tax rate.

Brown Advisory

NOVEMBER 5, 2021

It is tempting to contrast the good with the uncertainty surrounding us– the continuing pandemic, challenges to our relationship with China, supply chain disruption, fears of inflation and potential tax legislation. Formulating a plan to take the first incremental steps and assessing regularly are critical.

Brown Advisory

OCTOBER 12, 2023

Plan early, plan wisely, and prenuptial planning can help contribute to a happy marriage as well as a better outcome should that marriage come to an end.

Brown Advisory

NOVEMBER 1, 2019

This year, two factors will be important considerations in our year-end planning work: 1) current market dynamics (specifically, ongoing market volatility, low interest rates and a flat yield curve), and 2) the 2017 tax overhaul and our ongoing integration of new tax rules into clients’ long-term plans. Non-Taxable Gifts.

Good Financial Cents

AUGUST 12, 2023

READ MORE: How to Make $1,000 Per Month in Dividends Tax Considerations Tax implications for passive income differ from those of active income. Passive income may qualify for different tax rates or deductions, depending on jurisdiction and the type of income. You can read more about here about how passive income is taxed.

Clever Girl Finance

SEPTEMBER 7, 2023

It’s not just a set of numbers, rather, it’s a strategic plan that empowers you to navigate the complexities of financial decisions. Housing This category covers your mortgage or rent payments, property taxes, insurance, and home maintenance expenses. Table of contents What is a family budget?

Carson Wealth

JULY 5, 2022

At that time, he was bringing in – after taxes – about $40,000 a month. I was always planning and budgeting because our father made us aware of that at a young age,” Ogden said. . So, he knew to create a budget while he was in the NFL that accounted for his rent, his car, his gas, and his food. . “I Being worried about money.

WiserAdvisor

SEPTEMBER 8, 2023

It is important to have a clear understanding of your budget post-retirement, factoring in housing costs, property taxes, and maintenance expenses. Different states have different rules when it comes to income taxes. Engaging in careful tax planning is essential to navigate this potential tax challenge.

WiserAdvisor

MARCH 28, 2024

It offers tax-deferred growth and, in many cases, matching employer contributions. IRAs offer similar tax benefits as 401(k)s, high contribution limits for those aged 50 and older, and help accelerate your savings growth. Contributions to tax-deferred retirement accounts like 401(k)s and IRAs offer the advantage of tax-deferred growth.

WiserAdvisor

JANUARY 23, 2024

Seeking professional advice can provide valuable insights and a roadmap to achieve your financial goals with strategic planning. Step 2: See if the financial advisor conducts an annual tax review Ensuring that your financial advisor reviews your tax return annually is a crucial step in maximizing your financial benefits.

Zoe Financial

MARCH 22, 2023

Not all income is created equal – and different income sources also carry other consequences , especially regarding taxes. For example, the money you will withdraw from a Roth IRA would be tax-free, and some retirees jump in early to use their Roth IRA accounts. However, this is a mistake. Ready to Grow Your Wealth?

Good Financial Cents

DECEMBER 14, 2022

After all, people will always need financial services, whether investing their money , taking out loans, or managing their taxes. Thinking critically is of the utmost importance for business leaders when it comes time to make big decisions like hiring, budgeting, and strategic planning. Financial Decision-Making Skills.

WiserAdvisor

NOVEMBER 6, 2023

Pay attention to taxes Recognizing the potential impact of taxes on your investments is crucial, given the substantial sum of $100,000. Tax planning can help you maximize your earnings effectively. On the other hand, failing to optimize your tax situation can erode the value of your $100,000 savings fund.

The Big Picture

FEBRUARY 21, 2023

And we had prioritized all our strategic plans, we had to figure out how to get them done while people were remote. And you know, just simple things like, hey, the value of tax loss harvesting, how do you make that apparent to people? Something that, for us, save our clients about $300 million in four months, that alone.

International College of Financial Planning

MARCH 9, 2024

Who is a Certified Financial Planner® Professional A Certified Financial Planner® (CFP®) professional is a beacon in the financial advisory landscape, offering unmatched expertise in financial management and strategic planning.

Brown Advisory

MAY 4, 2020

We did a close review of the college’s strategic plan and its capital campaign plan, to better understand goals and associated costs, and to assess the likelihood of the college achieving its fundraising targets.

Brown Advisory

SEPTEMBER 4, 2019

challenge: STRATEGIC PLANNING/DEBT MANAGEMENT. . We did a close review of the college’s strategic plan and its capital campaign plan, to better understand goals and associated costs, and to assess the likelihood of the college achieving its fundraising targets. client: SMALL PRIVATE REGIONAL COLLEGE. BACKGROUND.

Brown Advisory

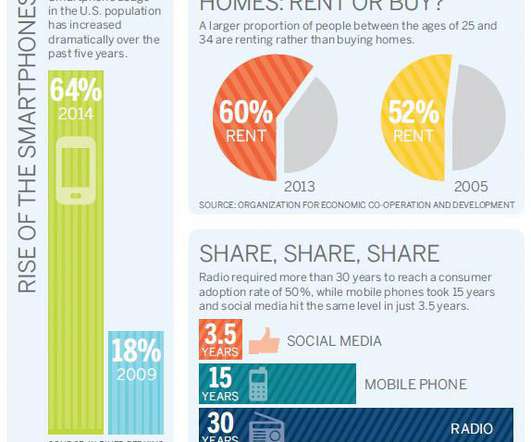

SEPTEMBER 1, 2015

Richard Gamper, Strategic Planning Analyst, Brown Advisory. . By Stephen Shutz, CFA, Tax-Exempt Portfolio Manager. Instead of ownership, they seek access to services and goods that provide fresh experiences to be captured on a smartphone and shared: travel, socializing, sports, adventure. Rude Awakening.

The Big Picture

MAY 7, 2024

And so we built this product called the one page plan that will literally analyze what you spend down to your DoorDash, down to your credit card, down to your Amazon, and then look at your investments and tell you you need to save $63,000 a year for the next 10 years to get even close to where you’re gonna be. What did I forget?

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content