Live from Heckerling: 2023 Estate and Tax Planning Developments

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Tax Planning Related Topics

Tax Planning Related Topics

Wealth Management

JANUARY 8, 2024

What were the significant tax and non-tax issues of last year? Speakers at Heckerling discuss tax planning, estate planning and philanthropy cases.

Nerd's Eye View

NOVEMBER 30, 2022

And the consequences for incorrect tax advice can include legal and financial penalties if a client were to be harmed by the wrong advice – which is often not covered by the firm’s E&O insurance –creating an expensive liability when tax advice goes wrong.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Wealth Management

MARCH 7, 2025

Carson, Mesirow and Sequoia are recent RIA dealmakers in the growing push to add tax planning and services.

Wealth Management

MARCH 23, 2023

Make the most of available charitable tax deductions.

Nerd's Eye View

JANUARY 21, 2025

What's unique about Daniel, though, is how his firm has expanded its tax focus to include "in-house" tax return preparation for its clients as a one-stop shop, but actually outsources the tax preparation work itself to trusted CPAs that he pays out of his own revenue (rather than bringing this service fully in-house) so that he can focus his staff (..)

Nerd's Eye View

DECEMBER 30, 2024

We start with several articles on retirement planning: Why considering a client's retirement time horizon and spending flexibility could lead to more accurate (and often higher) safe withdrawal rates than the simpler "4% rule" Four unique risks retirees face when drawing down their assets, from sequence of returns risk to tax risk, and how financial (..)

Wealth Management

OCTOBER 15, 2024

Thursday, November 14, 2024 | 2:00 PM ET

Wealth Management

AUGUST 15, 2022

Some advisors who have built their practices on ETFs and mutual funds have never experienced a market correction like the one we are in now.

Carson Wealth

FEBRUARY 13, 2025

To help you make the best decisions regarding your taxes, retirement savings, and charitable giving, here are a few of the common planning opportunities and current tax benefits to consider as you update your plans for this year. The post Tax Planning Checklist appeared first on Carson Wealth.

Abnormal Returns

NOVEMBER 6, 2024

podcasts.apple.com) Taxes A year-end tax planning checklist. kindnessfp.com) How to think about taxes in early retirement. (morningstar.com) Barry Ritholtz talks shareholder yield with Meb Faber of Cambria Investments. ritholtz.com) Carl Richards talks avoiding burnout with Jonny Miller.

Nerd's Eye View

NOVEMBER 28, 2024

Still others may choose a hybrid model, combining AUM fees with additional charges for other services like tax planning. Others may align with broader industry trends, like transitioning to fee-only structures to buffer against market volatility.

Nerd's Eye View

DECEMBER 27, 2024

Also in industry news this week: According to a recent survey, advisors are putting an increasing share of client assets into model portfolios, allowing for customization and time savings that advisors appear to be using to provide more comprehensive planning services RIA M&A deal volume saw an annual record in 2024 as a lower cost of capital, (..)

Nerd's Eye View

NOVEMBER 15, 2024

Also in industry news this week: NASAA has proposed an amendment to its broker-dealer conduct model rule that would restrict the use of the terms “advisor” and “adviser” for broker-dealers and their registered representatives who are not also investment advisers or investment adviser representatives A recent study suggests that (..)

Wealth Management

JULY 24, 2023

Charles Lubar, retired senior counsel from McDermott Will & Emery, details the complexities in dealing with tax implications of projects involving the Muppets and Michael Jackson.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Wealth Management

JULY 26, 2023

There’s a natural partnership between financial advisors and CPAs.

Nerd's Eye View

NOVEMBER 19, 2024

So, whether you're interested in learning about building a profitable hyperfocused practice, implementing a marketing approach that reaches a firm's ideal target client, or adding value for clients by offering advanced tax planning, then we hope you enjoy this episode of the Financial Advisor Success Podcast, with Anjali Jariwala.

Carson Wealth

FEBRUARY 27, 2025

Like gardening or working out, tax planning is one of those activities where you get out what you put in. Tax planning is similar in the sense that you can put work in on the front end that youll reap benefits from later. Many of us just do tax preparation, dropping off a shoebox of documents with a CPA for the weekend.

Harness Wealth

NOVEMBER 12, 2024

As the year comes to a close, now is the time to review potential financial moves to help minimize your tax burden heading into 2025. Proactive year-end tax planning can lead to significant savings and set you up for financial success in the new year. This is a product of Harness Tax LLC.

Abnormal Returns

NOVEMBER 11, 2024

thinkadvisor.com) A year-end tax planning checklist. (advisorperspectives.com) A three-part approach to developing a 'statement of financial purpose.' kitces.com) What it means to be a great adviser to retired clients. kindnessfp.com) Why it's so easy to lose focus. advisorperspectives.com)

Nerd's Eye View

DECEMBER 28, 2022

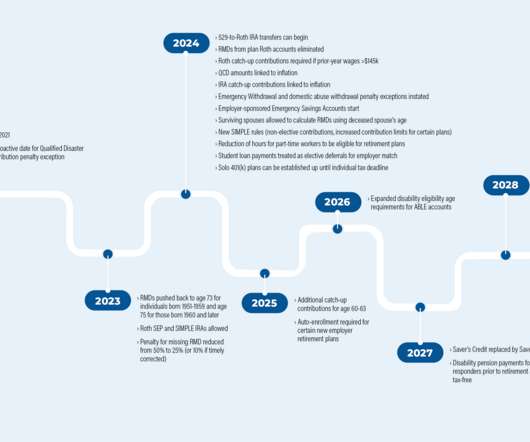

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

Nerd's Eye View

DECEMBER 28, 2022

The Setting Every Community Up for Retirement Enhancement (SECURE) Act, passed in December 2019, brought a wide range of changes to the retirement planning landscape, from the death of the ‘stretch’ IRA to raising the age for Required Minimum Distributions (RMDs) to 72.

Wealth Management

MARCH 12, 2025

The changes, which take effect September 2025, expand the CPWAs curriculum related to human dynamics, tax planning and specialty client strategies.

Wealth Management

JULY 11, 2024

Earned Wealth, founded in 2021, offers medical professionals advice on financial planning, tax planning, wealth management and investing on one interconnected platform.

Wealth Management

JANUARY 6, 2025

Tim Tallach has joined as director of advanced tax planning and family office services, as the RIA continues to expand its family office division.

Abnormal Returns

SEPTEMBER 8, 2024

awealthofcommonsense.com) Early in retirement is the time to do some tax planning. Top clicks this week High yields come with risk. Don't let anyone tell you otherwise. wsj.com) Three reasons why the stock market declines. whitecoatinvestor.com) Three reasons to buy Josh Brown's new book "You Weren’t Supposed To See That."

Wealth Management

NOVEMBER 14, 2024

Kevin Knull, President of TaxStatus, reveals how a direct integration with the IRS is revolutionizing tax planning at Nitrogen's 2024 Fearless Investing Summit.

Wealth Management

NOVEMBER 6, 2024

Smith, executive director with Eaton Vance, discusses tax law changes in 2026 and emphasizes the importance of proactive tax planning for investors.

Integrity Financial Planning

SEPTEMBER 19, 2022

So, make sure your Social Security and retirement account income plans are lined up so you can claim your maximum benefit with minimal taxation. Don’t just wait until tax season to figure out your tax plan. Taxes affect your whole retirement so factor them into your wealth preservation and income plan too.

Abnormal Returns

JANUARY 15, 2025

podcasts.apple.com) Retirement Retirement is a great time to do some creative tax planning. (podcasts.apple.com) Shane Parrish talks with Codie Sanchez author of "Main Street Millionaire: How to Make Extraordinary Wealth in Ordinary Businesses." awealthofcommonsense.com) The best retirement withdrawal strategy is one you can live with.

Abnormal Returns

NOVEMBER 18, 2024

justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand. downtownjoshbrown.com) How tax deferment can backfire. (podcasts.apple.com) Bogumil Baranowski talks with Justin Castelli about living an authentic life.

Wealth Management

FEBRUARY 3, 2023

This week, Orion announced they were making it easier for those in need of free financial planning to find help, TIFIN and Morningstar partnered to enhance their AI-powered distribution platform and eMoney responded to recently-passed legislation with tax planning upgrades.

Covisum

AUGUST 5, 2022

The Tax Cuts and Jobs Act simplified many aspects of tax planning and created opportunities. As a result, some tax techniques are more effective now than in the past. Additionally, the personal exemption phase-out and the limitation on itemized deductions for some filers were eliminated.

Nerd's Eye View

SEPTEMBER 25, 2024

Because not only were very few households actually subject to the 1950s-era top tax rates (which were triggered at the equivalent of over $2 million of income in today's dollars), but the long decline in nominal tax rates has also come with the elimination of many loopholes and deductions that have resulted in more income being subject to tax.

Abnormal Returns

JULY 8, 2024

thinkadvisor.com) How to do tax planning right. (blairbellecurve.com) Advisers need to consider their clients when contemplating selling their firm. citywire.com) How turning wealth into annuitized income in retirement boosts spending. kitces.com) Don't be this guy. When direct mail advertising backfires.

eMoney Advisor

APRIL 11, 2023

Financial planning and tax planning go hand in hand. Including tax planning as part of your service provides clients a comprehensive view of their finances and helps them achieve their financial goals. Start with Document Sharing The first step is to ask your clients to share their tax documents with you.

Financial Symmetry

OCTOBER 21, 2024

When thinking about preparing tax returns each year, many taxpayers have a binary view about the outcome that looks something like this: Owe Tax: BAD Receive Refund: GOOD While this may be the case if you are living paycheck-to-paycheck and … Continued The post Goals of Tax Planning appeared first on Financial Symmetry, Inc.

Abnormal Returns

FEBRUARY 14, 2024

50fires.com) Taxes What tax planning entails. (peterlazaroff.com) Barry Ritholtz talks value investing with Jeremy Schwartz of WisdomTree Investments. ritholtz.com) Carl Richards talks with Jamie author of "Confessions of a Sociopath: A Life Spent Hiding in Plain Sight."

Abnormal Returns

AUGUST 14, 2024

podcasts.apple.com) Taxes The 0% capital gains bracket is an opportunity. whitecoatinvestor.com) Why it's important to do tax planning before you start taking Social Security. nytimes.com) Retirement Six myths in retirement including 'You don't need a financial advisor.'

Abnormal Returns

SEPTEMBER 4, 2024

morningstar.com) Early in retirement is the time to do some tax planning. nextavenue.org) Estate planning Mistakes to avoid in your estate planning. (morningstar.com) Sam Dogen talks in ins and outs of early retirement with Khe Hy. sites.libsyn.com) Retirement Why spending decisions in retirement are challenging.

Wealth Management

JANUARY 29, 2025

It also allows the firm to offer internal tax planning and preparation services. The deal with Carlson Capital Management is Sequoias largest by number of employees and wealth advisors.

Abnormal Returns

AUGUST 28, 2023

taps.substack.com) Advisers Wade Pfau on why tax planning in retirement is so challenging. (kitces.com) The SEC is focusing on RIA marketing. citywire.com) Motivational interviewing is in large part about listening. kitces.com) How to send a follow-up e-mail.

Abnormal Returns

APRIL 10, 2023

blog.xyplanningnetwork.com) Technology Highlights from the 2023 T3 Advisor Conference including the growing importance of tax planning software. (etftrends.com) How to create a better onboarding process for new employees. kitces.com) The latest in adviser technology happenings including Altruists move to self-clearing.

Nerd's Eye View

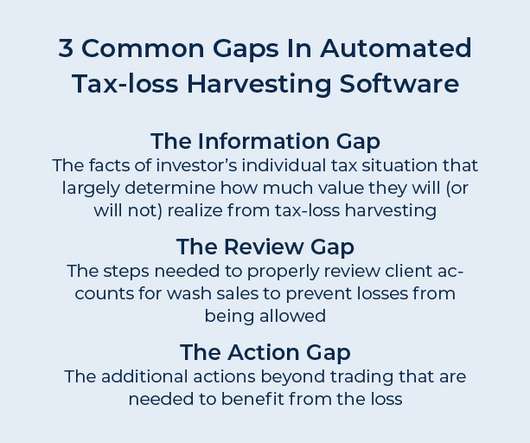

OCTOBER 5, 2022

And when factoring in the fees charged by those technology platforms, the value of such ‘tactical’ tax-loss harvesting might exceed the value the investor would have realized by relying on a technology solution to do it automatically! Read More.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content