U.S. Supreme Court Decision Upholds Constitutionality of Transition Tax

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Wealth Management

JUNE 21, 2024

What wealth advisors need to know about taxing unrealized gains.

Abnormal Returns

NOVEMBER 18, 2024

Podcasts Daniel Crosby talks with Christina Lynn about Motivational Interviewing in order to enhance the work of wealth advisors. justincastelli.io) Taxes Some speculation on what is next for the TCJA. kitces.com) Tax planning and wealth management go hand-in-hand.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Book of Secrets on the Month-End Close

What Your Financial Statements Are Telling You—And How to Listen!

Are Robots Replacing You? Keeping Humans in the Loop in Automated Environments

Data Talks, CFOs Listen: Why Analytics Is The Key To Better Spend Management

Wealth Management

FEBRUARY 17, 2023

The RIA space was on fire this week—eight acquisitions were announced, along with three newly created roles, one rebranding and a new head of NAPFA.

Wealth Management

JANUARY 29, 2025

The deal with Carlson Capital Management is Sequoias largest by number of employees and wealth advisors. It also allows the firm to offer internal tax planning and preparation services.

Abnormal Returns

AUGUST 5, 2024

Podcasts Michael Kitces talks divorce planning with Michelle Klisanich who is a Wealth Advisor for Financially Wise Divorce. kitces.com) Matt Zeigler talks with Wade Pfau about managing sequence of returns risk in retirement. youtube.com) Ted Seides talks with Jeff Assaf who is the founder and CIO of ICG Advisors.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Darrow Wealth Management

NOVEMBER 4, 2024

Looking to find fiduciary financial advisors and wealth managers? Only fiduciary advisors are legally bound to act in your best interest at all times. Here are five ways you can find a full-time fiduciary financial advisor. What is a fiduciary advisor?

Harness Wealth

OCTOBER 16, 2024

We recently connected with Michael Paley, Chief Operating Officer of Klingman & Associates , for a Q&A on how tax advisors can collaborate with wealth managers to better serve clients. Q: How can tax advisors align with the work of wealth advisors?

Darrow Wealth Management

MARCH 13, 2025

Charitable Contributions: Donating appreciated stock to charity while reducing capital gains tax. Options contracts as income and hedging strategies Options are often used in various hedging strategies, including single stock risk management strategies. Taking profits is a key part of managing concentrated stock positions.

Darrow Wealth Management

JUNE 14, 2023

For example, the tax laws and distribution terms for an inheritance is quite different to the tax and liquidity considerations during an IPO. Managing sudden wealth paid in cash after the sale of a business or winning the lottery also requires planning, but perhaps with a bit less to unpack in the beginning.

Abnormal Returns

JANUARY 16, 2023

(standarddeviationspod.com) Michael Kitces talks with Lisa Brown who is a Partner and Wealth Advisor for CI Brightworth about finding your ideal clients. thinkadvisor.com) Taxes Some steps you can take to upgrade your tax-planning game. thinkadvisor.com) Taxes Some steps you can take to upgrade your tax-planning game.

Diamond Consultants

DECEMBER 16, 2024

By Allie Brunwasser & Jason Diamond Its no secret that the wealth management industry has a major impending crisis: A shortage of quality next gen advisor talent. Option 2: Sell the business to a strategic buyer A quality wealth management business is like the holy grail: everyone wants it.

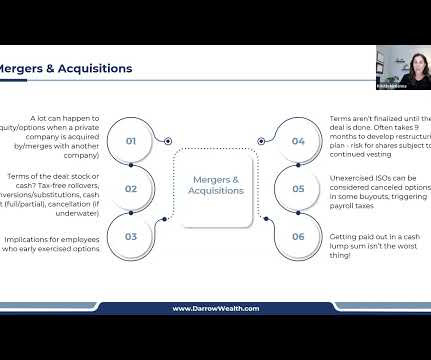

Darrow Wealth Management

OCTOBER 21, 2024

When unexercised ISOs are cashed out at closing, it’s considered a cancellation of stock options for tax purposes, not a disqualifying disposition. This is important, as the former will be subject to payroll tax. Should the deal not go through, you may be left with a large tax bill and no liquidity to pay it.

Darrow Wealth Management

OCTOBER 28, 2024

A strategy for managing your investments is also key: understanding your risk capacity vs appetite, balancing a need for a current income stream and future growth, and ways to be more tax efficient in taxable accounts. You receive $20 million dollars from selling your company and 30% goes to federal capital gains taxes and state tax.

Zoe Financial

NOVEMBER 13, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA November 14, 2023 Watch Time: 3 minutes Transcript : Welcome to this week’s Zoe’s Wealth Management Digest. That’s why Zoe’s extensive vetting process qualifies only the top 5% of managers in the United States.

FMG

JULY 14, 2022

For today’s Advisor Website Showcase, we are joined by Letizia Carlisto of Navis Wealth Advisors. Making use of FMG’s website engine, Navis Wealth Advisor took aim at creating a website themed around its logo – the compass. Modernize Your Website.

Darrow Wealth Management

JULY 30, 2024

For founders, employees, and executives with stock-based compensation, an 83(b) election can be a powerful tax planning tool. When you make an 83(b) election, you’re opting to pay tax on unvested shares now, instead of when the stock vests. In tax lingo, this is known as substantial risk of forfeiture.

Darrow Wealth Management

AUGUST 28, 2023

Your team of business and personal advisors will be instrumental in getting the deal over the finish line. Your business advisory team may consist of: a business broker or M&A advisor, accounting and tax advisors, and transaction/M&A attorney. And also how to protect your interests and prioritize your goals.

Darrow Wealth Management

SEPTEMBER 7, 2023

Pros and cons of exercising stock options in a pre-IPO window If you are new to the tax implications and basics about exercising stock options, please read this article first. Unfortunately, for those tax savings to materialize, the post-IPO stock price at sale must be considerably more than the pre-IPO valuation at exercise.

Harness Wealth

MAY 18, 2023

Is the Tax Industry in an Unprecedented Era? Though all of this change may seem unprecedented, it has a very relevant analog in one of the taxes sibling professions, financial advisory. This trend has also taken hold in other advisor markets like insurance brokerage where new platforms are creating additional leverage for advisors.

Darrow Wealth Management

MAY 3, 2024

First Steps in Managing a Windfall: Delay major purchases until you have a plan Partner with a sudden wealth management advisor Develop your financial, tax, and estate plan Managing a Large Financial Windfall A sudden wealth event changes your life.

Darrow Wealth Management

MAY 3, 2024

First Steps in Managing a Windfall: Delay major purchases until you have a plan Partner with a sudden wealth management advisor Develop your financial, tax, and estate plan Managing a Large Financial Windfall A sudden wealth event changes your life.

Zoe Financial

NOVEMBER 20, 2023

Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. That’s why Zoe’s extensive vetting process qualifies only the top 5% of managers in the United States.

WiserAdvisor

AUGUST 8, 2022

Managing vast sums of money, and investments like venture capital, non-fungible tokens (NFTs), and others, can be confusing. It also requires a good understanding of tax policies, laws, market sentiment, etc. It is evident that high-net-worth individuals need a good wealth manager. Certified Private Wealth Advisor (CPWA).

Darrow Wealth Management

MARCH 17, 2025

Even though interest rates have risen in the last few years, over time, holding cash will yield a real negative return after inflation and taxes. Even in periods of higher interest rates, the real return on cash after taxes and inflation can be negative. appeared first on Darrow Wealth Management.

Zoe Financial

NOVEMBER 13, 2023

Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. That’s why Zoe’s extensive vetting process qualifies only the top 5% of managers in the United States.

Good Financial Cents

JUNE 11, 2023

You see, financial advisors that focus primarily on wealth management can be costly to keep around. They charge either a percentage of assets managed or a flat hourly rate that can run as high as several hundred dollars per hour, plus trading commissions and administrative fees. Personal Capital to the rescue.

Zoe Financial

NOVEMBER 27, 2023

Nothing in these materials is intended to serve as personalized tax and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. That’s why Zoe’s extensive vetting process qualifies only the top 5% of managers in the United States.

WiserAdvisor

JANUARY 27, 2023

In general terms, a high-net-worth individual is someone with substantial wealth and a mix of liquid assets, such as cash, stocks, and bonds, as well as non-liquid assets, such as real estate and privately-held businesses. Consider consulting with a wealth advisor who can guide you on how to preserve as well as increase your wealth in 2023.

Darrow Wealth Management

FEBRUARY 24, 2025

In the right situations, early exercising stock options can reduce tax with an 83(b) election, and in the case of incentive stock options, potentially avoid the alternative minimum tax (AMT). Employees with stock options often focus on one thing: taxes. In the typical scenario, there are no tax implications at grant or vesting.

Darrow Wealth Management

OCTOBER 29, 2024

As you can see, there’s a lot to consider, so especially with a taxable account and possible tax implications, rebalancing can be both art and science. Capital gains tax must also must be considered when investing with a brokerage account (versus a retirement account). appeared first on Darrow Wealth Management.

International College of Financial Planning

DECEMBER 29, 2024

Modern financial planners must navigate complex investment products, understand evolving tax regulations, and adapt to technological innovations. The Evolution of Financial Planning The financial planning industry has transformed significantly over the past decade.

International College of Financial Planning

OCTOBER 26, 2023

A financial advisor isn’t just a title; it’s a commitment. Their wisdom extends to suggesting tax-efficient avenues for pivotal life moments, be it education or the golden years of retirement. They’re well-versed in recommending vital products like life insurance and are wizards at tax planning.

Sara Grillo

DECEMBER 12, 2022

pay me for investments, for the easy work that I can outsource to a third party manager, and I’ll give you all this hard stuff for free…I don’t believe that., Matt founded Exhale Wealth Management to provide comprehensive financial planning to individuals with complex lives, most notably technology employees with equity compensation.

Sara Grillo

AUGUST 14, 2023

Prior to joining EP Wealth Advisors in 2021, Scott worked for a number of the largest Wall Street firms, including UBS, Prudential and Wells Fargo. The Institute exists to preserve, protect and defend fiduciary principles in investment advice, wealth management and financial planning. in English Language and Literature.

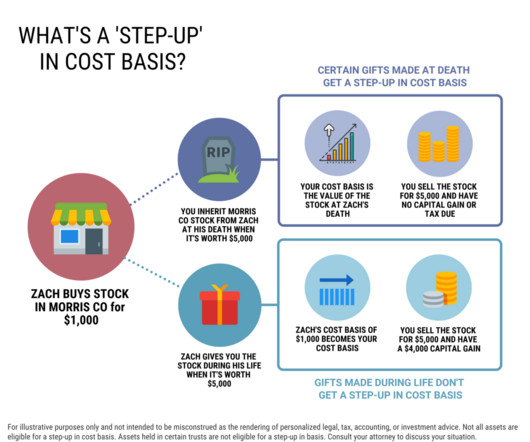

Darrow Wealth Management

JANUARY 16, 2025

A step-up in basis is a tax advantage for individuals who inherit stocks or other assets, like a home. Understanding step-up in basis at death If youve received an inheritance you may have questions about the tax treatment of certain assets. This increases the tax basis, which determines capital gains or losses when the asset is sold.

Zoe Financial

NOVEMBER 9, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA November 9, 2023 Watch Time: 3 minutes Transcript : All right, so let’s start with the first one here: President Biden’s junk fee crackdown. We believe financial advice should come from unbiased and certified professionals.

Zoe Financial

NOVEMBER 21, 2023

The Wealth Management Digest Featuring Zoe CEO & Founder, Andres Garcia-Amaya, CFA November 22, 2023 Watch Time: 2.5 minutes Transcript: Welcome to this week’s Wealth Management Digest. And then the second one is that LPL launches their W2 model for high-net-worth advisors. .”

The Big Picture

MAY 9, 2023

He is the Chief Investment Officer of Asset and Wealth Management at Goldman Sachs. He’s a member of the management committee. He co-chairs a number of the asset management investment committees. JULIAN SALISBURY, CHIEF INVESTMENT OFFICER OF ASSET AND WEALTH MANAGEMENT, GOLDMAN SACHS: Thanks, Barry.

Darrow Wealth Management

NOVEMBER 5, 2024

If eligible, you may be able to exclude up to 100% of the gain from federal taxes when you sell your shares through the capital gains tax exclusion. The potential tax savings simply cannot be understated. Using IRS Section 1202, taxpayers can sell stock potentially free of federal capital gains taxes if the requirements are met.

Harness Wealth

JULY 29, 2024

In this guest post, Harness Tax Advisory Council member, Griffin Bridgers, J.D., covers some of the top estate planning trends that tax advisors should be tracking during the second half of 2024. However, awareness is key, both for clients and advisors. citizens and residents.

Darrow Wealth Management

JANUARY 29, 2024

There are no tax benefits during life nor are there any adverse tax implications. This article is a high-level overview of the various estate planning techniques and considerations when using revocable living trusts from the perspective of a wealth advisor (e.g. Other living trust benefits State estate tax planning.

WiserAdvisor

JULY 24, 2022

If you are a high-net-worth individual and wish to learn about wealth preservation, tax-saving strategies, and management of large estates; engage the services of a wealth advisor who can advise you on the same. Income and capital gains tax planning: The tax system in the U.S

Abnormal Returns

NOVEMBER 4, 2024

Podcasts Meb Faber and Wes Gray talk about how ETFs unlock tax efficiency and the launch of the Cambria Tax Aware ETF ($TAX). awealthofcommonsense.com) Bogumil Baranowski talks the digitization of wealth management with Julia Carreon. podcasts.apple.com) The biz Facet Wealth has a new pile of capital to invest.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content