Why Health Savings Accounts (HSAs) Aren’t Always Worth The ‘Triple Tax Savings’ Advantage

Nerd's Eye View

FEBRUARY 5, 2025

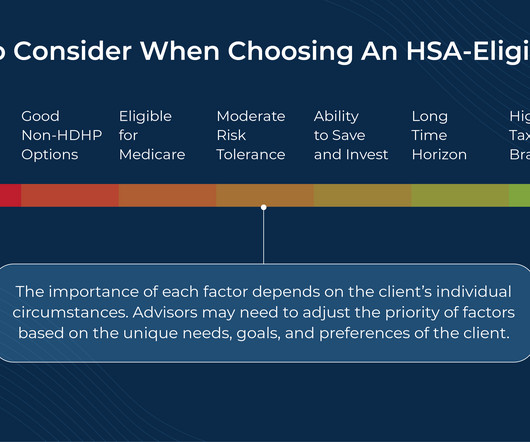

Health Savings Accounts (HSAs) have become an increasingly popular tool for financial advisors and their clients due in part to the 'triple tax savings' they offer: tax-deductible contributions, tax-free growth, and non-taxable distributions for qualifying expenses.

Let's personalize your content