U.S. Supreme Court Decision Upholds Constitutionality of Transition Tax

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

Wealth Management

FEBRUARY 17, 2023

The RIA space was on fire this week—eight acquisitions were announced, along with three newly created roles, one rebranding and a new head of NAPFA.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Nerd's Eye View

AUGUST 21, 2024

Irrevocable trusts lie at the heart of a variety of estate planning strategies, as gifts to irrevocable trusts can allow for the transfer of assets outside of an owner’s estate for estate tax purposes with more structure than an outright gift. the assets' original owner).

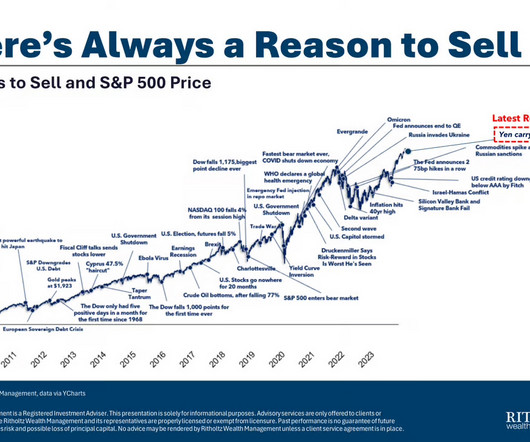

Abnormal Returns

NOVEMBER 18, 2024

Podcasts Daniel Crosby talks with Christina Lynn about Motivational Interviewing in order to enhance the work of wealth advisors. justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand.

Tobias Financial

JANUARY 18, 2023

Tobias Financial Advisors is proud that our team members constantly strive to grow and expand their knowledge. We are excited to announce that our Wealth Advisor Catalina Franco-Cicero recently earned her Certified Tax Specialist ( CTS ) designation. . To read more about Catalina, visit her bio here. .

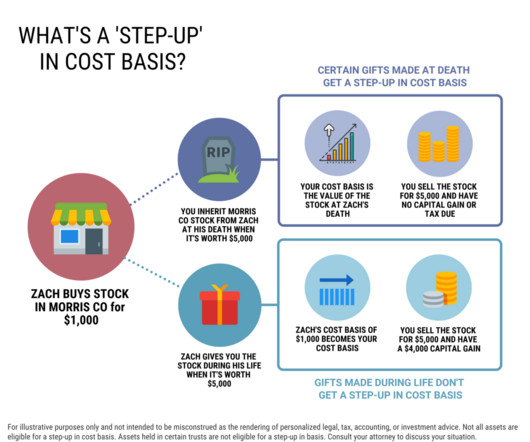

Darrow Wealth Management

JANUARY 16, 2025

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Wealth Management

JANUARY 29, 2025

The deal with Carlson Capital Management is Sequoias largest by number of employees and wealth advisors. It also allows the firm to offer internal tax planning and preparation services.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. youtube.com) Ted Seides talks with Jeff Assaf who is the founder and CIO of ICG Advisors. kitces.com) Taxes Following the RMD rules for inherited IRAs may not be optimal.

Darrow Wealth Management

MARCH 13, 2025

Charitable Contributions: Donating appreciated stock to charity while reducing capital gains tax. Work with a wealth advisor to discuss your financial goals and individual risk tolerances. But if you’re looking to reduce capital gains tax, this strategy won’t help. Finally, options are complex instruments.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Abnormal Returns

JANUARY 16, 2023

(standarddeviationspod.com) Michael Kitces talks with Lisa Brown who is a Partner and Wealth Advisor for CI Brightworth about finding your ideal clients. thinkadvisor.com) Taxes Some steps you can take to upgrade your tax-planning game. thinkadvisor.com) Taxes Some steps you can take to upgrade your tax-planning game.

Nerd's Eye View

NOVEMBER 22, 2022

Welcome back to the 308th episode of the Financial Advisor Success Podcast ! Matthew is the CEO of Equilibrium Wealth Advisors, an independent RIA based in Pittsburgh, Pennsylvania, that oversees more than $275 million in assets under management for 330 client households. My guest on today's podcast is Matthew Blocki.

Carson Wealth

DECEMBER 8, 2023

That must mean it’s time to roll up my sleeves and get to work on year-end financial planning – with an emphasis on 2023 income tax. One consideration this year is that we’re two years from the expiration of the Tax Cuts and Jobs Act of 2017 (TJCA). AGI impacts multiple other tax considerations.

FMG

MAY 22, 2023

For our latest Financial Advisor Website Showcase, we are joined by James. M Comblo, CEO of FSC Wealth Advisors. FSC Wealth Advisors was started by my grandfather in the 60s, and my uncle took over in the 80s. Initially, I didn’t plan to become an advisor. Tell us about your firm. What is your story?

FMG

JULY 14, 2022

For today’s Advisor Website Showcase, we are joined by Letizia Carlisto of Navis Wealth Advisors. Making use of FMG’s website engine, Navis Wealth Advisor took aim at creating a website themed around its logo – the compass. Modernize Your Website.

Zoe Financial

DECEMBER 28, 2024

Plan Your Tax Strategy Work with a financial advisor to optimize your tax situation. This could include leveraging tax-advantaged accounts, maximizing deductions, or planning for capital gains. Schedule a Financial Advisor Check-In Regularly meet with your wealth advisor to review your progress and refine your strategies.

Tobias Financial

APRIL 11, 2024

We are thrilled to announce that our Wealth Advisors, Edzai Chimedza, CFP® and Franklin Gay , CFP®, EA will be leading two Financial Planning Seminars at Nova Southeastern University. These seminars, scheduled for Friday, April 12th and Friday, May 3rd at 11 a.m., will cater specifically to the students of the dental school.

Tobias Financial

JULY 5, 2024

In a recent CNBC article, our Wealth Advisor, Catalina Franco-Cicero, MS, CFP®, CTS , was quoted on the topic of tax strategies during periods of unemployment. However, a period of lower income in 2024 could present valuable tax planning opportunities.

Darrow Wealth Management

JUNE 14, 2023

For example, the tax laws and distribution terms for an inheritance is quite different to the tax and liquidity considerations during an IPO. Managing sudden wealth paid in cash after the sale of a business or winning the lottery also requires planning, but perhaps with a bit less to unpack in the beginning.

Harness Wealth

OCTOBER 16, 2024

We recently connected with Michael Paley, Chief Operating Officer of Klingman & Associates , for a Q&A on how tax advisors can collaborate with wealth managers to better serve clients. Q: How can tax advisors align with the work of wealth advisors? Unlike an endowment, taxes really matter.

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. However, awareness is key, both for clients and advisors. citizens and residents.

Carson Wealth

MARCH 19, 2024

I’m talking about taxes. For many folks planning for taxes is a lot like asking for their first date. Most people look at me a little funny when I say that I try to run tax projections for their plan. I’ve said before, that I want clients to have a diversified tax strategy.

Tobias Financial

AUGUST 22, 2023

Our Wealth Advisor Catalina Franco-Cicero , MS, CFP®, CTS was recently quoted in Financial Planning, sharing her thoughts on paying off student loan debt. She also believes that it’s essential for financial advisors to be prepared to educate and guide younger generations who will likely be burdened with significant student loan debt.

Nerd's Eye View

APRIL 9, 2024

Welcome to the 380th episode of the Financial Advisor Success Podcast ! Andrew is the Managing Partner of Geometric Wealth Advisors, an RIA based in Washington, D.C., Welcome everyone! My guest on today's podcast is Andrew Leonard.

Zoe Financial

APRIL 23, 2023

Stay tuned for next week. – Andres Disclosure: This page is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. Ready to Grow Your Wealth?

Darrow Wealth Management

OCTOBER 28, 2024

A strategy for managing your investments is also key: understanding your risk capacity vs appetite, balancing a need for a current income stream and future growth, and ways to be more tax efficient in taxable accounts. With the help of a financial advisor , cash proceeds from the sale of your business can be invested in the financial markets.

Harness Wealth

MARCH 29, 2023

Councilor, Buchanan & Mitchell is a full-service accounting and advisory firm in the Mid-Atlantic region in the Harness Wealth Advisor network. Below are some insights from Richard Morris, Executive Vice President and Director of Tax Services, and Alex Seleznev, Senior Investment Advisor and Chief Operating Officer of MBI, LLC.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Darrow Wealth Management

AUGUST 28, 2023

Your team of business and personal advisors will be instrumental in getting the deal over the finish line. Your business advisory team may consist of: a business broker or M&A advisor, accounting and tax advisors, and transaction/M&A attorney. And also how to protect your interests and prioritize your goals.

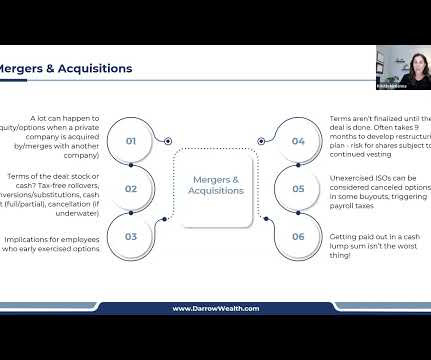

Darrow Wealth Management

OCTOBER 21, 2024

When unexercised ISOs are cashed out at closing, it’s considered a cancellation of stock options for tax purposes, not a disqualifying disposition. This is important, as the former will be subject to payroll tax. Should the deal not go through, you may be left with a large tax bill and no liquidity to pay it.

Darrow Wealth Management

NOVEMBER 4, 2024

How to find a fiduciary financial advisor Here are 5 ways to find a financial planner who will work in your best interests. If you’re working with a CPA for your taxes or have an estate planning attorney, consider asking them for a recommendation also. Personal referrals are especially helpful to get a sense of fees and services.

Harness Wealth

APRIL 17, 2023

The Alternative Minimum Tax (AMT) is an aspect of the US tax code designed to ensure that individuals pay a minimum amount of tax. AMT was introduced in 1969 in response to high-income Americans taking advantage of loopholes in the tax code to bring their taxable income to zero. How is AMT Calculated?

Zoe Financial

MAY 8, 2023

Stay tuned for next week. – Andres Disclosure: This page is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. Ready to Grow Your Wealth?

Nerd's Eye View

JANUARY 10, 2023

Welcome back to the 315th episode of the Financial Advisor Success Podcast ! Lisa is a Partner and Wealth Advisor for CI Brightworth, an RIA under the CI Financial umbrella with offices in Atlanta, Georgia, and Charlotte, North Carolina, that oversees nearly $5 billion in assets under management * for over 1,500 client households.

Darrow Wealth Management

JANUARY 29, 2024

There are no tax benefits during life nor are there any adverse tax implications. This article is a high-level overview of the various estate planning techniques and considerations when using revocable living trusts from the perspective of a wealth advisor (e.g. Other living trust benefits State estate tax planning.

Inside Information

JANUARY 31, 2025

Ayasha Jones, partner and Director of Operations at BlueSky Wealth Advisors in New Bern, NC said that she and other ops professionals are inundated with new fintech options all the time, and the IT percentage of the operating budget is larger than it ever was. But a number of readers got back to me with a reality check.

Carson Wealth

APRIL 18, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC®️, CExP, CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss business exit planning and how to make an intelligent exit. Rick Krebs and BSales Group are not an affiliate of Cetera Advisor Networks, LLC, or CWM, LLC.

WiserAdvisor

OCTOBER 4, 2022

There are multiple factors to weigh in, right from healthcare and inflation to estate planning, business succession planning, tax planning, and more. Some states have higher taxes than others. You may pick one where you have minimal tax liabilities and the standard of living is low. Retirement planning can be a bit complex.

Zoe Financial

MAY 1, 2023

Stay tuned for data on this week, next week. – Andres Disclosure: This page is not investment advice and should not be relied on for such advice or as a substitute for consultation with professional accounting, tax, legal or financial advisors. Ready to Grow Your Wealth?

Carson Wealth

JULY 30, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC®️, CExP, CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss business exit planning and how to make an intelligent exit. Rick Krebs and BSales Group are not an affiliate of Cetera Advisor Networks, LLC, or CWM, LLC.

WiserAdvisor

AUGUST 31, 2023

A financial advisor can help with maximizing your retirement income through tax planning After retirement, your income sources may become limited to pensions, Social Security benefits, and investment income. A financial advisor can craft tax-efficient withdrawal strategies to minimize the tax burden on your retirement income.

Carson Wealth

OCTOBER 7, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC ®️, CExP , CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss the importance of an accurate valuation when considering a business exit. Rick Krebs and BSales Group are not an affiliate of Cetera Advisor Networks, LLC, or CWM, LLC.

Tobias Financial

AUGUST 15, 2022

Tobias Financial Advisors is proud to announce that our Wealth Advisor Franklin “Franko” Gay serves on the National FPA NexGen Task Force and is one of the planners responsible for this year’s content at the 2022 FPA NexGen Gathering in Las Vegas from August 23 rd to 25 th.

Carson Wealth

AUGUST 19, 2024

Carson Wealth’s Thom Hall CFP®️, ChFC®️, CExP, CEPA Managing Director, Partner & Wealth Advisor and Rick Krebs CPA, CEPA discuss business exit planning and how to make an intelligent exit. Rick Krebs and BSales Group are not an affiliate of Cetera Advisor Networks, LLC, or CWM, LLC.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content